New VAT Guidance and Online Claim Forms for Builders of DIY 2023-2026

What is the New VAT Guidance and Online Claim Forms for Builders of DIY

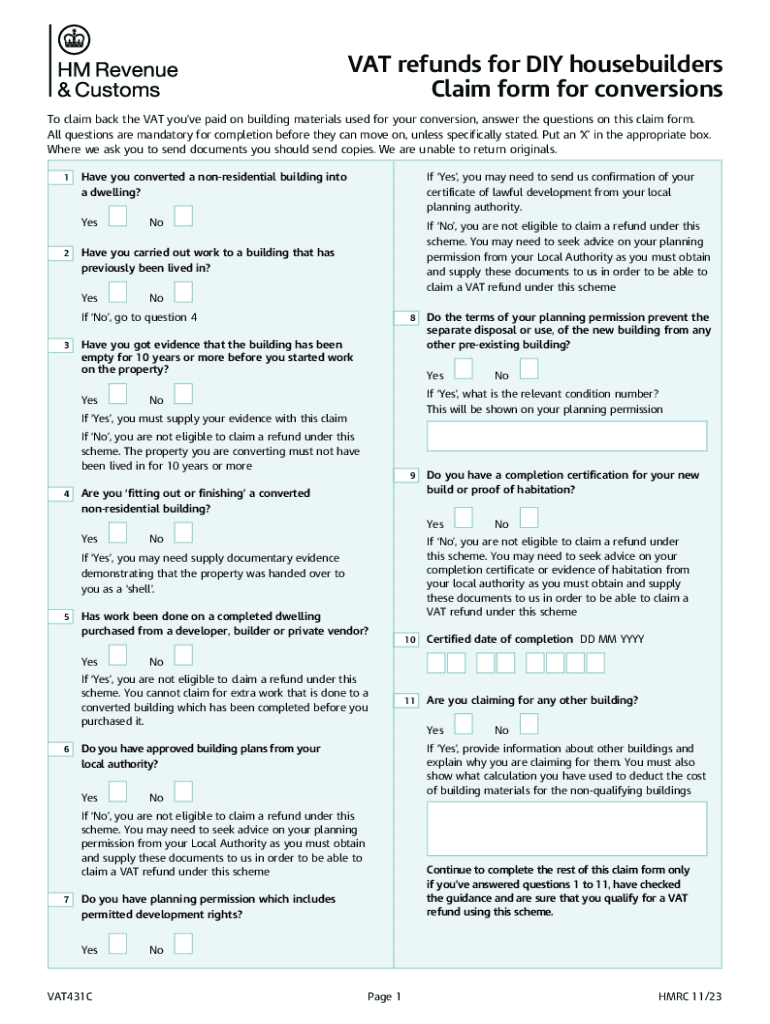

The New VAT Guidance and Online Claim Forms for Builders of DIY provide essential information for contractors and builders involved in DIY projects. This guidance outlines the current regulations regarding value-added tax (VAT) applicable to construction services. It is designed to assist builders in understanding their obligations and rights when claiming VAT refunds or exemptions related to DIY activities. The online claim forms simplify the process of submitting VAT claims, ensuring that builders can efficiently manage their tax responsibilities.

How to Use the New VAT Guidance and Online Claim Forms for Builders of DIY

To effectively utilize the New VAT Guidance and Online Claim Forms, builders should first familiarize themselves with the guidance documentation. This includes understanding the eligibility criteria for VAT claims and the specific requirements for completing the online forms. Once builders have reviewed the guidance, they can access the online claim forms through the designated platform. The forms require detailed information about the project, including costs incurred and services rendered. Builders should ensure that all information is accurate and complete to avoid delays in processing their claims.

Steps to Complete the New VAT Guidance and Online Claim Forms for Builders of DIY

Completing the online claim forms involves several key steps:

- Gather all necessary documentation, including invoices and receipts related to the DIY project.

- Access the online claim form and enter the required personal and project details.

- Provide a detailed account of the VAT amounts being claimed.

- Review the information for accuracy and completeness before submission.

- Submit the form electronically and keep a copy for your records.

Eligibility Criteria for the New VAT Guidance and Online Claim Forms for Builders of DIY

Eligibility for using the New VAT Guidance and Online Claim Forms primarily depends on the nature of the DIY project and the builder's tax status. Builders must be registered for VAT and should ensure that their projects qualify under the specific criteria outlined in the guidance. This may include factors such as the type of construction work performed and whether the materials used are eligible for VAT claims. It is crucial for builders to review these criteria carefully to determine their eligibility before proceeding with the claim process.

Required Documents for the New VAT Guidance and Online Claim Forms for Builders of DIY

When completing the online claim forms, builders must provide several key documents to support their claims. These typically include:

- Invoices from suppliers detailing the materials purchased.

- Contracts or agreements outlining the scope of work.

- Receipts for any additional expenses incurred during the project.

- Any correspondence related to VAT claims or inquiries.

Having these documents readily available will streamline the claim process and help ensure that all necessary information is submitted accurately.

Form Submission Methods for the New VAT Guidance and Online Claim Forms for Builders of DIY

The New VAT Guidance and Online Claim Forms can be submitted electronically through the designated online portal. This method is preferred for its efficiency and speed. Builders should ensure they have a stable internet connection to avoid any interruptions during submission. In addition to online submission, some jurisdictions may allow for paper submissions via mail or in-person delivery at designated offices. Builders should verify the submission methods available in their specific state or locality to ensure compliance with local regulations.

Create this form in 5 minutes or less

Find and fill out the correct new vat guidance and online claim forms for builders of diy

Create this form in 5 minutes!

How to create an eSignature for the new vat guidance and online claim forms for builders of diy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New VAT Guidance And Online Claim Forms For Builders Of DIY?

The New VAT Guidance And Online Claim Forms For Builders Of DIY provide essential information and tools for builders to navigate VAT changes effectively. This guidance helps ensure compliance while simplifying the claim process through user-friendly online forms.

-

How can airSlate SignNow assist with the New VAT Guidance And Online Claim Forms For Builders Of DIY?

airSlate SignNow offers a streamlined platform for eSigning and managing documents related to the New VAT Guidance And Online Claim Forms For Builders Of DIY. Our solution ensures that builders can easily send, sign, and store their VAT-related documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow with the New VAT Guidance And Online Claim Forms For Builders Of DIY?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of builders utilizing the New VAT Guidance And Online Claim Forms For Builders Of DIY. Our cost-effective solutions ensure that businesses of all sizes can access essential features without breaking the bank.

-

What features does airSlate SignNow offer for managing VAT-related documents?

With airSlate SignNow, users can benefit from features such as customizable templates, secure eSigning, and document tracking, all designed to support the New VAT Guidance And Online Claim Forms For Builders Of DIY. These tools enhance efficiency and ensure compliance with the latest VAT regulations.

-

Are there any integrations available for airSlate SignNow to support the New VAT Guidance And Online Claim Forms For Builders Of DIY?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, making it easier for builders to manage their VAT documentation. These integrations enhance workflow efficiency, allowing users to focus on their projects while staying compliant with the New VAT Guidance And Online Claim Forms For Builders Of DIY.

-

What benefits can builders expect from using airSlate SignNow in relation to the New VAT Guidance And Online Claim Forms For Builders Of DIY?

Builders can expect increased efficiency, reduced paperwork, and improved compliance when using airSlate SignNow for the New VAT Guidance And Online Claim Forms For Builders Of DIY. Our platform simplifies the document management process, allowing builders to save time and resources.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital document management?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for everyone, including those unfamiliar with digital document management. The platform's intuitive interface ensures that builders can easily navigate the New VAT Guidance And Online Claim Forms For Builders Of DIY without any hassle.

Get more for New VAT Guidance And Online Claim Forms For Builders Of DIY

Find out other New VAT Guidance And Online Claim Forms For Builders Of DIY

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe