Form UK HMRC P60Single Sheet Fill Online 2025-2026

What is the Form UK HMRC P60 Single Sheet Fill Online

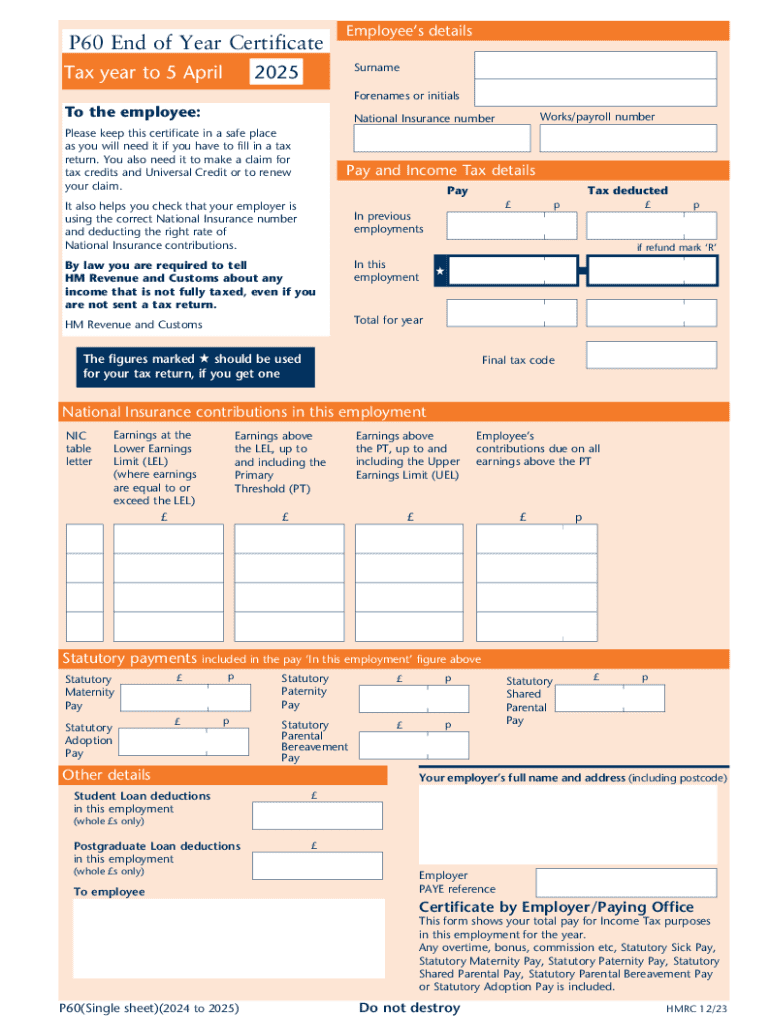

The Form UK HMRC P60 is a crucial document issued by employers in the United Kingdom. It summarizes an employee's total pay and deductions for a tax year. This form is essential for employees to understand their earnings, tax contributions, and National Insurance contributions. The P60 serves as proof of income and is often required for tax returns, loan applications, and other financial assessments.

How to use the Form UK HMRC P60 Single Sheet Fill Online

Using the Form UK HMRC P60 Single Sheet Fill Online involves a straightforward process. First, access the online form through a reliable platform that supports digital signatures. Fill in the required fields, ensuring all information matches your records. After completing the form, review it for accuracy. Once verified, you can eSign the document, making it legally binding. This digital method simplifies the process, allowing for quick submission and easy access to your records.

Steps to complete the Form UK HMRC P60 Single Sheet Fill Online

Completing the Form UK HMRC P60 Single Sheet Fill Online requires several steps:

- Access the online form on a trusted platform.

- Enter your personal details, including your name, address, and National Insurance number.

- Input your total earnings and tax deductions for the year.

- Review all entered information for accuracy.

- eSign the form to validate it.

- Save a copy for your records and submit it as required.

Key elements of the Form UK HMRC P60 Single Sheet Fill Online

The P60 includes several key elements that are vital for both employees and employers. These elements typically consist of:

- Employee information: Name, address, and National Insurance number.

- Employer information: Name and PAYE reference number.

- Total earnings: Gross pay for the tax year.

- Tax deductions: Total income tax deducted.

- National Insurance contributions: Amount contributed during the tax year.

Legal use of the Form UK HMRC P60 Single Sheet Fill Online

The Form UK HMRC P60 is legally recognized as a valid document for tax purposes. It is essential for employees to retain this form for their records, as it serves as proof of income and tax paid. Employers are obligated to provide a P60 to their employees by the end of May each year, ensuring compliance with tax regulations. Failure to provide or accurately complete this form can lead to penalties for employers.

Who Issues the Form UK HMRC P60 Single Sheet Fill Online

The Form UK HMRC P60 is issued by employers in the United Kingdom. Each employer is responsible for generating and distributing this document to their employees at the end of the tax year. It is crucial for employers to ensure that the information on the P60 is accurate and reflects the employee's earnings and deductions throughout the year.

Handy tips for filling out Form UK HMRC P60Single Sheet Fill Online online

Quick steps to complete and e-sign Form UK HMRC P60Single Sheet Fill Online online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Obtain access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to electronically sign and send Form UK HMRC P60Single Sheet Fill Online for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form uk hmrc p60single sheet fill online

Create this form in 5 minutes!

How to create an eSignature for the form uk hmrc p60single sheet fill online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form UK HMRC P60Single Sheet Fill Online?

The Form UK HMRC P60Single Sheet Fill Online is a digital solution that allows users to complete and submit their P60 tax forms electronically. This online form simplifies the process of filling out essential tax information, ensuring accuracy and compliance with HMRC regulations.

-

How can I access the Form UK HMRC P60Single Sheet Fill Online?

You can access the Form UK HMRC P60Single Sheet Fill Online through the airSlate SignNow platform. Simply create an account, navigate to the forms section, and select the P60 form to begin filling it out conveniently online.

-

Is there a cost associated with using the Form UK HMRC P60Single Sheet Fill Online?

Yes, there is a cost associated with using the Form UK HMRC P60Single Sheet Fill Online, but airSlate SignNow offers competitive pricing plans. These plans are designed to be cost-effective, providing businesses with a valuable tool for managing their tax documentation efficiently.

-

What features does the Form UK HMRC P60Single Sheet Fill Online offer?

The Form UK HMRC P60Single Sheet Fill Online includes features such as easy form filling, electronic signatures, and secure document storage. These features streamline the process, making it easier for users to manage their tax forms without hassle.

-

Can I integrate the Form UK HMRC P60Single Sheet Fill Online with other software?

Yes, the Form UK HMRC P60Single Sheet Fill Online can be integrated with various software applications. This allows for seamless data transfer and enhances your workflow by connecting with tools you already use in your business.

-

What are the benefits of using the Form UK HMRC P60Single Sheet Fill Online?

Using the Form UK HMRC P60Single Sheet Fill Online offers numerous benefits, including time savings, increased accuracy, and reduced paperwork. It empowers businesses to manage their tax forms efficiently while ensuring compliance with HMRC requirements.

-

Is the Form UK HMRC P60Single Sheet Fill Online secure?

Absolutely! The Form UK HMRC P60Single Sheet Fill Online is designed with security in mind. airSlate SignNow employs advanced encryption and security measures to protect your sensitive information throughout the form-filling process.

Get more for Form UK HMRC P60Single Sheet Fill Online

- From name and address of reporting agency form

- The omb control number for this collection is 3090 0014 form

- Send only comments relating to our time estimate including suggestions form

- Report of personal property for sale gsa form

- Property disposal authorization and survey report form

- Using the federal records center a guide for headquarters form

- Employee information form doe idaho department

- Office of personnel management statement of prior form

Find out other Form UK HMRC P60Single Sheet Fill Online

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application