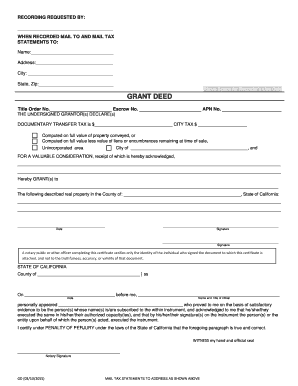

The UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX is $ CITY TAX $ Form

Understanding the Documentary Transfer Tax

The Documentary Transfer Tax is a tax imposed on the transfer of real property within certain jurisdictions in the United States. This tax is typically calculated based on the sale price or the value of the property being transferred. The undersigned grantors declare the amount of this tax on the relevant form, which is essential for ensuring compliance with local tax regulations. The tax amount may vary by city or county, reflecting local tax rates and regulations.

How to Use the Documentary Transfer Tax Form

To use the Documentary Transfer Tax form effectively, individuals must accurately complete all required fields, including the tax amount and any pertinent details about the property being transferred. This form is often submitted during real estate transactions, and it is crucial for both buyers and sellers to ensure that the tax is calculated correctly to avoid potential legal issues. The form must be signed by the grantors, affirming the accuracy of the information provided.

Steps to Complete the Documentary Transfer Tax Form

Completing the Documentary Transfer Tax form involves several steps:

- Gather necessary information about the property, including its sale price and legal description.

- Locate the appropriate form for your jurisdiction, as tax rates may differ by location.

- Fill in the required fields, ensuring that the tax amount is calculated accurately based on the local rate.

- Review the form for any errors or omissions before signing.

- Submit the completed form to the appropriate local tax authority, either in person or by mail.

Key Elements of the Documentary Transfer Tax Form

Key elements of the Documentary Transfer Tax form include the names of the grantors, the legal description of the property, the sale price, and the calculated tax amount. Additionally, the form may require signatures from all parties involved in the transaction. Accurate completion of these elements is vital for the form to be valid and accepted by tax authorities.

State-Specific Rules for the Documentary Transfer Tax

Each state in the U.S. may have specific rules governing the Documentary Transfer Tax, including different rates and exemptions. It is important for individuals to familiarize themselves with the regulations applicable in their state or locality. Some jurisdictions may have exemptions for certain types of transactions, such as transfers between family members or nonprofit organizations, which can impact the tax liability.

Examples of Using the Documentary Transfer Tax Form

Common scenarios for using the Documentary Transfer Tax form include residential property sales, commercial real estate transactions, and transfers of property as part of an estate settlement. In each case, the form must reflect the accurate sale price and comply with local tax regulations to ensure proper tax assessment and payment.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the undersigned grantors declares documentary transfer tax is city tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the statement 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $'?

This statement is used to declare the amount of documentary transfer tax applicable to a property transfer. It ensures compliance with local tax regulations and provides clarity on the financial obligations associated with the transfer. Understanding this can help streamline the eSigning process with airSlate SignNow.

-

How does airSlate SignNow help with managing documentary transfer tax declarations?

airSlate SignNow simplifies the process of managing documentary transfer tax declarations by allowing users to easily fill out and eSign necessary documents. With our platform, you can ensure that 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $' is accurately represented in your documents. This reduces errors and speeds up the transaction process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that all necessary declarations, such as 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $', are handled efficiently. This makes it easier for businesses to manage their documentation needs.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, ensuring that you can manage declarations like 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $' without breaking the bank. This affordability helps small businesses streamline their operations.

-

Can airSlate SignNow integrate with other software tools?

Absolutely! airSlate SignNow offers integrations with various software tools, enhancing your workflow efficiency. By integrating with platforms that handle real estate transactions, you can ensure that 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $' is seamlessly incorporated into your existing processes.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and security protocols to protect all information shared on our platform. This ensures that sensitive declarations, such as 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $', remain confidential and secure throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for document eSigning?

Using airSlate SignNow for document eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance. By ensuring that declarations like 'THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $' are accurately completed and signed, businesses can expedite their transactions and improve overall productivity.

Get more for THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $

Find out other THE UNDERSIGNED GRANTORs DECLAREs DOCUMENTARY TRANSFER TAX Is $ CITY TAX $

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement