VAT431C Form and Notes VAT Refunds for DIY Housebuilders Claim Form and Notes for Conversions 2019

What is the VAT431C Form?

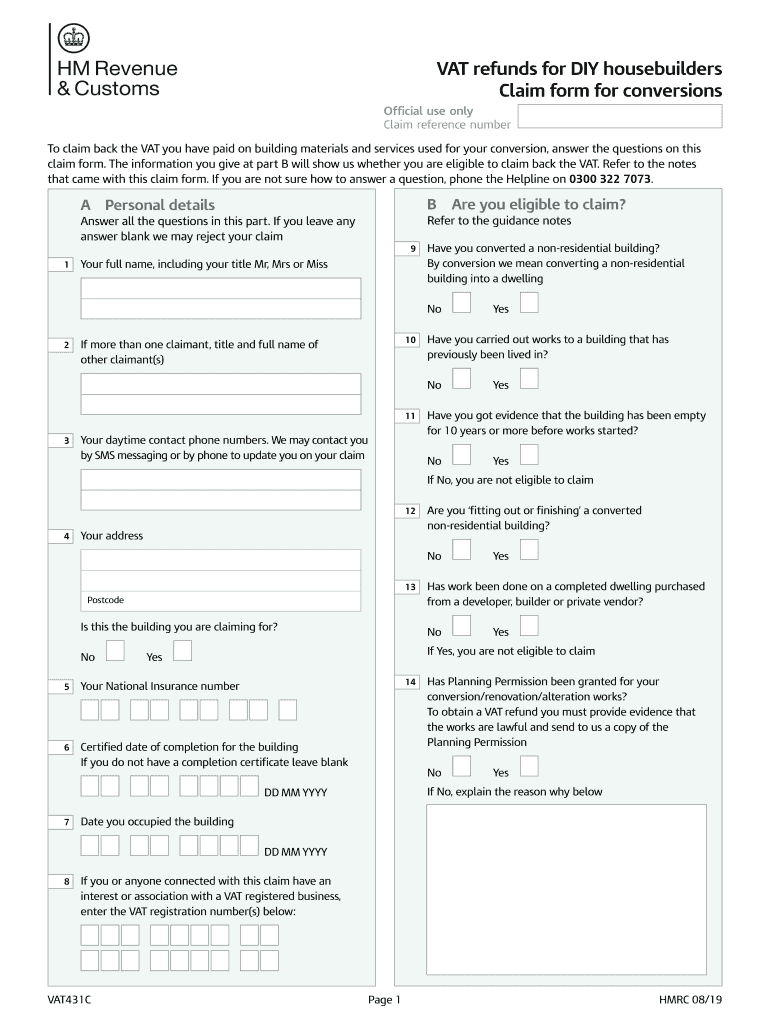

The VAT431C form is a specific document used for claiming VAT refunds for DIY housebuilders. This form is essential for individuals undertaking home construction or conversion projects who wish to reclaim VAT on eligible purchases. The form includes sections that require detailed information about the construction project and the VAT incurred on materials and services. Understanding the purpose and requirements of the VAT431C form is crucial for ensuring a successful claim.

How to Use the VAT431C Form

Using the VAT431C form involves several steps to ensure that all necessary information is accurately provided. First, gather all relevant invoices and receipts that detail the VAT paid on materials and services. Next, complete the form by entering your personal details, project information, and the total VAT amount you are claiming. It is important to double-check all entries for accuracy before submitting the form to avoid delays or rejections.

Steps to Complete the VAT431C Form

Completing the VAT431C form requires careful attention to detail. Follow these steps:

- Collect all invoices and receipts related to your DIY project.

- Fill in your personal information, including name and address.

- Provide details about the project, including its location and nature.

- List the VAT amounts from each invoice, ensuring totals are calculated correctly.

- Sign and date the form before submission.

By following these steps, you can ensure that your VAT431C form is filled out correctly, increasing the likelihood of a successful refund claim.

Legal Use of the VAT431C Form

The VAT431C form is legally recognized for VAT refund claims in the United States. It is important to use this form in compliance with relevant tax regulations to ensure that your claim is valid. Proper use of the form includes providing accurate information and retaining copies of all submitted documents for your records. Understanding the legal implications of using this form can help you navigate the VAT refund process more effectively.

