Required Minimum Distribution Rmd Request 2024-2026

What is the Required Minimum Distribution RMD Request

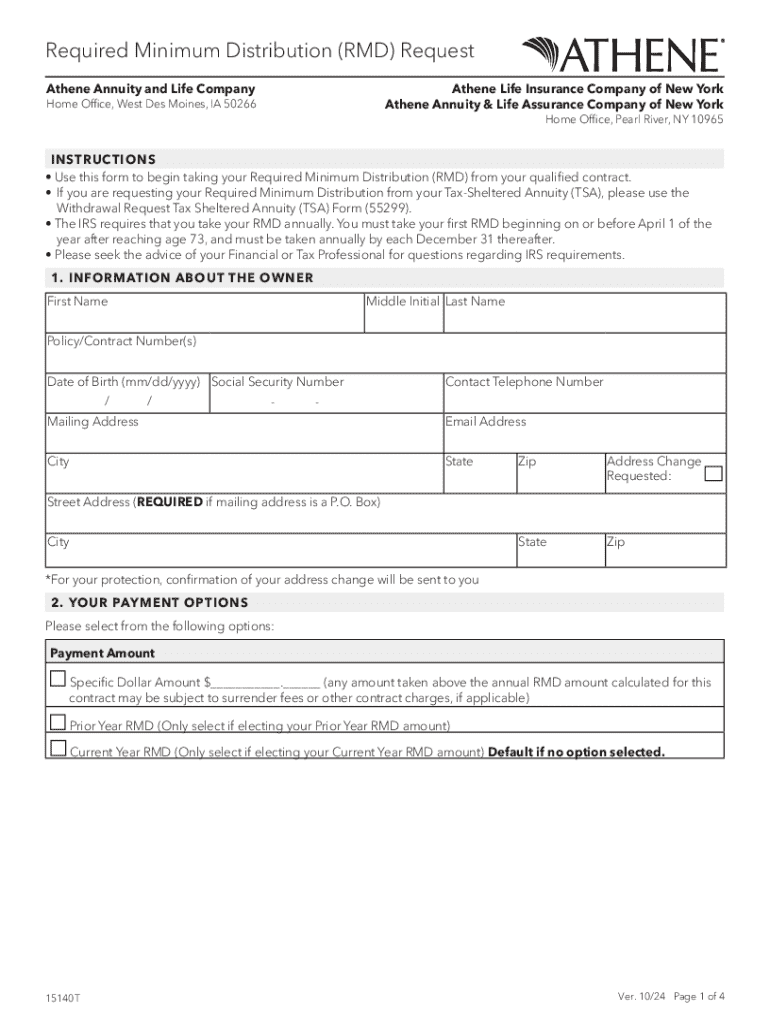

The Required Minimum Distribution (RMD) Request is a formal document that individuals must submit to withdraw a specified amount from their retirement accounts. This requirement typically applies to individuals aged seventy-two and older who have tax-deferred retirement accounts such as IRAs and 401(k)s. The RMD is calculated based on the account balance and the individual's life expectancy, as defined by IRS tables. This process ensures that individuals begin to withdraw funds from their retirement accounts, thus paying taxes on those distributions over time.

How to use the Required Minimum Distribution RMD Request

Using the Required Minimum Distribution Request involves several straightforward steps. First, individuals must determine the amount they are required to withdraw based on their account balance and IRS life expectancy tables. Next, they should complete the RMD Request form, providing necessary personal information and account details. After filling out the form, individuals can submit it to their financial institution, either online or via traditional mail. It is important to ensure that the request is submitted by the deadline to avoid any penalties.

Steps to complete the Required Minimum Distribution RMD Request

Completing the Required Minimum Distribution Request involves a series of clear steps:

- Determine your RMD amount using the IRS life expectancy tables.

- Gather necessary information, including your account number and personal identification.

- Fill out the RMD Request form accurately, ensuring all required fields are completed.

- Review the form for accuracy to prevent delays.

- Submit the form to your financial institution through your preferred method, whether online or by mail.

Key elements of the Required Minimum Distribution RMD Request

Several key elements must be included in the Required Minimum Distribution Request to ensure its validity:

- Personal Information: Full name, address, and Social Security number.

- Account Details: The type of retirement account and account number.

- RMD Amount: The specific amount being requested for withdrawal.

- Signature: Required to authorize the distribution.

IRS Guidelines

The IRS provides specific guidelines regarding Required Minimum Distributions. According to IRS regulations, individuals must begin taking RMDs by April first of the year following the year they turn seventy-two. The amount is calculated based on the account balance as of December thirty-first of the previous year, divided by a life expectancy factor determined by the IRS. Failure to take the required distribution can result in significant penalties, amounting to fifty percent of the amount that should have been withdrawn.

Penalties for Non-Compliance

Not complying with RMD requirements can lead to severe financial penalties. If an individual fails to withdraw the required minimum amount, the IRS imposes a penalty of fifty percent on the shortfall. For example, if the required distribution is ten thousand dollars and the individual only withdraws five thousand, the penalty would be two thousand five hundred dollars. It is crucial for individuals to understand these penalties to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct required minimum distribution rmd request

Create this form in 5 minutes!

How to create an eSignature for the required minimum distribution rmd request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Required Minimum Distribution (RMD) Request?

A Required Minimum Distribution (RMD) Request is a formal request to withdraw a minimum amount from your retirement accounts as mandated by the IRS. Understanding how to properly submit an RMD Request is crucial for compliance and to avoid penalties. airSlate SignNow simplifies this process by allowing you to eSign and send your RMD Request documents securely.

-

How does airSlate SignNow facilitate the RMD Request process?

airSlate SignNow streamlines the Required Minimum Distribution RMD Request process by providing an intuitive platform for document preparation and electronic signatures. Users can easily create, send, and track their RMD Requests, ensuring that all necessary information is included and submitted on time. This efficiency helps users avoid costly mistakes and delays.

-

What are the pricing options for using airSlate SignNow for RMD Requests?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those specifically for handling Required Minimum Distribution RMD Requests. You can choose from monthly or annual subscriptions, with options for additional features as needed. This cost-effective solution ensures that you can manage your RMD Requests without breaking the bank.

-

Are there any integrations available for managing RMD Requests?

Yes, airSlate SignNow integrates seamlessly with various financial and accounting software, making it easier to manage your Required Minimum Distribution RMD Requests. These integrations allow for automatic data transfer and streamlined workflows, enhancing efficiency. You can connect with popular platforms to ensure your RMD Requests are processed smoothly.

-

What features does airSlate SignNow offer for RMD Requests?

airSlate SignNow provides a range of features designed to simplify the Required Minimum Distribution RMD Request process. Key features include customizable templates, secure eSigning, document tracking, and automated reminders. These tools help ensure that your RMD Requests are completed accurately and on time.

-

How secure is the airSlate SignNow platform for RMD Requests?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Required Minimum Distribution RMD Requests. The platform employs advanced encryption and compliance with industry standards to protect your data. You can trust that your RMD Requests are safe and secure throughout the entire process.

-

Can I access airSlate SignNow on mobile devices for RMD Requests?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your Required Minimum Distribution RMD Requests on the go. Whether you need to send, sign, or track documents, the mobile app provides the same functionality as the desktop version, ensuring convenience and flexibility.

Get more for Required Minimum Distribution rmd Request

Find out other Required Minimum Distribution rmd Request

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure