Ohio it 1140 UPC for Pass through EntityFiduciary 2023

What is the Ohio IT 1140 UPC For Pass Through EntityFiduciary

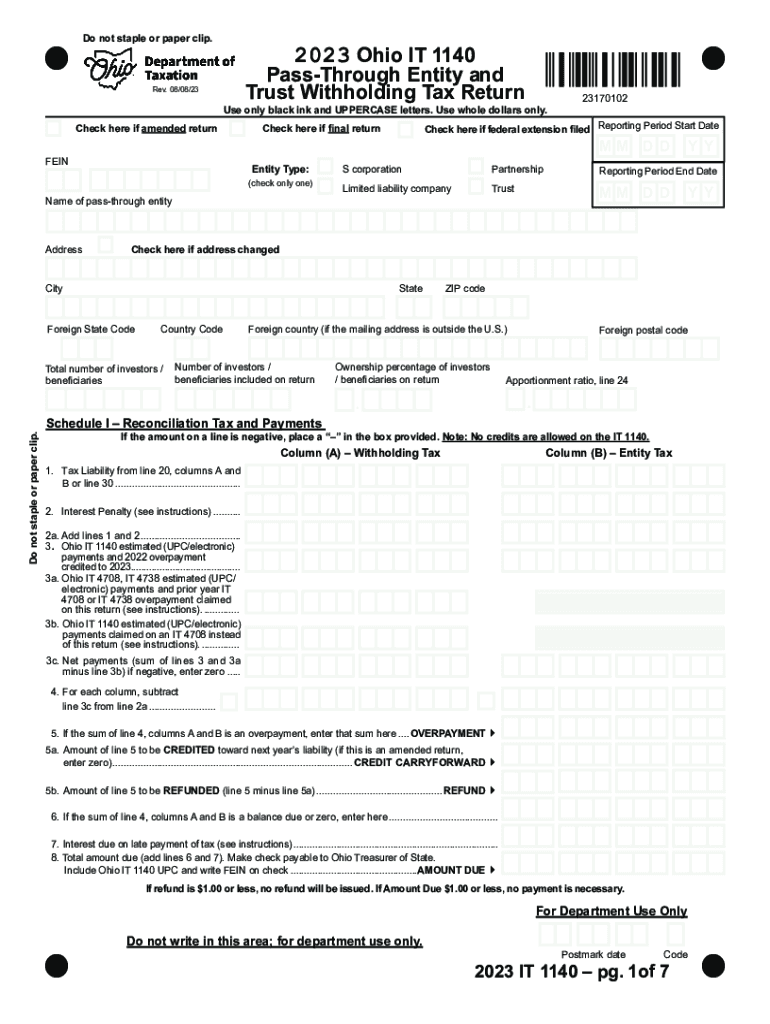

The Ohio IT 1140 UPC is a tax form specifically designed for pass-through entities, such as partnerships and S corporations, that are required to report income, deductions, and credits to the state of Ohio. This form allows fiduciaries to file on behalf of the entity, ensuring that tax obligations are met in compliance with Ohio state law. It is essential for entities that do not pay income tax at the corporate level but pass their income through to their owners or shareholders, who then report it on their personal tax returns.

How to use the Ohio IT 1140 UPC For Pass Through EntityFiduciary

To use the Ohio IT 1140 UPC, entities must first gather all necessary financial information, including income, deductions, and credits. The form requires accurate reporting of these figures to ensure compliance with state tax regulations. After completing the form, it should be signed by the fiduciary, affirming the accuracy of the information provided. Once finalized, the form can be submitted to the Ohio Department of Taxation either electronically or via traditional mail.

Steps to complete the Ohio IT 1140 UPC For Pass Through EntityFiduciary

Completing the Ohio IT 1140 UPC involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form, ensuring all income, deductions, and credits are accurately reported.

- Review the completed form for any errors or omissions.

- Sign the form as the fiduciary, confirming the information is correct.

- Submit the form to the Ohio Department of Taxation by the specified deadline.

Required Documents

When completing the Ohio IT 1140 UPC, certain documents are essential for accurate reporting. These may include:

- Financial statements for the entity.

- Records of income received and expenses incurred.

- Documentation of any tax credits or deductions claimed.

- Previous year’s tax returns for reference.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 1140 UPC are crucial to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the entity's fiscal year. For entities operating on a calendar year, this means the form is due by April 15. It is important to stay informed about any changes in deadlines that may occur due to state regulations or special circumstances.

Penalties for Non-Compliance

Failing to file the Ohio IT 1140 UPC by the deadline can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes.

- Potential legal action for continued non-compliance.

Entities should ensure timely submission to avoid these consequences and maintain good standing with the Ohio Department of Taxation.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 1140 upc for pass through entityfiduciary

Create this form in 5 minutes!

How to create an eSignature for the ohio it 1140 upc for pass through entityfiduciary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

The Ohio IT 1140 UPC For Pass Through EntityFiduciary is a tax form used by fiduciaries to report income for pass-through entities in Ohio. It ensures that the income is accurately reported to the state, allowing for proper tax assessment. Understanding this form is crucial for compliance and effective tax management.

-

How can airSlate SignNow help with the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

airSlate SignNow simplifies the process of preparing and submitting the Ohio IT 1140 UPC For Pass Through EntityFiduciary by providing an intuitive platform for document management. Users can easily eSign and send necessary documents, ensuring a smooth workflow. This efficiency helps reduce errors and saves time during tax season.

-

What are the pricing options for using airSlate SignNow for the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling the Ohio IT 1140 UPC For Pass Through EntityFiduciary. Plans are designed to be cost-effective, ensuring that users can access essential features without breaking the bank. You can choose a plan that fits your budget and document volume.

-

What features does airSlate SignNow provide for managing the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Ohio IT 1140 UPC For Pass Through EntityFiduciary. These tools enhance productivity and ensure that all documents are handled securely and efficiently. Users can also collaborate in real-time, making the process seamless.

-

Are there any integrations available with airSlate SignNow for the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

Yes, airSlate SignNow offers integrations with various accounting and tax software that can assist in managing the Ohio IT 1140 UPC For Pass Through EntityFiduciary. These integrations streamline the workflow, allowing for easy data transfer and document management. This connectivity enhances overall efficiency for businesses.

-

What are the benefits of using airSlate SignNow for the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

Using airSlate SignNow for the Ohio IT 1140 UPC For Pass Through EntityFiduciary provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can signNowly speed up the filing process. Additionally, it helps ensure compliance with state regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with the Ohio IT 1140 UPC For Pass Through EntityFiduciary?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the Ohio IT 1140 UPC For Pass Through EntityFiduciary. The platform offers guided workflows and support resources to help users navigate the process easily. This ensures that everyone can manage their documents confidently.

Get more for Ohio IT 1140 UPC For Pass Through EntityFiduciary

Find out other Ohio IT 1140 UPC For Pass Through EntityFiduciary

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document