Tax Engagement Letter Form

What is the Tax Engagement Letter

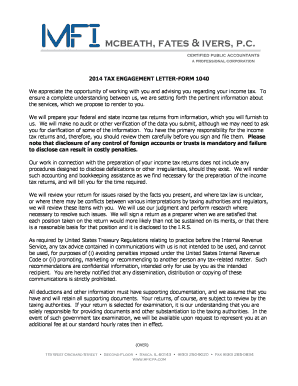

The tax engagement letter is a formal document that outlines the relationship between a tax professional and their client. This letter serves as a contract that specifies the scope of services to be provided, including details about tax preparation, planning, and any additional advisory services. It also clarifies the responsibilities of both parties, ensuring transparency and mutual understanding. By establishing clear expectations, the tax engagement letter helps to prevent misunderstandings and potential disputes.

Key elements of the Tax Engagement Letter

A well-crafted tax engagement letter includes several critical components:

- Client Information: Basic details such as the client's name, address, and contact information.

- Scope of Services: A detailed description of the services that will be provided, including any limitations.

- Fees and Payment Terms: Clear information on the fees for services rendered and payment schedules.

- Responsibilities: Outline of the responsibilities of both the tax professional and the client, including document submission and compliance.

- Confidentiality Clause: Assurance that the client's information will be kept confidential and secure.

- Termination Clause: Conditions under which either party can terminate the agreement.

How to use the Tax Engagement Letter

To effectively use the tax engagement letter, both the tax professional and the client should review the document thoroughly. The client should ensure that all details accurately reflect their understanding of the services to be provided. Once both parties agree to the terms, they should sign the letter to formalize the agreement. Keeping a copy of the signed letter is essential for future reference, especially in case of any disputes or questions about the services rendered.

Steps to complete the Tax Engagement Letter

Completing a tax engagement letter involves several straightforward steps:

- Draft the Letter: Begin by drafting the letter, including all key elements mentioned earlier.

- Review with the Client: Discuss the draft with the client to ensure clarity and agreement on all terms.

- Make Revisions: Adjust the letter based on client feedback to ensure it meets their expectations.

- Sign the Document: Both parties should sign the final version of the letter to formalize the agreement.

- Store Safely: Keep a signed copy of the letter for record-keeping and future reference.

Legal use of the Tax Engagement Letter

The tax engagement letter is legally binding once signed by both parties, meaning it can be enforced in a court of law if necessary. It is important for both the tax professional and the client to adhere to the terms outlined in the letter. This document not only protects the interests of both parties but also ensures compliance with relevant tax laws and regulations. Proper use of the engagement letter can mitigate risks associated with misunderstandings or disputes regarding tax services.

IRS Guidelines

The Internal Revenue Service (IRS) does not mandate a specific format for tax engagement letters; however, it emphasizes the importance of clear communication between tax professionals and their clients. Following IRS guidelines helps ensure that both parties are aware of their obligations and the scope of services. Tax professionals are encouraged to maintain thorough documentation, including engagement letters, to support their work and provide clarity in case of audits or inquiries.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax engagement letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax engagement letter?

A tax engagement letter is a formal document that outlines the terms of the relationship between a tax professional and their client. It specifies the services to be provided, the responsibilities of both parties, and the fees involved. Using airSlate SignNow, you can easily create and eSign tax engagement letters, ensuring clarity and compliance.

-

How does airSlate SignNow simplify the process of creating a tax engagement letter?

airSlate SignNow offers user-friendly templates that allow you to quickly draft a tax engagement letter tailored to your needs. With drag-and-drop functionality, you can customize the document and add necessary fields for signatures. This streamlines the process, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for tax engagement letters?

Using airSlate SignNow for tax engagement letters provides several benefits, including enhanced security, ease of use, and quick turnaround times. The platform ensures that your documents are securely stored and easily accessible. Additionally, eSigning eliminates the need for printing and scanning, making the process more efficient.

-

Is there a cost associated with using airSlate SignNow for tax engagement letters?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while still gaining access to essential features for creating and managing tax engagement letters. A free trial is also available to help you evaluate the service before committing.

-

Can I integrate airSlate SignNow with other software for managing tax engagement letters?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software. This allows you to streamline your workflow by connecting your tax engagement letters with other tools you already use, enhancing productivity and collaboration.

-

How secure is the information in my tax engagement letter when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your tax engagement letters and sensitive information. You can rest assured that your documents are safe from unauthorized access and data bsignNowes.

-

Can I track the status of my tax engagement letter with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your tax engagement letters. You can see when the document has been sent, viewed, and signed, giving you complete visibility over the signing process and ensuring timely follow-ups.

Get more for Tax Engagement Letter

Find out other Tax Engagement Letter

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure