Do Not Staple or Paper Clip Ohio it 1140 Rev 2024-2026

What is the Do Not Staple Or Paper Clip Ohio IT 1140 Rev

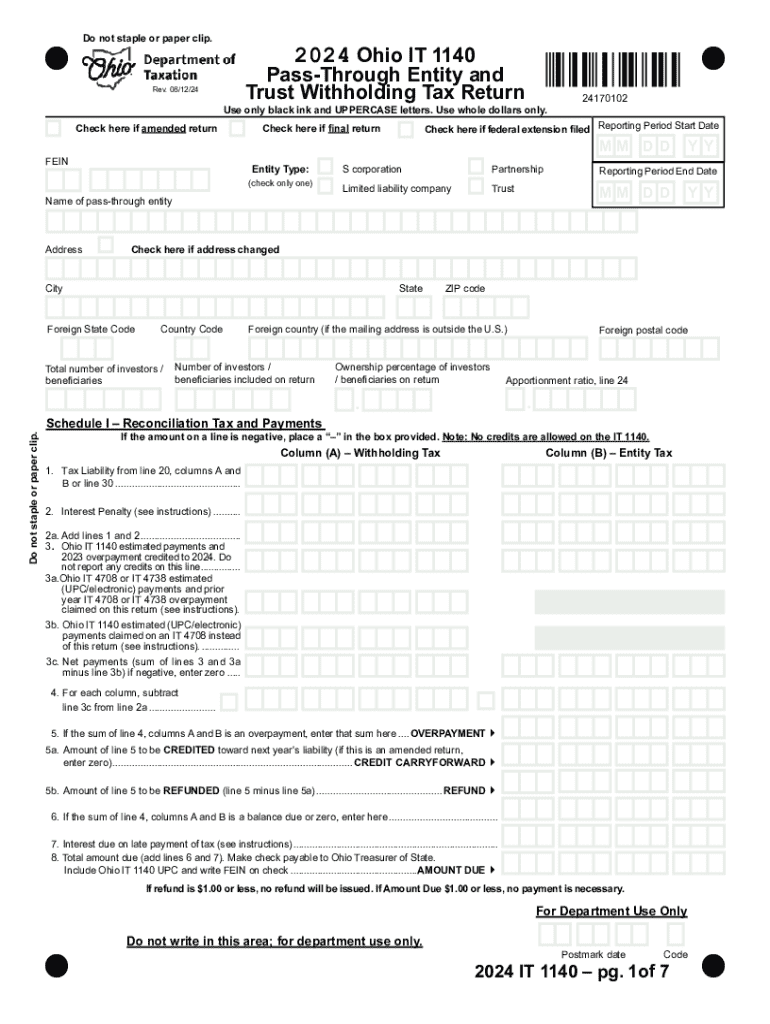

The Do Not Staple Or Paper Clip Ohio IT 1140 Rev is a tax form used by individuals and businesses in Ohio for income tax purposes. This form is specifically designed to report income, calculate tax liabilities, and claim any applicable credits. It is essential for ensuring compliance with Ohio tax regulations. The form emphasizes that it should not be stapled or fastened with paper clips, which is crucial for processing efficiency and accuracy.

Steps to complete the Do Not Staple Or Paper Clip Ohio IT 1140 Rev

Completing the Ohio IT 1140 Rev involves several key steps:

- Gather necessary documentation, including income statements and any relevant tax documents.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations to verify that income and tax amounts are correct.

- Sign and date the form where indicated.

- Submit the form by the designated deadline, ensuring it is not stapled or clipped.

Legal use of the Do Not Staple Or Paper Clip Ohio IT 1140 Rev

The legal use of the Ohio IT 1140 Rev is governed by state tax laws. This form must be used by eligible taxpayers to report their income and fulfill their tax obligations. Failure to use the form correctly can result in penalties or delays in processing. It is crucial to adhere to all instructions provided with the form to ensure compliance with Ohio tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 1140 Rev are typically aligned with the state income tax deadlines. Taxpayers should be aware of these dates to avoid late penalties. Generally, the deadline for filing is April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. It is important to stay informed about any changes to these dates each tax year.

Required Documents

To complete the Ohio IT 1140 Rev, taxpayers must gather several required documents, including:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any deductions or credits being claimed

- Documentation supporting income and expenses

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods

The Ohio IT 1140 Rev can be submitted through various methods:

- Online submission via the Ohio Department of Taxation website

- Mailing the completed form to the appropriate tax office

- In-person submission at designated tax offices

Each method has its own processing times, so taxpayers should choose the one that best fits their needs.

Create this form in 5 minutes or less

Find and fill out the correct do not staple or paper clip ohio it 1140 rev

Create this form in 5 minutes!

How to create an eSignature for the do not staple or paper clip ohio it 1140 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.'?

The instruction 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.' is crucial for ensuring that your documents are processed correctly by the Ohio Department of Taxation. Staples and paper clips can interfere with scanning and processing, potentially delaying your submission. By following this guideline, you help ensure a smoother review process.

-

How does airSlate SignNow help with the 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.' requirement?

airSlate SignNow provides a digital solution that eliminates the need for physical staples or paper clips. By using our eSigning platform, you can submit your 'Ohio IT 1140 Rev.' documents electronically, ensuring compliance with the 'Do Not Staple Or Paper Clip' requirement. This not only saves time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, starting from a free trial to more comprehensive paid plans. Each plan includes features that facilitate compliance with requirements like 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.' You can choose a plan based on your document volume and required features.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features streamline the process of submitting documents like the 'Ohio IT 1140 Rev.' while ensuring that you adhere to guidelines like 'Do Not Staple Or Paper Clip.' This enhances efficiency and compliance.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage services. This allows you to manage your documents seamlessly while ensuring compliance with 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.' requirements. Integrations enhance your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By adhering to the 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.' guideline, you can ensure that your documents are processed without delays. This digital approach also helps in maintaining a professional image.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow employs advanced security measures to protect your sensitive documents. Our platform ensures that your submissions, including those related to 'Do Not Staple Or Paper Clip Ohio IT 1140 Rev.', are encrypted and stored securely. You can trust us to handle your information with the utmost care.

Get more for Do Not Staple Or Paper Clip Ohio IT 1140 Rev

- Confidential fee schedule 2014 2019 form

- Irs 13909 complaint 2016 2019 form

- Offer to purchase residential comfree form

- Church logoname here wheeler avenue baptist church wheeleravebc form

- Waiver of liability and hold harmless agreement bumadoc form

- Elevated gas pressure request form oampm 22241

- 2014 ohio tax form

- Ocl intake form and instructions english 2016 ocl intake form and instructions english 2016 ontariocourtforms on

Find out other Do Not Staple Or Paper Clip Ohio IT 1140 Rev

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form