Driver License Liability Insurance Certification Allstar Underwriters 2006-2026

Understanding the Driver License Liability Insurance Certification from Allstar Underwriters

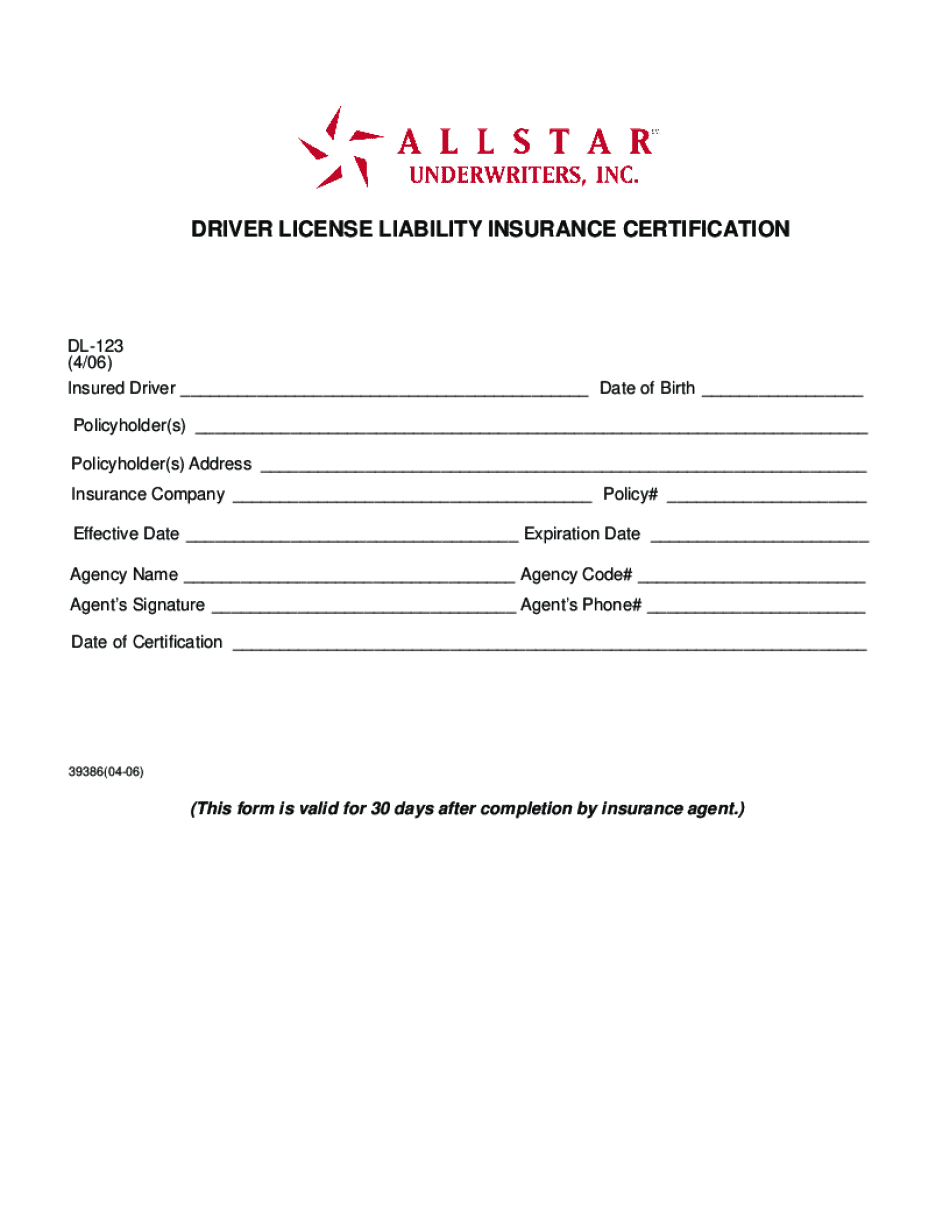

The Driver License Liability Insurance Certification from Allstar Underwriters serves as a crucial document for individuals and businesses that need to demonstrate proof of liability insurance associated with their vehicle operation. This certification is essential for compliance with state regulations, ensuring that drivers have the necessary coverage to protect themselves and others in the event of an accident. It outlines the coverage limits and the specific terms of the insurance policy, which can vary based on state requirements and the insurer's policies.

Steps to Complete the Driver License Liability Insurance Certification

Completing the Driver License Liability Insurance Certification involves several key steps:

- Gather necessary information about your vehicle and insurance policy, including policy numbers and coverage details.

- Fill out the certification form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed certification to the appropriate state agency or department of motor vehicles as required.

