VA Form 26 8923

Understanding VA Form 26 8923

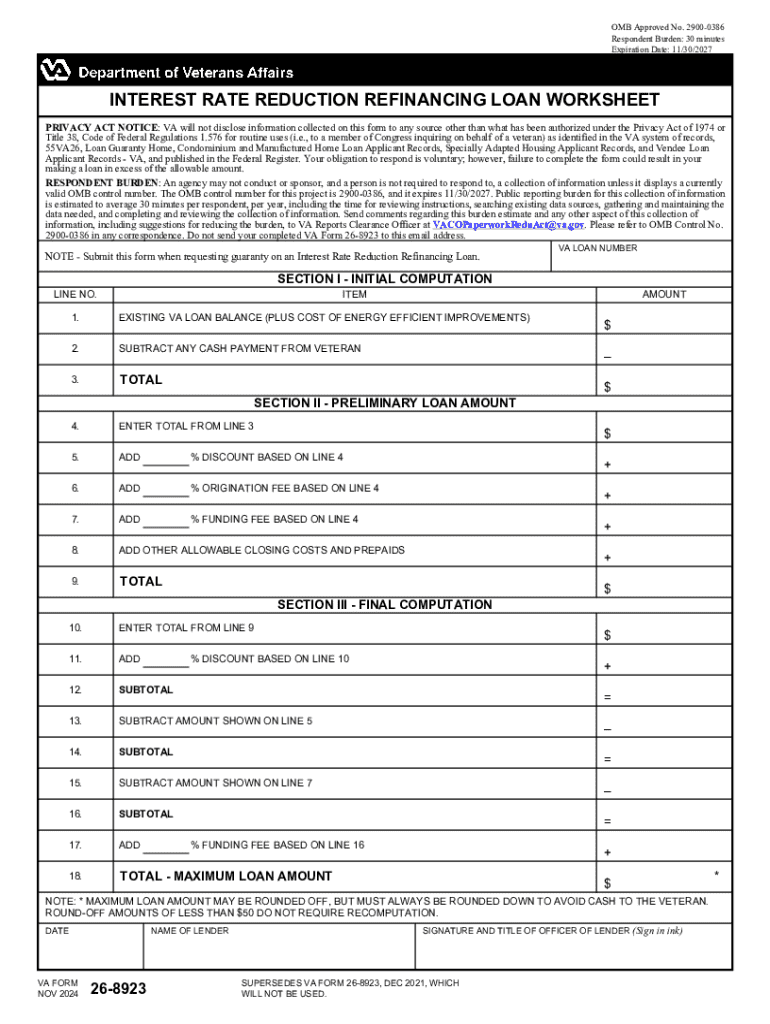

VA Form 26 8923, also known as the “Interest Rate Reduction Refinancing Loan (IRRRL) Worksheet,” is a document utilized by veterans seeking to refinance their existing VA loans. This form helps streamline the refinancing process by collecting essential information regarding the veteran's current mortgage, the proposed loan, and the benefits of refinancing. It is crucial for veterans to accurately complete this form to ensure they receive the best possible terms on their new loan.

Steps to Complete VA Form 26 8923

Completing VA Form 26 8923 involves several key steps. First, gather all necessary information, including details about your current mortgage and the new loan you are considering. Next, fill out the form by providing accurate data in each section, ensuring that all required fields are completed. Pay special attention to the calculations related to your interest rates and potential savings. Once you have reviewed the form for accuracy, it can be submitted to your lender for processing.

How to Obtain VA Form 26 8923

VA Form 26 8923 can be obtained from the official U.S. Department of Veterans Affairs website or through your lender. Many lenders provide this form directly to their clients as part of the refinancing process. It is important to ensure that you are using the most current version of the form to avoid any processing delays.

Legal Use of VA Form 26 8923

The legal use of VA Form 26 8923 is primarily for veterans looking to take advantage of the Interest Rate Reduction Refinancing Loan program. This form is designed to comply with federal regulations governing VA loans and refinancing. Proper completion and submission of this form are essential for ensuring that the refinancing process adheres to legal standards and that veterans receive the benefits they are entitled to.

Key Elements of VA Form 26 8923

Key elements of VA Form 26 8923 include personal information about the veteran, details of the current loan, and information about the proposed refinancing loan. The form also requires the veteran to provide information regarding their eligibility for the VA loan program and any potential savings from the refinancing. Understanding these elements is crucial for accurately completing the form and maximizing the benefits of the refinancing process.

Form Submission Methods

VA Form 26 8923 can be submitted through various methods, depending on the lender's requirements. Common submission methods include online submission via the lender's portal, mailing a physical copy of the form, or delivering it in person to the lender's office. It is advisable to check with your lender for specific submission guidelines to ensure timely processing of your refinancing application.

Eligibility Criteria for VA Form 26 8923

To be eligible for using VA Form 26 8923, a veteran must meet certain criteria, including having an existing VA loan and a satisfactory payment history. Additionally, the veteran must be seeking to refinance to a lower interest rate or to switch from an adjustable-rate mortgage to a fixed-rate mortgage. Understanding these eligibility criteria is essential for veterans to determine if they can benefit from the refinancing options available through this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va form 26 8923

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VA Form 26 8923?

The VA Form 26 8923 is a document used by veterans to apply for a VA loan. This form helps streamline the loan process by providing essential information to lenders. Understanding how to fill out the VA Form 26 8923 correctly can signNowly enhance your chances of loan approval.

-

How can airSlate SignNow help with the VA Form 26 8923?

airSlate SignNow simplifies the process of completing and signing the VA Form 26 8923. With our platform, you can easily fill out the form electronically and send it for eSignature. This not only saves time but also ensures that your document is securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the VA Form 26 8923?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, allowing you to manage your documents, including the VA Form 26 8923, without breaking the bank. You can choose a plan that best fits your usage requirements.

-

What features does airSlate SignNow offer for the VA Form 26 8923?

airSlate SignNow provides a range of features for managing the VA Form 26 8923, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your document workflow, ensuring that you can complete the form quickly and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other tools for the VA Form 26 8923?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the VA Form 26 8923. Whether you use CRM systems, cloud storage, or other document management tools, our platform can connect seamlessly to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the VA Form 26 8923?

Using airSlate SignNow for the VA Form 26 8923 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. Additionally, the ease of use allows you to focus on what matters most—getting your loan approved.

-

How secure is airSlate SignNow when handling the VA Form 26 8923?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data when handling the VA Form 26 8923. Our platform complies with industry standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for VA Form 26 8923

- C o m roman shade order form castec

- Commercially useful function cuf certification form bidsync com

- Resume rubric form

- The schools of mckeel academy volunteer application raptor form

- Progress energy florida sunsense schools program tion applica form

- Fine arts judging sheets fill and sign printable form

- Bishop larkin catholic school emergency medical form

- Veterans day chapel nov form

Find out other VA Form 26 8923

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free