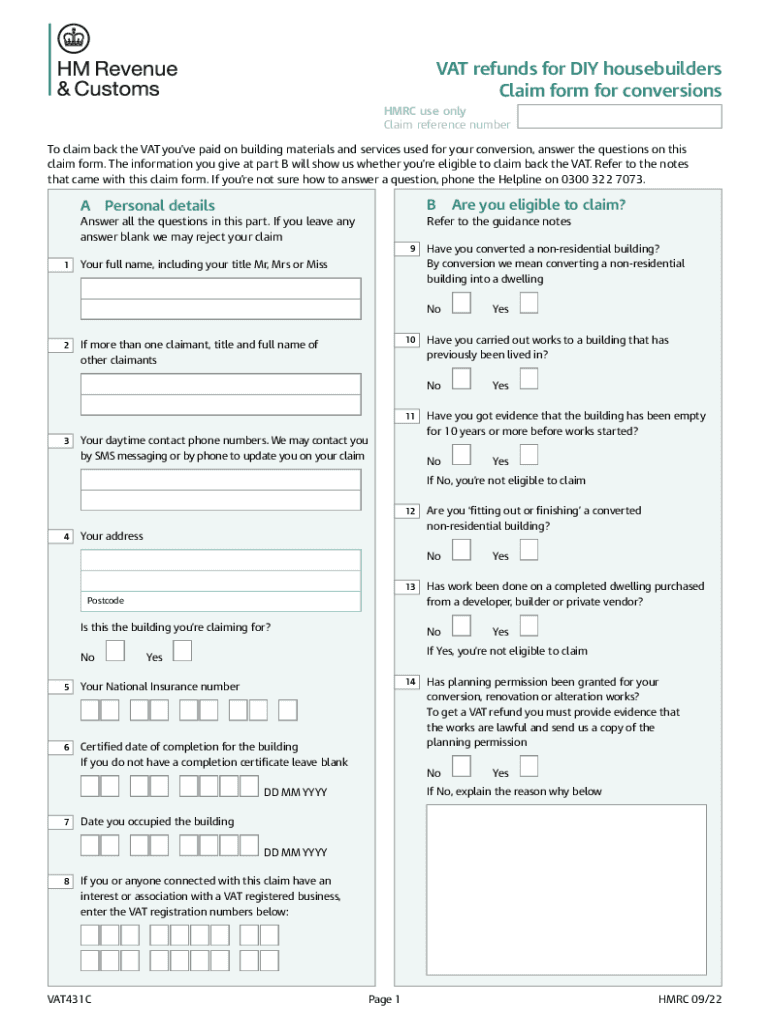

VAT431C Form and Notes VAT Refunds for DIY Housebuilders Claim Form for Conversions 2022

What is the VAT431C Form?

The VAT431C form is a crucial document for DIY housebuilders in the United States seeking to claim VAT refunds for conversion projects. This form allows individuals to reclaim VAT on eligible building materials and services used during construction or renovation. Understanding the specifics of this form is essential for ensuring compliance with tax regulations and maximizing potential refunds. The VAT431C form is specifically tailored for those undertaking significant alterations or conversions of residential properties, making it a vital tool for homeowners and builders alike.

Steps to Complete the VAT431C Form

Completing the VAT431C form involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including invoices and receipts for materials and services purchased. Next, accurately fill out the form by providing details such as your personal information, project specifics, and the total amount of VAT you wish to reclaim. It is important to double-check all entries for correctness before submission. Finally, submit the completed form along with any required supporting documents to the appropriate tax authority. Following these steps carefully can help streamline the refund process and reduce the risk of errors.

Legal Use of the VAT431C Form

The legal use of the VAT431C form is governed by specific regulations that outline eligibility criteria for VAT refunds. To ensure your claim is valid, it is essential to adhere to these guidelines, which include using the form for qualifying construction projects and maintaining accurate records of all related expenses. Additionally, the form must be submitted within the designated time frame set by tax authorities. Understanding the legal framework surrounding the VAT431C form can help prevent potential disputes or penalties, ensuring a smooth refund process.

