POWER of ATTORNEY NEW YORK STATUTORY GIFTS RIDER Tcnylaw Com Form

Understanding the Power of Attorney New York Statutory Gifts Rider

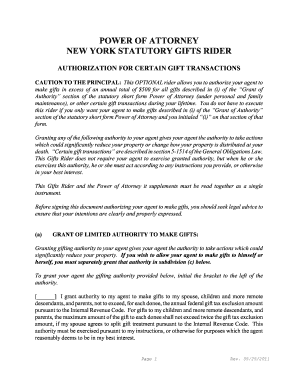

The Power of Attorney New York Statutory Gifts Rider is a legal document that allows an individual to authorize another person to make gifts on their behalf. This rider is particularly important in New York, as it specifies the powers granted to an agent regarding gifting. It is essential for individuals who wish to ensure their financial decisions regarding gifts are managed by a trusted person, especially in scenarios involving estate planning or elder care.

How to Utilize the Power of Attorney New York Statutory Gifts Rider

To effectively use the Power of Attorney New York Statutory Gifts Rider, the principal must complete the document accurately. This includes specifying the agent's authority to make gifts, which can include cash, property, or other assets. The principal should also consider outlining any limitations on the gifting authority, ensuring that the agent acts in their best interest. Once completed, the document must be signed and notarized to be legally binding.

Steps to Complete the Power of Attorney New York Statutory Gifts Rider

Completing the Power of Attorney New York Statutory Gifts Rider involves several key steps:

- Obtain the official form for the Power of Attorney and the Statutory Gifts Rider.

- Fill in the principal's information, including name and address.

- Designate the agent who will have the authority to make gifts.

- Clearly outline the scope of the gifting authority, including any limitations.

- Sign the document in the presence of a notary public.

Legal Considerations for the Power of Attorney New York Statutory Gifts Rider

When utilizing the Power of Attorney New York Statutory Gifts Rider, it is crucial to understand the legal implications. The agent must act within the authority granted and in the best interests of the principal. Misuse of this power can lead to legal consequences, including potential liability for the agent. It is advisable for both the principal and the agent to seek legal counsel to ensure compliance with New York laws.

Key Elements of the Power of Attorney New York Statutory Gifts Rider

Several key elements must be included in the Power of Attorney New York Statutory Gifts Rider to ensure its effectiveness:

- The full name and address of the principal and agent.

- A clear statement of the powers granted to the agent regarding gifting.

- Any specific limitations or conditions on the gifting authority.

- Signatures of the principal and a notary public.

Examples of Using the Power of Attorney New York Statutory Gifts Rider

There are various scenarios in which the Power of Attorney New York Statutory Gifts Rider may be beneficial:

- An elderly person who wishes to gift assets to family members while retaining control over their estate.

- A parent who wants to set up educational funds for their children.

- Individuals planning their estate and wanting to minimize tax liabilities through strategic gifting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the power of attorney new york statutory gifts rider tcnylaw com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

The POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER is a legal document that allows an individual to authorize another person to make gifts on their behalf in accordance with New York law. This rider is essential for ensuring that your financial and estate planning needs are met while complying with state regulations.

-

How can airSlate SignNow help with the POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER efficiently. Our solution simplifies the process, ensuring that you can manage your legal documents with ease and confidence.

-

What are the benefits of using airSlate SignNow for my POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

Using airSlate SignNow for your POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER offers numerous benefits, including cost-effectiveness, ease of use, and secure document management. You can streamline your signing process and ensure that your documents are legally binding and compliant with New York law.

-

Is there a cost associated with creating a POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for creating a POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER. However, our pricing plans are designed to be affordable and provide excellent value for the features and services offered, making it a worthwhile investment for your legal needs.

-

Can I integrate airSlate SignNow with other applications for my POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage your POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER alongside your existing workflows. This flexibility enhances productivity and ensures that all your documents are easily accessible.

-

How secure is my information when using airSlate SignNow for the POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

Security is a top priority at airSlate SignNow. When you use our platform for your POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER, your information is protected with advanced encryption and security protocols, ensuring that your sensitive data remains confidential and secure.

-

What features does airSlate SignNow offer for managing the POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER?

airSlate SignNow offers a variety of features for managing your POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER, including customizable templates, real-time tracking, and automated reminders. These features help you stay organized and ensure that your documents are completed efficiently.

Get more for POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER Tcnylaw com

Find out other POWER OF ATTORNEY NEW YORK STATUTORY GIFTS RIDER Tcnylaw com

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT