RLZ 1 S V 10 Summary of Source Deductions and Employer Contributions 2022

What is the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

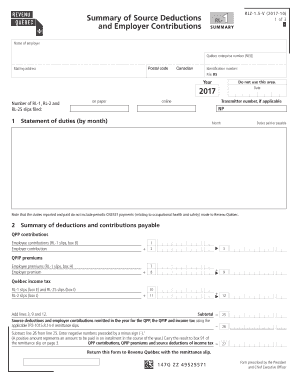

The RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions is a crucial document used by employers in the United States to summarize the deductions made from employee wages and the corresponding employer contributions. This form provides a comprehensive overview of various deductions, including federal income tax, Social Security, Medicare, and any state-specific tax withholdings. It serves as a record for both employers and employees, ensuring transparency in payroll practices and compliance with tax regulations.

How to use the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

To effectively use the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions, employers should first gather all relevant payroll data for the reporting period. This includes individual employee earnings, deductions, and contributions. Once this data is compiled, it can be entered into the form, ensuring accuracy in each section. After completing the form, employers should distribute copies to employees for their records and retain a copy for their own documentation. This process helps maintain compliance with federal and state tax laws.

Key elements of the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

The RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions includes several key elements essential for accurate reporting. These elements typically encompass:

- Employee Information: Names, Social Security numbers, and other identifying details.

- Gross Earnings: Total wages earned by employees during the reporting period.

- Deductions: Itemized deductions such as federal income tax, state tax, Social Security, and Medicare.

- Employer Contributions: Contributions made by the employer towards Social Security, Medicare, and any other benefits.

- Net Pay: The final amount received by employees after deductions.

Steps to complete the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

Completing the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions involves several systematic steps:

- Gather all payroll records for the relevant period.

- Calculate total gross earnings for each employee.

- Identify and calculate all applicable deductions for each employee.

- Document employer contributions accurately.

- Fill out the form with the compiled data, ensuring all information is correct.

- Review the completed form for accuracy and completeness.

- Distribute copies to employees and retain a copy for your records.

Legal use of the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

The RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions must be used in accordance with federal and state laws governing payroll and taxation. Employers are legally required to provide accurate information regarding employee deductions and contributions. Failure to comply with these regulations can lead to penalties, including fines and legal action. Therefore, it is essential for employers to maintain precise records and ensure that the information reported on this form aligns with IRS guidelines and state tax laws.

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines associated with the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions. Typically, these forms must be submitted annually or quarterly, depending on the employer's reporting schedule. It is crucial to check the IRS guidelines for the exact due dates, as late submissions can result in penalties. Keeping a calendar of important dates can help ensure compliance and timely filing.

Create this form in 5 minutes or less

Find and fill out the correct rlz 1 s v 10 summary of source deductions and employer contributions

Create this form in 5 minutes!

How to create an eSignature for the rlz 1 s v 10 summary of source deductions and employer contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

The RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions is a crucial document that outlines the deductions made from employee wages and the corresponding employer contributions. This summary helps businesses ensure compliance with tax regulations and provides a clear overview of financial obligations.

-

How can airSlate SignNow assist with the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

airSlate SignNow streamlines the process of preparing and signing the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions. Our platform allows users to easily create, send, and eSign documents, ensuring that all necessary information is accurately captured and securely stored.

-

What are the pricing options for using airSlate SignNow for the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced functionalities for managing the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions, we have a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities, all designed to simplify the management of the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions. These tools enhance efficiency and reduce the risk of errors in documentation.

-

Can airSlate SignNow integrate with other software for the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

Yes, airSlate SignNow seamlessly integrates with various accounting and HR software, making it easier to manage the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions. This integration ensures that all data is synchronized and accessible, improving overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

Using airSlate SignNow for the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our user-friendly interface allows for quick document preparation and signing, making the process hassle-free.

-

Is airSlate SignNow secure for handling the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption methods to protect your documents, including the RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions. You can trust that your sensitive information is safe with us.

Get more for RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

Find out other RLZ 1 S V 10 Summary Of Source Deductions And Employer Contributions

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document