Eligibility Criteria for the VAT431C Form

To qualify for a VAT refund using the VAT431C form, certain eligibility criteria must be met. Typically, this includes being a DIY housebuilder who has incurred VAT on materials and services for a qualifying construction project. Additionally, the project must meet specific guidelines set forth by tax authorities. It is advisable to review these criteria thoroughly to ensure that your claim is valid and to avoid unnecessary complications.

Required Documents for VAT431C Submission

When submitting the VAT431C form, it is essential to include all required documents to support your claim. These typically include:

- Invoices and receipts showing VAT paid on materials and services.

- A completed VAT431C form with accurate information.

- Any additional documentation that may be requested by tax authorities.

Having these documents prepared and organized will facilitate a smoother submission process and help ensure that your claim is processed efficiently.

Quick guide on how to complete vat431c form and notes vat refunds for diy housebuilders claim form and notes for conversions

Effortlessly Prepare VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions with Ease

- Locate VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat431c form and notes vat refunds for diy housebuilders claim form and notes for conversions

Create this form in 5 minutes!

How to create an eSignature for the vat431c form and notes vat refunds for diy housebuilders claim form and notes for conversions

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a purchase request form in airSlate SignNow?

A purchase request form in airSlate SignNow is a digital document that businesses use to formally request the purchase of goods or services. This form streamlines the approval process, ensuring that all necessary information is captured and organized for approval. With SignNow, you can create customizable purchase request forms to fit your organization's needs.

-

How can I create a purchase request form using airSlate SignNow?

Creating a purchase request form with airSlate SignNow is simple and intuitive. You can start by selecting a template from the library or building a form from scratch using our drag-and-drop editor. Once you have tailored your purchase request form, you can easily share it with your team for e-signature and approval.

-

What features does airSlate SignNow offer for purchase request forms?

airSlate SignNow provides several key features for managing purchase request forms, including customizable templates, real-time tracking, and automated notifications. Additionally, you can integrate various fields and conditions for approvals to suit your workflow. These features enhance efficiency and facilitate smoother approval processes.

-

How does airSlate SignNow ensure the security of my purchase request form?

Security is a top priority at airSlate SignNow. All purchase request forms are protected with industry-standard encryption, ensuring that your data remains confidential and secure. Furthermore, the platform features audit trails and role-based access controls to ensure that only authorized users can view and sign sensitive documents.

-

What are the pricing options for using airSlate SignNow for purchase request forms?

airSlate SignNow offers various pricing plans, tailored to fit the needs of different businesses. You can choose from a monthly or annual subscription that includes unlimited e-signatures and access to all features related to purchase request forms. For large organizations, custom pricing plans are available to accommodate your specific requirements.

-

Can I integrate airSlate SignNow with other tools for managing purchase request forms?

Yes! airSlate SignNow seamlessly integrates with a wide array of software, including popular tools like Google Drive, Salesforce, and Zapier. These integrations enhance the functionality of your purchase request form, allowing for better data management and streamlined workflows across different platforms.

-

What benefits can I expect from using airSlate SignNow for purchase request forms?

Using airSlate SignNow for your purchase request forms can signNowly save time and reduce manual errors. The automated workflows and e-signature capabilities ensure faster approvals, while the digital format allows for easy tracking and management of requests. Overall, this leads to increased efficiency and better resource management in your organization.

Get more for VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions

- 2022 m4npnol net operating loss deduction 2022 m4npnol net operating loss deduction form

- Sc withholding quarterly tax return south carolina form

- 2022 schedule m15 underpayment of estimated income tax form

- Minnesota form m1mtc alternative minimum tax creditminnesota form m1mtc alternative minimum tax creditminnesota form m1mtc

- 2022 m11h insurance premium tax return for hmos 2022 m11h insurance premium tax return for hmos form

- Liquor by the drink excise tax reportl 2172 scgov form

- Form schedule m1ls tax on lump sum distribution free legal forms

- Minnesota form m15c additional charge for underpayment of estimated

Find out other VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form And Notes For Conversions

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure