the Difference between Fair Market Value and Fair Value Business 2020

Understanding the Difference Between Fair Market Value and Fair Value

Fair market value (FMV) and fair value are terms often used in business and finance, but they have distinct meanings. Fair market value refers to the price that a willing buyer would pay to a willing seller in an open market, assuming both parties are knowledgeable and not under any undue pressure. This value is commonly used in real estate transactions and tax assessments.

On the other hand, fair value is a broader concept that considers the intrinsic worth of an asset or liability, taking into account various factors such as market conditions, the asset's earning potential, and the specific circumstances of the transaction. Fair value is often used in financial reporting and accounting, particularly under accounting standards like GAAP and IFRS.

Key Elements of Fair Market Value and Fair Value

Understanding the key elements of both fair market value and fair value can help businesses make informed decisions. For fair market value, important elements include:

- Market conditions at the time of sale

- Comparable sales of similar assets

- The motivations of both buyer and seller

For fair value, the key elements often involve:

- Valuation techniques, such as discounted cash flow analysis

- Market participant assumptions

- Specific risks associated with the asset or liability

Examples of Fair Market Value and Fair Value in Business

To illustrate the differences, consider a real estate transaction. The fair market value of a property may be determined by recent sales of comparable properties in the area. In contrast, the fair value of a business might be assessed using a discounted cash flow model, which estimates future cash flows and discounts them to present value, taking into account the specific risks associated with that business.

Another example is in mergers and acquisitions, where fair value is often used to assess the worth of a company, while fair market value may be referenced for specific assets involved in the transaction.

Legal Use of Fair Market Value and Fair Value

Both fair market value and fair value have legal implications, particularly in tax assessments and financial reporting. Fair market value is often required for tax purposes to determine property taxes and capital gains. Fair value, on the other hand, is crucial for compliance with accounting standards, ensuring that financial statements accurately reflect the value of assets and liabilities.

Understanding these legal uses is essential for businesses to maintain compliance and avoid potential penalties.

Steps to Determine Fair Market Value and Fair Value

Determining fair market value typically involves several steps:

- Researching comparable sales in the market

- Analyzing current market conditions

- Considering the specific characteristics of the asset

For fair value, the process may include:

- Identifying the asset or liability to be valued

- Choosing an appropriate valuation method

- Gathering necessary financial data and assumptions

State-Specific Rules for Fair Market Value and Fair Value

Different states may have specific regulations regarding the determination of fair market value and fair value. These rules can affect property tax assessments, business valuations, and other financial reporting requirements. Businesses should be aware of their state's guidelines to ensure compliance and accurate reporting.

IRS Guidelines on Fair Market Value

The Internal Revenue Service (IRS) provides guidelines on how to determine fair market value for tax purposes. These guidelines emphasize the importance of using reliable data and methodologies. Businesses should refer to IRS publications and consult with tax professionals to ensure they are following the correct procedures for reporting fair market value in their tax filings.

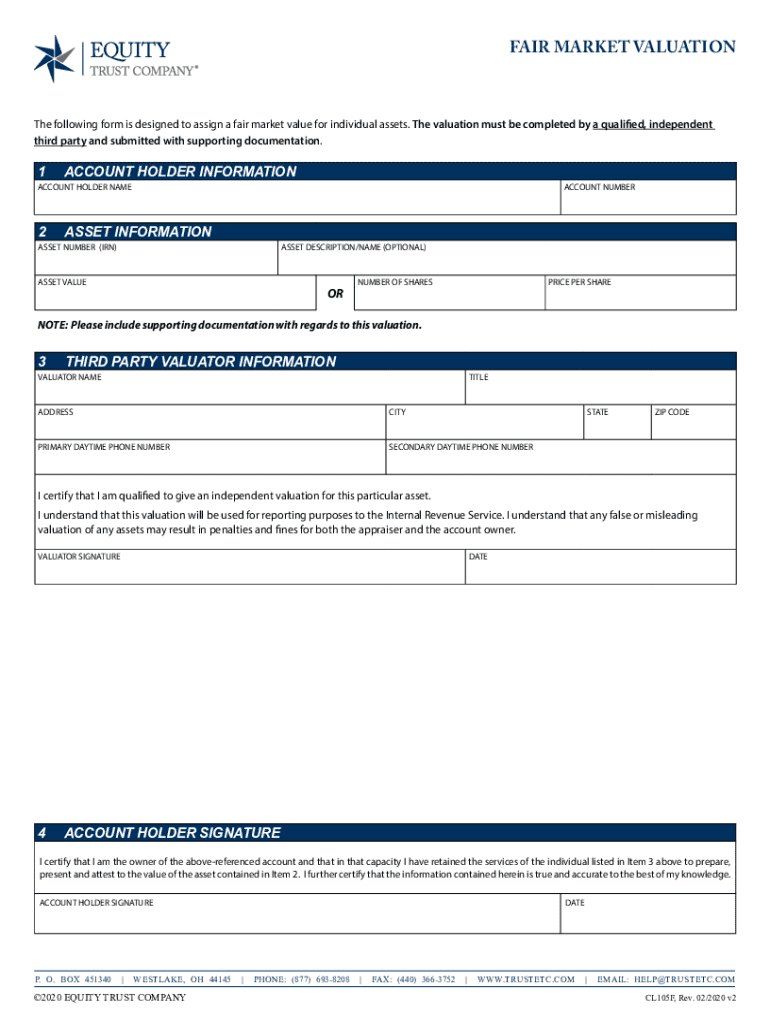

Create this form in 5 minutes or less

Find and fill out the correct the difference between fair market value and fair value business

Create this form in 5 minutes!

How to create an eSignature for the the difference between fair market value and fair value business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between fair market value and fair value in business?

The difference between fair market value and fair value in business lies in their definitions and applications. Fair market value refers to the price that a willing buyer and seller would agree upon in an open market, while fair value is often used in financial reporting and reflects the estimated worth of an asset based on its intrinsic value. Understanding the difference between fair market value and fair value business is crucial for accurate financial assessments.

-

How does airSlate SignNow help in determining fair market value?

airSlate SignNow can assist businesses in determining fair market value by providing a platform for efficient document management and eSigning. By streamlining the process of gathering and sharing financial documents, businesses can more easily analyze and negotiate values. This efficiency is essential for understanding the difference between fair market value and fair value business.

-

What features does airSlate SignNow offer for business valuation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are beneficial for business valuation. These tools help ensure that all necessary documents are accurately prepared and signed, which is vital when assessing the difference between fair market value and fair value business. This can lead to more informed decision-making.

-

Can airSlate SignNow integrate with other financial tools?

Yes, airSlate SignNow integrates seamlessly with various financial tools and software, enhancing its functionality for businesses. This integration allows users to manage their documents alongside their financial data, making it easier to analyze the difference between fair market value and fair value business. Such connectivity ensures a more comprehensive approach to business valuation.

-

What are the benefits of using airSlate SignNow for business transactions?

Using airSlate SignNow for business transactions offers numerous benefits, including increased efficiency, reduced costs, and enhanced security. By simplifying the eSigning process, businesses can focus on understanding the difference between fair market value and fair value business without the hassle of traditional paperwork. This leads to quicker transactions and better financial outcomes.

-

Is airSlate SignNow suitable for small businesses?

Absolutely, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its user-friendly interface and affordable pricing make it accessible for those who need to understand the difference between fair market value and fair value business without breaking the bank. Small businesses can leverage this tool to streamline their operations.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and secure cloud storage. This ensures that sensitive information related to the difference between fair market value and fair value business is protected at all times. Businesses can confidently manage their documents knowing that their data is secure.

Get more for The Difference Between Fair Market Value And Fair Value Business

- Uben 121 form

- Aiu high school diplomats program parentguardian release form

- Eastern new mexico university explore experience excel form

- Direct loan exit counseling guide federal student aid form

- Csn form

- F f i c e form

- Capp florida institute of technology form

- When the student begins college in 20182019 form

Find out other The Difference Between Fair Market Value And Fair Value Business

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free