Obtaining the Driver License Liability Insurance Certification

To obtain the Driver License Liability Insurance Certification from Allstar Underwriters, you typically need to follow these steps:

- Contact Allstar Underwriters or your insurance agent to request the certification form.

- Provide the necessary information about your insurance policy and vehicle.

- Complete any required documentation as specified by your insurer.

- Receive the certification once your insurance coverage is confirmed and all details are processed.

Legal Use of the Driver License Liability Insurance Certification

The legal use of the Driver License Liability Insurance Certification is vital for ensuring compliance with state laws regarding vehicle operation. This certification acts as proof that a driver has the required liability insurance coverage, which is mandatory in most states. It is often required when registering a vehicle, renewing a driver's license, or during traffic stops. Failure to present this certification when required can lead to legal penalties, including fines or suspension of driving privileges.

Key Elements of the Driver License Liability Insurance Certification

Key elements of the Driver License Liability Insurance Certification include:

- The name of the insured individual or business.

- The vehicle identification number (VIN) of the insured vehicle.

- Details of the insurance policy, including coverage limits and effective dates.

- The insurance provider's name and contact information.

- Signature of the authorized representative from Allstar Underwriters or the insurance agent.

State-Specific Rules for the Driver License Liability Insurance Certification

Each state has specific rules regarding the Driver License Liability Insurance Certification. These rules can dictate the minimum coverage amounts required, the process for submitting the certification, and the penalties for non-compliance. It is essential for drivers to familiarize themselves with their state's regulations to ensure they meet all legal obligations. Consulting with an insurance professional can provide clarity on these state-specific requirements.

Handy tips for filling out Driver License Liability Insurance Certification Allstar Underwriters online

Quick steps to complete and e-sign Driver License Liability Insurance Certification Allstar Underwriters online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant service for optimum simplicity. Use signNow to e-sign and send Driver License Liability Insurance Certification Allstar Underwriters for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct driver license liability insurance certification allstar underwriters

Create this form in 5 minutes!

How to create an eSignature for the driver license liability insurance certification allstar underwriters

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Driver License Liability Insurance Certification Allstar Underwriters?

Driver License Liability Insurance Certification Allstar Underwriters is a specialized insurance certification that provides coverage for drivers. It ensures that drivers are protected against liabilities that may arise from accidents or damages while operating a vehicle. This certification is essential for businesses that require their drivers to be adequately insured.

-

How can I obtain Driver License Liability Insurance Certification Allstar Underwriters?

To obtain Driver License Liability Insurance Certification Allstar Underwriters, you can apply through authorized insurance agents or directly via the Allstar Underwriters website. The process typically involves providing necessary documentation and information about your driving history. Once approved, you will receive your certification promptly.

-

What are the benefits of Driver License Liability Insurance Certification Allstar Underwriters?

The benefits of Driver License Liability Insurance Certification Allstar Underwriters include financial protection against legal claims and damages. It also enhances your credibility as a driver or business owner, ensuring compliance with legal requirements. Additionally, having this certification can lower your insurance premiums over time.

-

What features are included in Driver License Liability Insurance Certification Allstar Underwriters?

Driver License Liability Insurance Certification Allstar Underwriters includes features such as comprehensive coverage for bodily injury and property damage. It also offers legal defense costs and coverage for uninsured motorists. These features ensure that you are fully protected while driving.

-

Is Driver License Liability Insurance Certification Allstar Underwriters affordable?

Yes, Driver License Liability Insurance Certification Allstar Underwriters is designed to be cost-effective. Pricing varies based on factors such as driving history and coverage limits, but many find it to be a worthwhile investment. By comparing quotes from different providers, you can find a plan that fits your budget.

-

Can I integrate Driver License Liability Insurance Certification Allstar Underwriters with other services?

Yes, Driver License Liability Insurance Certification Allstar Underwriters can often be integrated with various business management and e-signature solutions. This integration allows for streamlined processes and better management of your insurance documentation. Check with your service provider for specific integration options.

-

How does Driver License Liability Insurance Certification Allstar Underwriters protect my business?

Driver License Liability Insurance Certification Allstar Underwriters protects your business by covering potential liabilities that may arise from accidents involving your drivers. This protection helps safeguard your assets and ensures that your business can continue operating smoothly. It also builds trust with clients who expect responsible business practices.

Get more for Driver License Liability Insurance Certification Allstar Underwriters

- Enagic paperwork form

- Ir6163 form

- Tn fae 173 form

- Kifas application form

- Application for extension of time to file inheritance tax return application for extension of time to file inheritance tax form

- Form rp 466 a vol application for volunteer firefightersambulance workers exemption revised 1124

- Application for temporary operation permit form

- Franchise and excise tax return form

Find out other Driver License Liability Insurance Certification Allstar Underwriters

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament