Ohio it 1140 Pass through Entity and Trust 2022

What is the Ohio IT 1140 Pass Through Entity And Trust

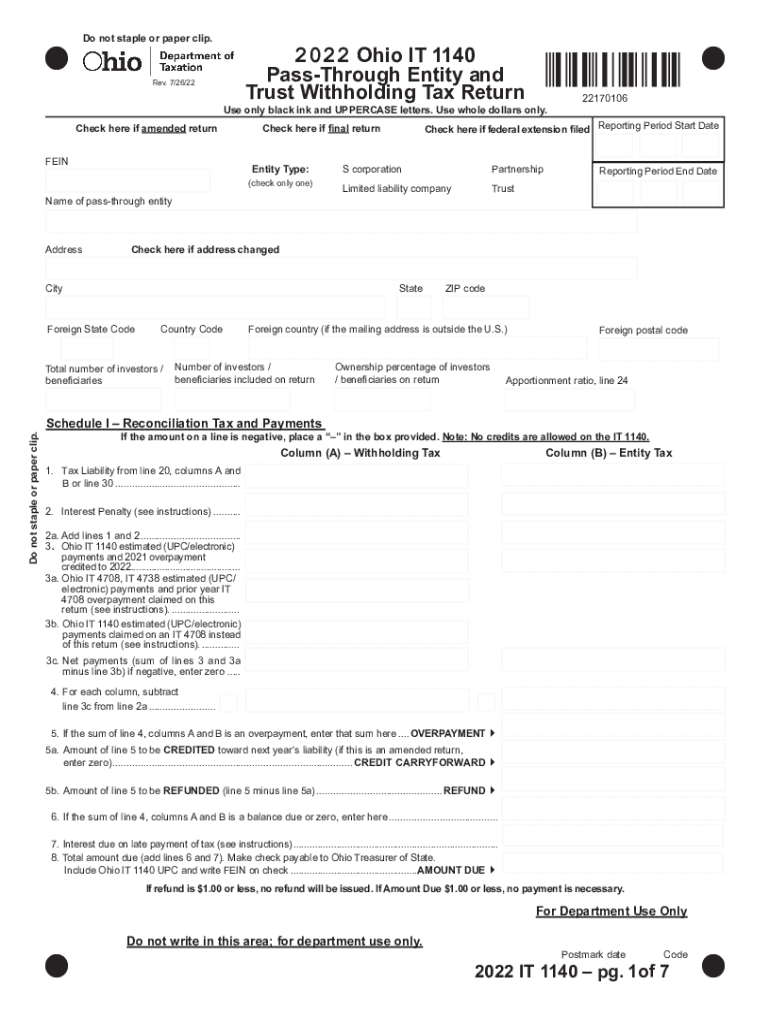

The Ohio IT 1140 Pass Through Entity and Trust form is a tax document used by certain business entities in Ohio to report income that passes through to individual owners, partners, or beneficiaries. This form is essential for partnerships, S corporations, and trusts, allowing them to report income, deductions, and credits to the state of Ohio. By using this form, entities can ensure compliance with state tax regulations while facilitating the correct taxation of income distributed to individual stakeholders.

Steps to complete the Ohio IT 1140 Pass Through Entity And Trust

Completing the Ohio IT 1140 Pass Through Entity and Trust involves several key steps:

- Gather necessary information: Collect all relevant financial data, including income statements, expense reports, and prior tax filings.

- Fill out the form: Input the required information accurately, ensuring that all income, deductions, and credits are reported correctly.

- Review for accuracy: Double-check all entries to minimize errors that could lead to penalties or delays.

- Submit the form: Choose a submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Required Documents

To complete the Ohio IT 1140 Pass Through Entity and Trust, several documents are typically required:

- Financial statements: Income statements and balance sheets for the reporting period.

- Prior year tax returns: Previous filings can provide context and assist in completing the current form.

- Supporting schedules: Any additional schedules that detail specific deductions or credits claimed.

- Partnership agreements or trust documents: These may be necessary to clarify ownership and distribution of income.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Ohio IT 1140 Pass Through Entity and Trust to avoid penalties. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the entity's tax year. For entities operating on a calendar year, this typically falls on April 15. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day.

State-specific rules for the Ohio IT 1140 Pass Through Entity And Trust

Ohio has specific regulations governing the use of the IT 1140 Pass Through Entity and Trust form. For example, entities must ensure that all income reported aligns with Ohio tax laws. Additionally, certain deductions may be limited or disallowed based on state-specific rules. Understanding these regulations is essential for compliance and to optimize tax obligations. Entities should consult the Ohio Department of Taxation for detailed guidance on applicable rules.

Penalties for Non-Compliance

Failure to file the Ohio IT 1140 Pass Through Entity and Trust form on time or inaccuracies in the submission can result in penalties. These penalties may include fines based on the amount of tax owed, interest on unpaid taxes, and potential legal repercussions for willful non-compliance. It is advisable for entities to maintain accurate records and file timely to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 1140 pass through entity and trust

Create this form in 5 minutes!

How to create an eSignature for the ohio it 1140 pass through entity and trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio IT 1140 Pass Through Entity And Trust?

The Ohio IT 1140 Pass Through Entity And Trust is a tax form used by pass-through entities and trusts in Ohio to report income and calculate tax liabilities. Understanding this form is crucial for compliance and ensuring accurate tax reporting for your business.

-

How can airSlate SignNow help with the Ohio IT 1140 Pass Through Entity And Trust?

airSlate SignNow simplifies the process of preparing and signing documents related to the Ohio IT 1140 Pass Through Entity And Trust. Our platform allows you to easily eSign and manage your tax documents, ensuring you stay compliant and organized.

-

What features does airSlate SignNow offer for managing the Ohio IT 1140 Pass Through Entity And Trust?

With airSlate SignNow, you can access features like document templates, secure eSigning, and real-time collaboration. These tools streamline the management of your Ohio IT 1140 Pass Through Entity And Trust documents, making the process efficient and hassle-free.

-

Is airSlate SignNow cost-effective for handling the Ohio IT 1140 Pass Through Entity And Trust?

Yes, airSlate SignNow offers a cost-effective solution for managing your Ohio IT 1140 Pass Through Entity And Trust documents. Our pricing plans are designed to fit various business needs, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for Ohio IT 1140 Pass Through Entity And Trust management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for the Ohio IT 1140 Pass Through Entity And Trust. This integration allows for easy data transfer and document management.

-

What are the benefits of using airSlate SignNow for the Ohio IT 1140 Pass Through Entity And Trust?

Using airSlate SignNow for the Ohio IT 1140 Pass Through Entity And Trust offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and compliance.

-

How secure is airSlate SignNow for handling sensitive Ohio IT 1140 Pass Through Entity And Trust documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Ohio IT 1140 Pass Through Entity And Trust documents. You can trust that your sensitive information is safe with us.

Get more for Ohio IT 1140 Pass Through Entity And Trust

Find out other Ohio IT 1140 Pass Through Entity And Trust

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now