P60Cont 09 09 Qxd P60Cont07 08 If You Are an Employer, You Must Provide a Form P60 to Each Employee Who is Working for You Hmrc 2011

Understanding the P60Cont 09 09 qxd P60Cont07 08

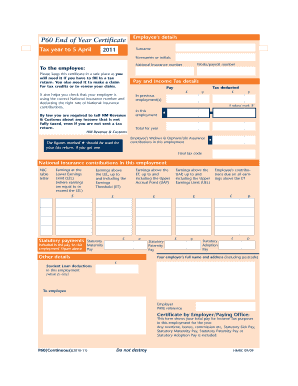

The P60Cont 09 09 qxd P60Cont07 08 is a critical document for employers in the United States, serving as a summary of an employee's earnings and tax deductions for the tax year. This form is essential for both employees and employers, as it provides a clear record of income and taxes withheld, which is necessary for accurate tax reporting. Employers are required to provide this form to each employee who has worked for them during the tax year, ensuring compliance with IRS regulations.

How to Use the P60Cont 09 09 qxd P60Cont07 08

Using the P60Cont 09 09 qxd P60Cont07 08 involves several steps to ensure that the information is accurately reported. Employers should first gather all relevant payroll information for each employee, including total earnings and taxes withheld. Once this data is collected, it can be entered into the form. After completion, employers must distribute copies to their employees and retain a copy for their records. This process helps in maintaining transparency and ensures that employees have the necessary documentation for their tax filings.

Steps to Complete the P60Cont 09 09 qxd P60Cont07 08

Completing the P60Cont 09 09 qxd P60Cont07 08 requires careful attention to detail. Employers should follow these steps:

- Gather all payroll records for the tax year.

- Calculate total earnings for each employee.

- Determine the total amount of taxes withheld.

- Fill out the form with accurate information.

- Review the completed form for any errors.

- Distribute the form to each employee by the deadline.

- Keep a copy for your records for future reference.

Legal Use of the P60Cont 09 09 qxd P60Cont07 08

The P60Cont 09 09 qxd P60Cont07 08 is not just a formality; it has legal implications for both employers and employees. Employers are legally obligated to provide this form to their employees, as it serves as proof of income and tax payments. Failure to issue this form can result in penalties from the IRS. Employees use this form to file their annual tax returns, making it essential for accurate reporting and compliance with tax laws.

Filing Deadlines and Important Dates

Employers must be aware of specific deadlines related to the P60Cont 09 09 qxd P60Cont07 08. Typically, employers need to provide this form to employees by the end of January following the tax year. Additionally, employers must submit the form to the IRS by the designated deadline to avoid penalties. Staying informed about these dates is crucial for maintaining compliance and ensuring that employees receive their necessary tax documentation on time.

Penalties for Non-Compliance

Non-compliance with the requirements surrounding the P60Cont 09 09 qxd P60Cont07 08 can lead to significant penalties for employers. The IRS may impose fines for failing to provide the form to employees or for inaccuracies in the information reported. These penalties can vary based on the severity of the violation, making it essential for employers to ensure that they meet all requirements and deadlines associated with this form.

Create this form in 5 minutes or less

Find and fill out the correct p60cont 09 09 qxd p60cont07 08 if you are an employer you must provide a form p60 to each employee who is working for you hmrc

Create this form in 5 minutes!

How to create an eSignature for the p60cont 09 09 qxd p60cont07 08 if you are an employer you must provide a form p60 to each employee who is working for you hmrc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of providing a Form P60 to employees?

As an employer, it is crucial to provide a Form P60 to each employee who is working for you, as it summarizes their total pay and deductions for the tax year. This document is essential for employees to complete their tax returns and ensure compliance with HMRC regulations. By understanding the significance of the P60, you can better manage your payroll responsibilities.

-

How can airSlate SignNow help with the P60 form process?

airSlate SignNow streamlines the process of sending and eSigning documents, including Form P60. With our easy-to-use platform, you can quickly generate, send, and track P60 forms for your employees, ensuring they receive their documents promptly. This efficiency helps you stay compliant with HMRC requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including customizable templates, secure eSigning, and real-time tracking. These features allow you to manage Form P60 and other important documents efficiently. By utilizing these tools, you can enhance your workflow and ensure that all necessary forms are completed accurately.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while still providing the necessary tools to manage Form P60 and other documents. This affordability makes it easier for small businesses to comply with HMRC regulations.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your document management capabilities. Whether you use accounting software or HR platforms, our integrations ensure that you can seamlessly manage Form P60 and other essential documents without disrupting your existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By eSigning Form P60 and other documents electronically, you can save time and resources while ensuring that your documents are securely stored and easily accessible. This modern approach aligns with HMRC's guidelines for document handling.

-

How does airSlate SignNow ensure the security of sensitive documents?

airSlate SignNow prioritizes the security of your sensitive documents through advanced encryption and secure storage solutions. When handling Form P60 and other important documents, you can trust that your data is protected against unauthorized access. Our commitment to security helps you maintain compliance with HMRC and safeguard your employees' information.

Get more for P60Cont 09 09 qxd P60Cont07 08 If You Are An Employer, You Must Provide A Form P60 To Each Employee Who Is Working For You Hmrc

Find out other P60Cont 09 09 qxd P60Cont07 08 If You Are An Employer, You Must Provide A Form P60 To Each Employee Who Is Working For You Hmrc

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate