Refinance Mortgage Calculator Form

What is the Refinance Mortgage Calculator

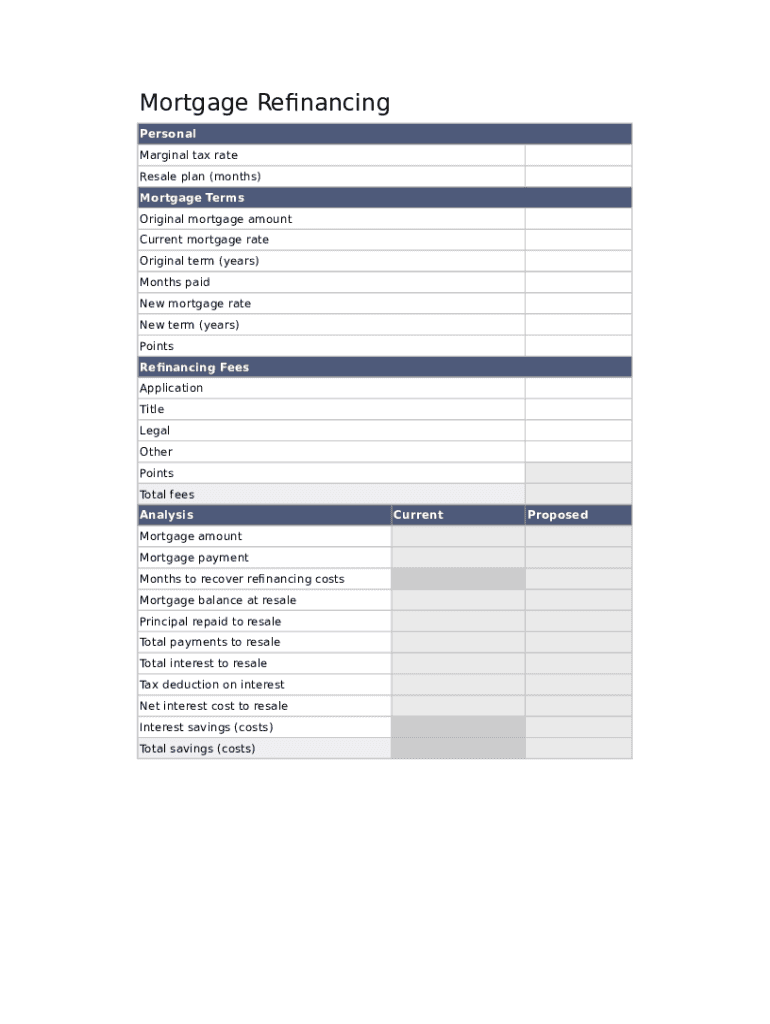

The Refinance Mortgage Calculator is a financial tool designed to help homeowners evaluate the potential benefits of refinancing their existing mortgage. By inputting key details such as the current mortgage balance, interest rate, loan term, and new interest rate, users can determine how much they could save on monthly payments and overall interest costs. This calculator simplifies the decision-making process by providing clear insights into whether refinancing is a financially sound choice.

How to Use the Refinance Mortgage Calculator

Using the Refinance Mortgage Calculator involves a few straightforward steps. First, gather your current mortgage information, including the remaining balance, interest rate, and remaining loan term. Next, enter the new interest rate and desired loan term for the refinance. The calculator will then compute your potential monthly payment, total interest savings, and the break-even point, which indicates how long it will take to recoup any closing costs associated with the refinance.

Steps to Complete the Refinance Mortgage Calculator

To effectively complete the Refinance Mortgage Calculator, follow these steps:

- Input your current mortgage balance.

- Enter your current interest rate.

- Specify the remaining term of your current loan.

- Provide the new interest rate you are considering for refinancing.

- Choose the new loan term you wish to explore.

- Review the results, including estimated monthly payments and total savings.

Key Elements of the Refinance Mortgage Calculator

Several key elements make the Refinance Mortgage Calculator effective:

- Current Mortgage Details: Accurate information about your existing mortgage is essential for reliable calculations.

- New Loan Information: Inputting the new interest rate and loan term is crucial to assess potential savings.

- Closing Costs: Understanding any fees associated with refinancing can impact your decision.

- Break-Even Analysis: This feature helps you determine how soon you will start saving money after refinancing.

Examples of Using the Refinance Mortgage Calculator

Consider a homeowner with a $200,000 mortgage at a four percent interest rate, with 25 years remaining. If they find a new rate of three percent for a 30-year refinance, they can input these figures into the calculator. The results may show a lower monthly payment, significant interest savings over the life of the loan, and a break-even point of two years, indicating that refinancing could be a beneficial financial move.

Eligibility Criteria

Eligibility for refinancing typically depends on several factors, including:

- Your credit score, which affects the interest rate you may qualify for.

- The current equity in your home, as lenders usually require a minimum equity percentage.

- Your debt-to-income ratio, which lenders assess to ensure you can manage the new mortgage payments.

- Your employment status and income stability, which impact your ability to repay the loan.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the refinance mortgage calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Refinance Mortgage Calculator?

A Refinance Mortgage Calculator is a tool that helps homeowners estimate potential savings from refinancing their mortgage. By inputting current loan details and new loan terms, users can see how much they could save on monthly payments and overall interest costs.

-

How does the Refinance Mortgage Calculator work?

The Refinance Mortgage Calculator works by allowing users to enter their existing mortgage details, such as loan amount, interest rate, and remaining term. It then calculates the potential savings based on new loan terms, providing a clear comparison of costs and benefits.

-

Is the Refinance Mortgage Calculator free to use?

Yes, the Refinance Mortgage Calculator is free to use. airSlate SignNow offers this tool as part of its commitment to providing cost-effective solutions for businesses and homeowners looking to make informed financial decisions.

-

What are the benefits of using a Refinance Mortgage Calculator?

Using a Refinance Mortgage Calculator can help you understand your refinancing options and potential savings. It simplifies the decision-making process by providing clear insights into how refinancing could impact your financial situation.

-

Can I integrate the Refinance Mortgage Calculator with other tools?

Yes, the Refinance Mortgage Calculator can be integrated with various financial tools and platforms. This allows users to streamline their refinancing process and access additional resources for better financial planning.

-

What features should I look for in a Refinance Mortgage Calculator?

When choosing a Refinance Mortgage Calculator, look for features like user-friendly interface, detailed breakdown of costs, and the ability to compare multiple scenarios. These features will enhance your experience and provide more accurate insights.

-

How accurate is the Refinance Mortgage Calculator?

The Refinance Mortgage Calculator provides estimates based on the information you input. While it offers a good approximation of potential savings, actual results may vary based on lender terms and market conditions.

Get more for Refinance Mortgage Calculator

- Rccc transcript form

- Csf volunteer log clovis east high school form

- What is to fill in proposed academic study area in confedential report form

- Graduate studies application form pdf

- Di ciero form

- Field trip request birmingham city schools form

- Mt sac igetc certification form

- Observation form for student behavior

Find out other Refinance Mortgage Calculator

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF