Claim a VAT Refund If You Build New Houses on a DIY Basis 2021

Understanding the VAT Refund Claim for DIY Home Builders

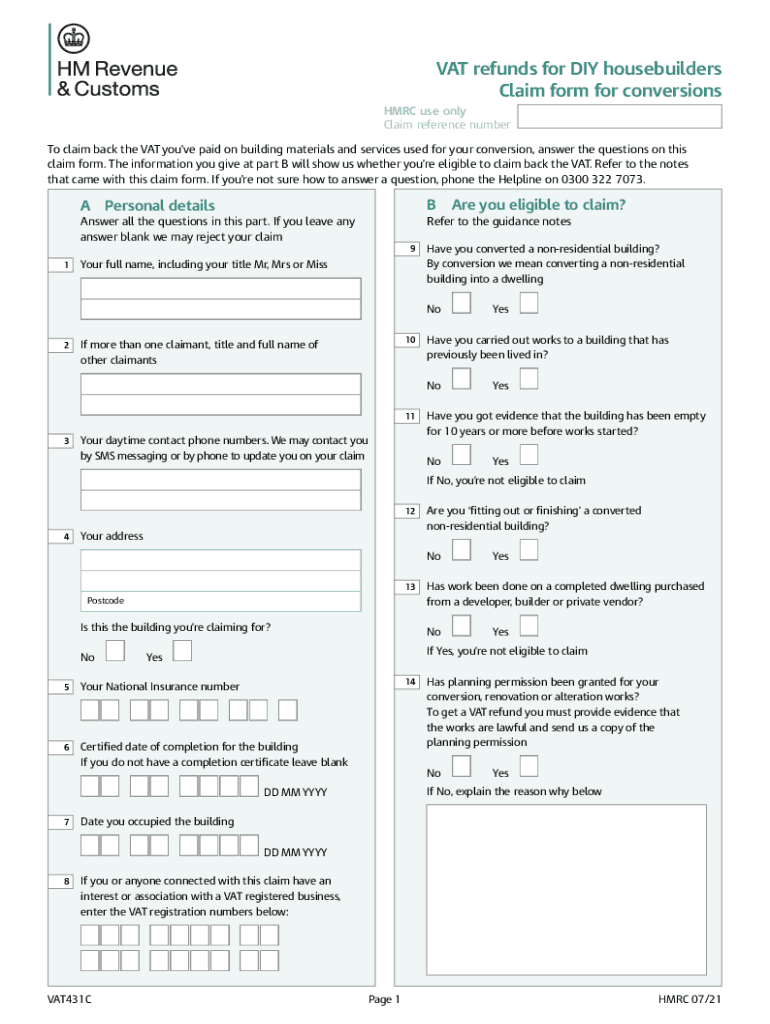

The VAT431C form is essential for individuals who have built new homes on a DIY basis and wish to claim a VAT refund. This process allows homeowners to recover VAT incurred on materials and services used during construction. The eligibility for this refund typically requires that the construction meets specific criteria set by the HMRC, including that the property is intended for residential use and that it is completed within a certain timeframe. Understanding these requirements is crucial for a successful claim.

Steps to Complete the VAT431C Claim Form

Filling out the VAT431C form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, including invoices and receipts for materials purchased. Next, complete the form by providing details about the construction project, including the property's address, the nature of the work done, and the total VAT paid. It's important to double-check all entries for accuracy before submission. Finally, submit the form to HMRC either online or by mail, depending on your preference.

Required Documents for the VAT431C Claim

To successfully submit the VAT431C claim, certain documents are required. These include:

- Invoices and receipts for all materials and services purchased.

- A copy of the planning permission or building regulations approval.

- Evidence of the completion of the project, such as a completion certificate.

Having these documents ready will streamline the claims process and help avoid delays.

Eligibility Criteria for VAT Refunds

Eligibility for a VAT refund using the VAT431C form is determined by several factors. The property must be a new build, and the construction must be completed within three years of the claim date. Additionally, the property must be intended for residential use. Homeowners should also ensure that they have not previously claimed VAT refunds for the same project. Understanding these criteria is essential for ensuring that your claim is valid and accepted by HMRC.

Filing Deadlines for VAT431C Claims

Filing deadlines are critical when submitting the VAT431C form. Homeowners must submit their claim within three months of the completion of the construction project. Missing this deadline can result in the loss of the right to claim a refund. It is advisable to keep track of all relevant dates and ensure that all documentation is prepared in advance to meet this timeline.

Legal Use of the VAT431C Claim Form

The VAT431C form is legally recognized for claiming VAT refunds on DIY home builds. To ensure that the claim is legally valid, it is important to comply with HMRC regulations and provide accurate information. Submitting false information or failing to provide necessary documentation can lead to penalties or rejection of the claim. Therefore, using the form correctly and understanding the legal implications is crucial for homeowners.

Quick guide on how to complete claim a vat refund if you build new houses on a diy basis

Effortlessly Prepare Claim A VAT Refund If You Build New Houses On A DIY Basis on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional paper documents that need to be printed and signed, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Claim A VAT Refund If You Build New Houses On A DIY Basis on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to Modify and Electronically Sign Claim A VAT Refund If You Build New Houses On A DIY Basis with Ease

- Locate Claim A VAT Refund If You Build New Houses On A DIY Basis and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Alter and electronically sign Claim A VAT Refund If You Build New Houses On A DIY Basis while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim a vat refund if you build new houses on a diy basis

Create this form in 5 minutes!

How to create an eSignature for the claim a vat refund if you build new houses on a diy basis

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the form vat431c pdf and why is it important?

The form vat431c pdf is a specific document used for VAT purposes in certain jurisdictions. It is crucial for businesses to accurately file this form to comply with tax regulations and avoid penalties.

-

How can airSlate SignNow assist with completing the form vat431c pdf?

airSlate SignNow streamlines the process of filling out the form vat431c pdf by allowing users to electronically sign and send documents effortlessly. Our platform ensures that your form is completed correctly and quickly, saving you valuable time.

-

Is there a cost to use airSlate SignNow for the form vat431c pdf?

Yes, airSlate SignNow offers various pricing plans, each designed to provide excellent value for businesses needing to manage forms like the form vat431c pdf. You can choose a plan that fits your needs and budget.

-

Can I integrate airSlate SignNow with other software to manage the form vat431c pdf?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools, which can help you manage the form vat431c pdf efficiently. This means you can automate your workflow and keep all relevant documents organized.

-

What features does airSlate SignNow offer for users of the form vat431c pdf?

airSlate SignNow provides features like document templates, easy electronic signature options, and secure storage for the form vat431c pdf. These tools make it convenient to handle your documentation and ensure compliance.

-

How does airSlate SignNow ensure the security of the form vat431c pdf?

Security is a top priority for airSlate SignNow. We employ advanced encryption and secure access protocols, ensuring that your form vat431c pdf and any other sensitive documents are protected at all times.

-

Can I track the status of my form vat431c pdf once it's sent?

Yes, with airSlate SignNow, you can easily track the status of your form vat431c pdf after it has been sent. Our platform provides real-time updates, so you know when your document is viewed and signed.

Get more for Claim A VAT Refund If You Build New Houses On A DIY Basis

- Request to claimant regarding amount due and unpaid individual form

- Request to claimant regarding amount due and unpaid form

- Fillable online brood mare lease agreement fax form

- Response of claimant to request regarding amount due and form

- Kind of business form

- Unpaid corporation form

- Horse lease agreement example form

- Waiver of lien individual form

Find out other Claim A VAT Refund If You Build New Houses On A DIY Basis

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form