Required Documents for the VAT431C Form

When preparing to submit the VAT431C form, certain documents are necessary to support your claim. These typically include:

- Invoices and receipts for all materials and services purchased

- Proof of payment for the expenses incurred

- Any relevant contracts or agreements related to the construction project

- Documentation proving the nature of the conversion or renovation

Having these documents on hand will facilitate the completion of the form and ensure that your claim is substantiated, helping to expedite the refund process.

Eligibility Criteria for the VAT431C Form

To qualify for a VAT refund using the VAT431C form, certain eligibility criteria must be met. Primarily, the claim must be related to a qualifying conversion project, which typically involves significant alterations to a residential property. Additionally, the claimant must be the individual or entity that incurred the VAT expenses. It is also essential that the materials and services claimed are directly linked to the construction work. Familiarizing yourself with these criteria can enhance your chances of a successful claim.

Form Submission Methods

The VAT431C form can be submitted through various methods, catering to the preferences of different users. Common submission methods include:

- Online submission via the appropriate tax authority's website

- Mailing a printed copy of the completed form and supporting documents

- In-person submission at designated tax offices

Choosing the right submission method can affect the processing time of your claim, so it is advisable to consider each option carefully before proceeding.

Quick guide on how to complete vat431c form and notes vat refunds for diy housebuilders claim form for conversions

Complete VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions seamlessly

- Locate VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your PC.

Forget about lost or mislaid documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management within a few clicks from any device of your choosing. Edit and eSign VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vat431c form and notes vat refunds for diy housebuilders claim form for conversions

Create this form in 5 minutes!

How to create an eSignature for the vat431c form and notes vat refunds for diy housebuilders claim form for conversions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a requisition request form and how can airSlate SignNow help?

A requisition request form is a document used by businesses to request the procurement of goods or services. airSlate SignNow simplifies this process by allowing you to create, send, and electronically sign these forms quickly and securely, streamlining your procurement workflow.

-

How does airSlate SignNow ensure the security of my requisition request form?

With airSlate SignNow, your requisition request form is protected by advanced encryption and secure cloud storage. Additionally, our platform complies with industry standards to safeguard sensitive information and provide audit trails for document transactions.

-

What features does airSlate SignNow offer for managing requisition request forms?

airSlate SignNow provides a range of features for managing requisition request forms, including customizable templates, automated workflows, and real-time tracking. These tools help organizations streamline their document processes and improve efficiency.

-

Can I integrate airSlate SignNow with other software for handling requisition request forms?

Yes, airSlate SignNow seamlessly integrates with various platforms, such as CRM systems and accounting software, making it easy to incorporate your requisition request forms into your existing workflows. This integration enhances collaboration and data management across your business.

-

Is there a mobile app available for completing requisition request forms?

Absolutely! airSlate SignNow offers a mobile app that allows users to complete and sign requisition request forms on the go. This ensures that you can manage your requests anytime and anywhere, improving accessibility and responsiveness.

-

What are the pricing options for using airSlate SignNow for requisition request forms?

airSlate SignNow offers various pricing plans to suit different business needs, including options that specifically cater to teams handling requisition request forms. These plans are designed to be cost-effective while providing all the necessary features for efficient document management.

-

Can I customize my requisition request form in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your requisition request form to meet your specific requirements. You can easily add fields, modify layouts, and include your company branding to ensure the form fits seamlessly into your business processes.

Get more for VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions

- Origins earth is born worksheet answers form

- Specialty medication prior authorization form peach state health plan

- Shoshone bannock tribes form

- Lccc transcripts form

- Form cem 4101 materials release summary state of california dot ca

- Sale non compete agreement template form

- Sale or return agreement template 787747198 form

- Generator maintenance contract template form

Find out other VAT431C Form And Notes VAT Refunds For DIY Housebuilders Claim Form For Conversions

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document