Borrower's Certification and Authorization the 2 Mortgage Guys Form

What is the Borrower's Certification and Authorization?

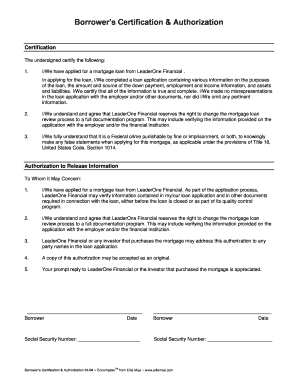

The Borrower's Certification and Authorization is a crucial document used in the mortgage application process. It serves as a formal declaration by the borrower, affirming the accuracy of the information provided in their loan application. This certification allows lenders to verify the borrower's financial details, including income, debts, and credit history, ensuring that all submitted data is truthful and complete. The document also grants permission for the lender to obtain necessary financial information from third parties, which is essential for evaluating the borrower's creditworthiness.

Key Elements of the Borrower's Certification and Authorization

This certification typically includes several key components that are vital for both the borrower and the lender. These elements often encompass:

- Personal Information: Full name, address, and Social Security number of the borrower.

- Income Verification: Details regarding the borrower's income sources and amounts.

- Debt Disclosure: A comprehensive list of existing debts and obligations.

- Authorization Clause: A statement permitting the lender to obtain financial information from relevant institutions.

- Signature: The borrower's signature, which confirms their agreement to the terms outlined in the document.

Steps to Complete the Borrower's Certification and Authorization

Completing the Borrower's Certification and Authorization involves several straightforward steps:

- Gather Required Information: Collect all necessary personal and financial details, including income statements and debt records.

- Fill Out the Form: Carefully complete the certification form, ensuring all information is accurate and up to date.

- Review the Document: Double-check the form for any errors or omissions before submission.

- Sign the Document: Provide your signature to validate the certification and authorization.

- Submit the Form: Send the completed document to your lender as part of your mortgage application package.

How to Use the Borrower's Certification and Authorization

The Borrower's Certification and Authorization is primarily used during the mortgage application process. It is essential for borrowers to accurately complete this document to facilitate the lender's assessment of their financial situation. By providing a clear and truthful certification, borrowers can help streamline the approval process, making it easier for lenders to verify their information and make informed decisions regarding loan approval.

Legal Use of the Borrower's Certification and Authorization

Legally, the Borrower's Certification and Authorization serves as a binding agreement between the borrower and the lender. It ensures that the borrower is aware of their obligations and the implications of providing false information. This document is crucial in protecting both parties, as it allows lenders to comply with regulatory requirements while safeguarding the borrower's rights. Understanding the legal significance of this certification can help borrowers navigate the mortgage process more effectively.

Examples of Using the Borrower's Certification and Authorization

In practice, the Borrower's Certification and Authorization can be utilized in various scenarios, including:

- Home Purchases: When applying for a mortgage to buy a new home, this certification is often required.

- Refinancing: Borrowers seeking to refinance their existing mortgage may need to submit this document to verify their current financial status.

- Loan Modifications: In cases where borrowers request modifications to their existing loan terms, this certification may be necessary.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrower39s certification and authorization the 2 mortgage guys

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Borrower's Certification And Authorization The 2 Mortgage Guys?

The Borrower's Certification And Authorization The 2 Mortgage Guys is a crucial document that allows lenders to verify a borrower's financial information. This certification ensures that all provided data is accurate and up-to-date, facilitating a smoother mortgage application process.

-

How does airSlate SignNow simplify the Borrower's Certification And Authorization process?

airSlate SignNow streamlines the Borrower's Certification And Authorization process by providing an intuitive platform for eSigning and document management. Users can easily send, sign, and store their documents securely, reducing the time and effort involved in traditional methods.

-

What are the pricing options for using airSlate SignNow for Borrower's Certification And Authorization?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users. Whether you are an individual or a business, you can choose a plan that fits your budget while ensuring you have access to the features necessary for managing the Borrower's Certification And Authorization efficiently.

-

What features does airSlate SignNow offer for Borrower's Certification And Authorization?

Key features of airSlate SignNow for Borrower's Certification And Authorization include customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the user experience and ensure that all necessary steps are completed promptly.

-

How can I integrate airSlate SignNow with other tools for Borrower's Certification And Authorization?

airSlate SignNow offers seamless integrations with various third-party applications, making it easy to incorporate the Borrower's Certification And Authorization into your existing workflow. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

What are the benefits of using airSlate SignNow for Borrower's Certification And Authorization?

Using airSlate SignNow for Borrower's Certification And Authorization provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. This solution allows users to focus on their core tasks while ensuring compliance and accuracy in their documentation.

-

Is airSlate SignNow secure for handling Borrower's Certification And Authorization?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Borrower's Certification And Authorization, are protected with advanced encryption and secure storage. Users can trust that their sensitive information is safe throughout the signing process.

Get more for Borrower's Certification And Authorization The 2 Mortgage Guys

- Massachusetts policy background form

- Letter from landlord to tenant about time of intent to enter premises massachusetts form

- Tenant landlord rent 497309669 form

- Letter from tenant to landlord about sexual harassment massachusetts form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children massachusetts form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497309673 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497309674 form

Find out other Borrower's Certification And Authorization The 2 Mortgage Guys

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple