FL 150 S DECLARACIN DE INGRESOS Y GASTOS 2019-2026

What is the FL 150 S DECLARACIN DE INGRESOS Y GASTOS

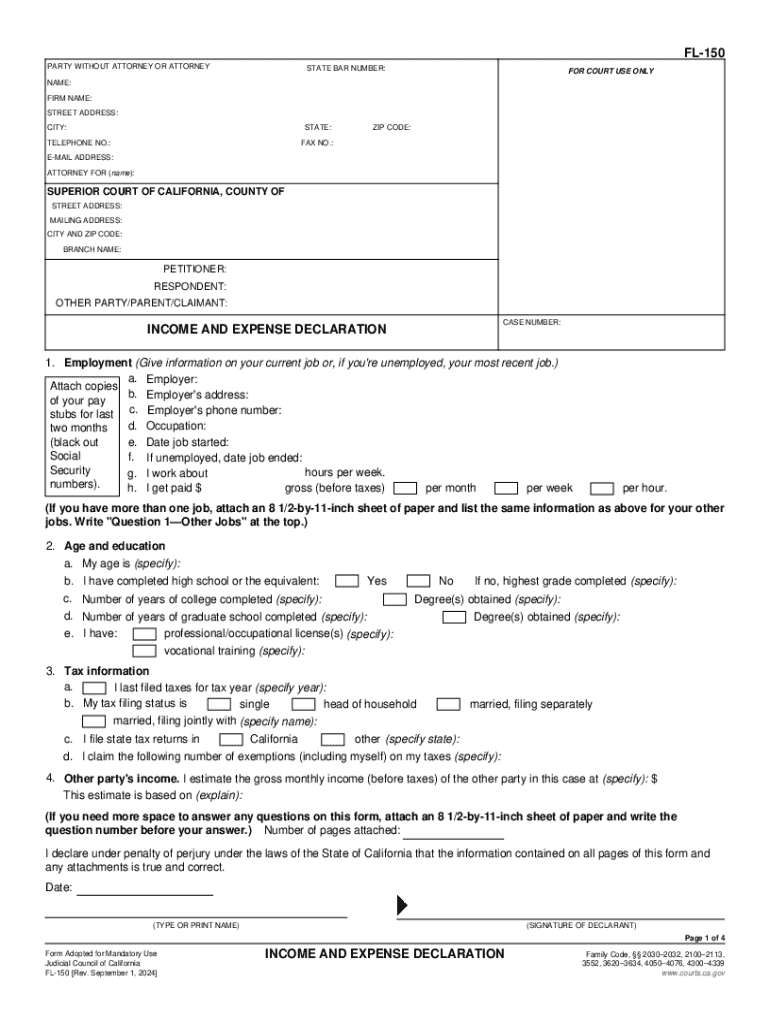

The FL 150 S DECLARACIN DE INGRESOS Y GASTOS is a financial declaration form used in the state of California. This form is primarily designed for individuals involved in family law proceedings, such as divorce or child custody cases. It requires the disclosure of income and expenses to provide the court with a clear picture of an individual's financial situation. Completing this form accurately is essential for the fair determination of support obligations and other financial matters in legal proceedings.

Steps to complete the FL 150 S DECLARACIN DE INGRESOS Y GASTOS

Completing the FL 150 S involves several steps to ensure accuracy and compliance with legal requirements. Start by gathering all necessary financial documents, including pay stubs, tax returns, and bank statements. Next, fill out the form by entering your income sources, such as wages, bonuses, and any additional earnings. After detailing your income, list all expenses, including housing costs, utilities, transportation, and any other relevant expenditures. Review the completed form for accuracy, sign it, and ensure it is filed with the appropriate court.

Key elements of the FL 150 S DECLARACIN DE INGRESOS Y GASTOS

The FL 150 S contains several key sections that must be completed. These include personal information, income details, and a comprehensive list of expenses. It also requires information about any dependents and additional financial obligations. Each section is crucial for providing the court with a complete understanding of your financial circumstances. Accurate reporting of all income and expenses is vital, as discrepancies can lead to legal complications.

Legal use of the FL 150 S DECLARACIN DE INGRESOS Y GASTOS

The FL 150 S is legally required in family law cases where financial disclosures are necessary. Courts utilize this form to assess financial needs and obligations, particularly in determining child support or spousal support. Filing this form is not optional; failure to submit it can result in legal penalties or unfavorable outcomes in court. It is essential to understand the legal implications of the information provided on this form.

How to obtain the FL 150 S DECLARACIN DE INGRESOS Y GASTOS

The FL 150 S can be obtained from various sources. It is typically available at local family law courts or through the California Judicial Branch website. Additionally, legal aid organizations may provide access to this form and offer assistance in completing it. Ensure that you are using the most current version of the form to avoid any issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the FL 150 S can vary based on the specific court and the nature of the legal proceedings. Generally, it is advisable to submit the form as soon as possible after the initiation of a family law case. Courts may set specific deadlines for financial disclosures, and failing to meet these deadlines can result in delays or complications in your case. Always check with the court for the most accurate and relevant deadlines.

Handy tips for filling out FL 150 S DECLARACIN DE INGRESOS Y GASTOS online

Quick steps to complete and e-sign FL 150 S DECLARACIN DE INGRESOS Y GASTOS online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Obtain access to a GDPR and HIPAA compliant platform for maximum efficiency. Use signNow to e-sign and send FL 150 S DECLARACIN DE INGRESOS Y GASTOS for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct fl 150 s declaracin de ingresos y gastos

Create this form in 5 minutes!

How to create an eSignature for the fl 150 s declaracin de ingresos y gastos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

The FL 150 S DECLARACIN DE INGRESOS Y GASTOS is a financial declaration form used in various jurisdictions to report income and expenses. This form is essential for individuals and businesses to ensure compliance with tax regulations. By accurately completing the FL 150 S, you can avoid potential penalties and streamline your financial reporting.

-

How can airSlate SignNow help with the FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the FL 150 S DECLARACIN DE INGRESOS Y GASTOS. Our solution simplifies the document management process, allowing you to focus on your financial reporting rather than paperwork. With airSlate SignNow, you can ensure that your declarations are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Our cost-effective solution makes it easy to manage your FL 150 S DECLARACIN DE INGRESOS Y GASTOS without breaking the bank.

-

Are there any integrations available for managing the FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline the management of your FL 150 S DECLARACIN DE INGRESOS Y GASTOS. These integrations help you keep all your documents organized and accessible.

-

What features does airSlate SignNow offer for the FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

airSlate SignNow offers a range of features designed to simplify the completion of the FL 150 S DECLARACIN DE INGRESOS Y GASTOS. Key features include customizable templates, secure eSigning, and real-time tracking of document status. These tools ensure that your financial declarations are processed quickly and securely.

-

How secure is airSlate SignNow when handling the FL 150 S DECLARACIN DE INGRESOS Y GASTOS?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data while you manage the FL 150 S DECLARACIN DE INGRESOS Y GASTOS. You can trust that your sensitive financial information is safe with us.

-

Can I access my FL 150 S DECLARACIN DE INGRESOS Y GASTOS documents from anywhere?

Absolutely! With airSlate SignNow, you can access your FL 150 S DECLARACIN DE INGRESOS Y GASTOS documents from any device with an internet connection. This flexibility allows you to manage your financial declarations on the go, ensuring you never miss a deadline.

Get more for FL 150 S DECLARACIN DE INGRESOS Y GASTOS

Find out other FL 150 S DECLARACIN DE INGRESOS Y GASTOS

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form