K 60 Kansas Community Service Contribution Credit Rev 8 20 K S a 79 32,195 Et Seq Provides for an Income, Privilege or Premiums 2024-2026

Understanding the K-60 Kansas Community Service Contribution Credit

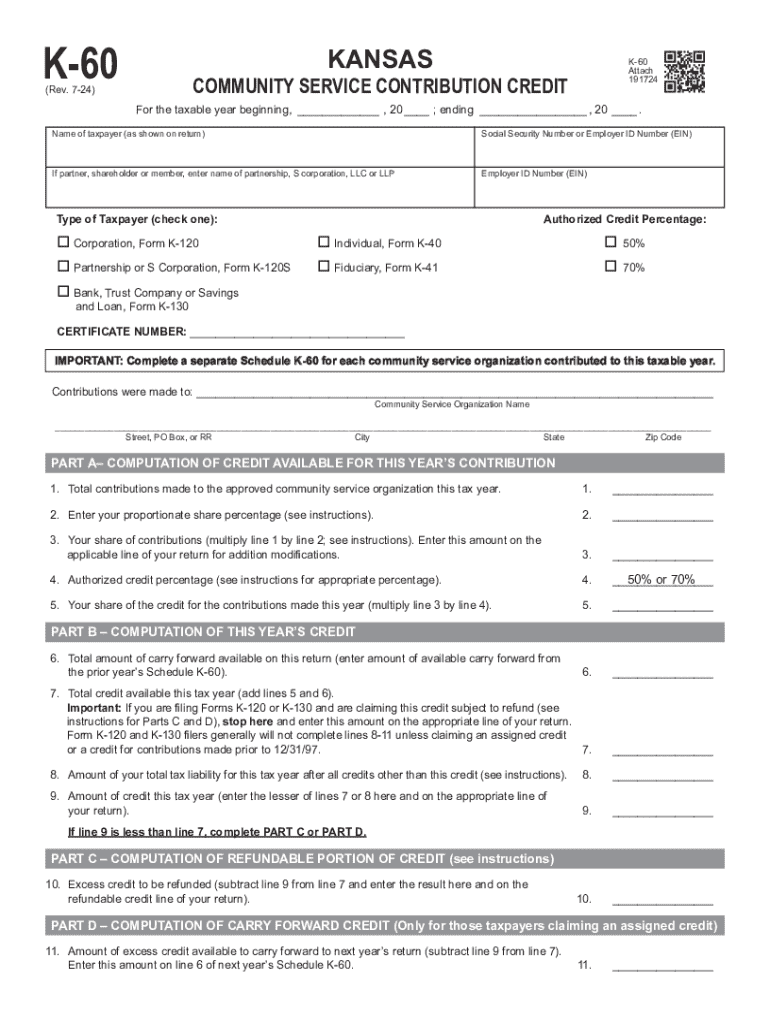

The K-60 Kansas Community Service Contribution Credit is a tax credit designed to encourage contributions to approved community service organizations. This credit is available to individuals and businesses who make donations to organizations that provide community services, as defined under K.S.A. 79-32,195 et seq. The amount of the credit can offset income, privilege, or premiums taxes, making it a beneficial option for taxpayers looking to support their communities while also reducing their tax liabilities.

How to Utilize the K-60 Kansas Community Service Contribution Credit

To effectively utilize the K-60 Kansas Community Service Contribution Credit, taxpayers must first ensure that their contributions are made to an approved community service organization. After making a qualifying donation, individuals or businesses can claim the credit on their Kansas tax return. It is essential to keep detailed records of contributions, including receipts and acknowledgment letters from the organizations, as these documents may be required for verification during the filing process.

Steps to Complete the K-60 Kansas Community Service Contribution Credit

Completing the K-60 form involves several key steps:

- Gather documentation of contributions made to approved community service organizations.

- Obtain the K-60 form from the Kansas Department of Revenue website or through their office.

- Fill out the form with accurate information regarding your contributions and personal details.

- Attach any required documentation to substantiate your claims.

- Submit the completed K-60 form along with your Kansas tax return by the designated deadline.

Eligibility Criteria for the K-60 Kansas Community Service Contribution Credit

To qualify for the K-60 Kansas Community Service Contribution Credit, taxpayers must meet certain eligibility criteria. Contributions must be made to organizations that are recognized as approved community service providers by the state of Kansas. Additionally, the contributions must be cash donations or in-kind services that are valued appropriately. Taxpayers should verify the status of the organization to ensure it meets the requirements before making a contribution.

Required Documents for the K-60 Kansas Community Service Contribution Credit

When claiming the K-60 Kansas Community Service Contribution Credit, it is important to have the following documents ready:

- Receipts or confirmation letters from the approved community service organizations.

- The completed K-60 form with all required information filled in.

- Any additional documentation that supports the claim for the tax credit.

Filing Deadlines for the K-60 Kansas Community Service Contribution Credit

Taxpayers must be aware of the filing deadlines associated with the K-60 Kansas Community Service Contribution Credit. The credit should be claimed on the Kansas income tax return for the year in which the contribution was made. Typically, the deadline for filing state income tax returns aligns with the federal tax return deadline, which is usually April 15. However, it is advisable to check for any specific extensions or changes in due dates each tax year.

Create this form in 5 minutes or less

Find and fill out the correct k 60 kansas community service contribution credit rev 8 20 k s a 79 32195 et seq provides for an income privilege or premiums

Create this form in 5 minutes!

How to create an eSignature for the k 60 kansas community service contribution credit rev 8 20 k s a 79 32195 et seq provides for an income privilege or premiums

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq?

The K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq provides for an income, privilege, or premiums tax credit for contributions made to approved community service organizations. This credit encourages individuals and businesses to support community services programs, enhancing local initiatives and services.

-

How can I apply for the K 60 Kansas Community Service Contribution Credit?

To apply for the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq, you must complete the appropriate tax forms and provide documentation of your contributions to approved organizations. Ensure that you follow the guidelines set by the Kansas Department of Revenue to maximize your eligibility for the credit.

-

What types of contributions qualify for the K 60 Kansas Community Service Contribution Credit?

Contributions that qualify for the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq include cash donations, property donations, and other forms of support to approved community service organizations. It's essential to verify that the organization is recognized by the state to ensure your contributions are eligible for the credit.

-

What are the benefits of utilizing the K 60 Kansas Community Service Contribution Credit?

Utilizing the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq allows taxpayers to reduce their tax liability while supporting valuable community services. This credit not only benefits the community but also provides a financial incentive for individuals and businesses to contribute to local organizations.

-

Is there a limit on the amount I can claim under the K 60 Kansas Community Service Contribution Credit?

Yes, there is a limit on the amount you can claim under the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq. The specific limit may vary based on your income and the total contributions made, so it's advisable to consult the Kansas Department of Revenue for detailed information on the maximum allowable credit.

-

How does airSlate SignNow assist with the K 60 Kansas Community Service Contribution Credit process?

airSlate SignNow simplifies the documentation process for the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq by providing an easy-to-use platform for eSigning and sending necessary forms. This ensures that all contributions are documented accurately and efficiently, making it easier for users to claim their credits.

-

Can I integrate airSlate SignNow with other tools for managing my contributions?

Yes, airSlate SignNow offers integrations with various tools that can help you manage your contributions and documentation related to the K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq. This allows for a seamless workflow, ensuring that all your contributions are tracked and documented effectively.

Get more for K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq Provides For An Income, Privilege Or Premiums

Find out other K 60 Kansas Community Service Contribution Credit Rev 8 20 K S A 79 32,195 Et Seq Provides For An Income, Privilege Or Premiums

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free