Required Minimum Distribution RMD Form 2023

What is the Required Minimum Distribution RMD Form

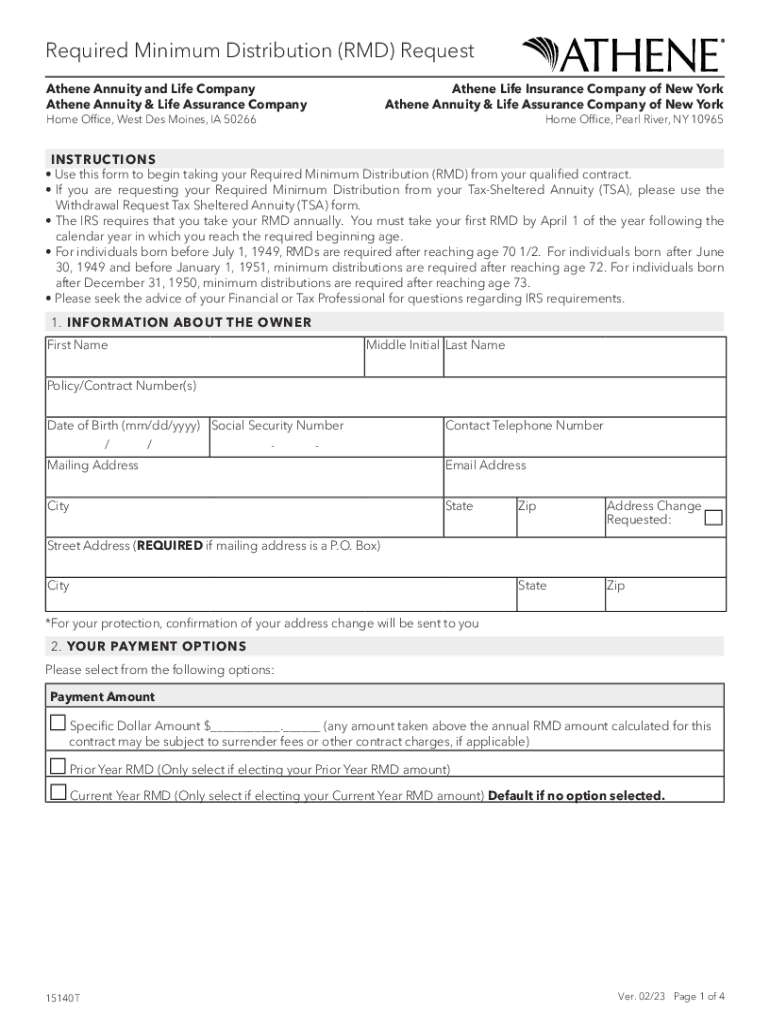

The Required Minimum Distribution (RMD) Form is a crucial document for individuals who have retirement accounts, such as traditional IRAs or 401(k)s. This form is used to report the minimum amount that must be withdrawn from these accounts each year once the account holder reaches a certain age, typically seventy-two. The RMD is mandated by the Internal Revenue Service (IRS) to ensure that individuals do not defer taxes on their retirement savings indefinitely.

Understanding the RMD Form is essential for compliance with IRS regulations. Failure to withdraw the required amount can result in significant penalties, making it vital for account holders to be aware of their obligations.

How to use the Required Minimum Distribution RMD Form

Using the Required Minimum Distribution RMD Form involves several steps. First, individuals must determine their RMD amount, which can be calculated based on their account balance and life expectancy factors provided by the IRS. Once the amount is established, the form can be filled out to initiate the withdrawal process.

It is important to accurately complete the form by providing necessary information, such as personal details, account numbers, and the calculated RMD. After filling out the form, individuals should submit it to their financial institution, which will process the withdrawal accordingly.

Steps to complete the Required Minimum Distribution RMD Form

Completing the Required Minimum Distribution RMD Form involves specific steps to ensure accuracy and compliance:

- Identify your retirement accounts that require RMDs.

- Calculate your RMD using the IRS life expectancy tables and your account balance.

- Fill out the RMD Form with your personal information and the calculated amount.

- Review the form for completeness and accuracy.

- Submit the form to your financial institution via the preferred method, such as online, by mail, or in person.

Following these steps helps ensure that you meet your RMD requirements and avoid potential penalties.

Key elements of the Required Minimum Distribution RMD Form

The Required Minimum Distribution RMD Form contains several key elements that are essential for proper completion:

- Personal Information: This includes the account holder's name, address, and Social Security number.

- Account Details: Information about the retirement accounts from which the RMD is being withdrawn.

- RMD Calculation: The specific amount that must be withdrawn, based on IRS guidelines.

- Signature: The account holder's signature is required to validate the form and authorize the withdrawal.

Ensuring all these elements are correctly filled out is crucial for the form's acceptance and processing.

IRS Guidelines

The IRS provides specific guidelines regarding Required Minimum Distributions. According to these guidelines, individuals must begin taking distributions from their retirement accounts by April first of the year following the year they turn seventy-two. The RMD amount is calculated based on the account balance at the end of the previous year and the IRS life expectancy tables.

It's important to stay updated with any changes in IRS regulations, as these can affect the calculation and timing of RMDs. Consulting IRS publications or a tax professional can provide additional clarity on these guidelines.

Penalties for Non-Compliance

Failing to comply with the RMD requirements can lead to significant penalties. The IRS imposes a penalty of fifty percent on the amount that was not withdrawn as required. This means that if an individual was supposed to withdraw a certain amount but did not, they could owe half of that amount in penalties.

To avoid these penalties, it is essential for account holders to understand their RMD obligations and to ensure timely withdrawals from their retirement accounts.

Create this form in 5 minutes or less

Find and fill out the correct required minimum distribution rmd form

Create this form in 5 minutes!

How to create an eSignature for the required minimum distribution rmd form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Required Minimum Distribution RMD Form?

A Required Minimum Distribution RMD Form is a document that individuals must complete to withdraw a minimum amount from their retirement accounts, such as IRAs or 401(k)s, once they signNow a certain age. This form ensures compliance with IRS regulations regarding mandatory withdrawals, helping you avoid penalties.

-

How can airSlate SignNow help with the Required Minimum Distribution RMD Form?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning your Required Minimum Distribution RMD Form. With our user-friendly interface, you can easily manage your documents and ensure they are securely signed and stored, simplifying the entire process.

-

Is there a cost associated with using airSlate SignNow for the Required Minimum Distribution RMD Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our cost-effective solutions ensure that you can efficiently manage your Required Minimum Distribution RMD Form without breaking the bank.

-

What features does airSlate SignNow offer for managing the Required Minimum Distribution RMD Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to enhance your experience with the Required Minimum Distribution RMD Form. These tools help you streamline the signing process and maintain compliance with ease.

-

Can I integrate airSlate SignNow with other software for my Required Minimum Distribution RMD Form?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services, making it easy to manage your Required Minimum Distribution RMD Form alongside your other business tools. This flexibility enhances your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the Required Minimum Distribution RMD Form?

Using airSlate SignNow for your Required Minimum Distribution RMD Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally, allowing you to focus on other important aspects of your financial planning.

-

How secure is the airSlate SignNow platform for my Required Minimum Distribution RMD Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your Required Minimum Distribution RMD Form and other sensitive documents, ensuring that your information remains confidential and secure.

Get more for Required Minimum Distribution RMD Form

Find out other Required Minimum Distribution RMD Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document