RL 1 SummarySummary of Source Deductions and 2021

What is the RL 1 Summary of Source Deductions?

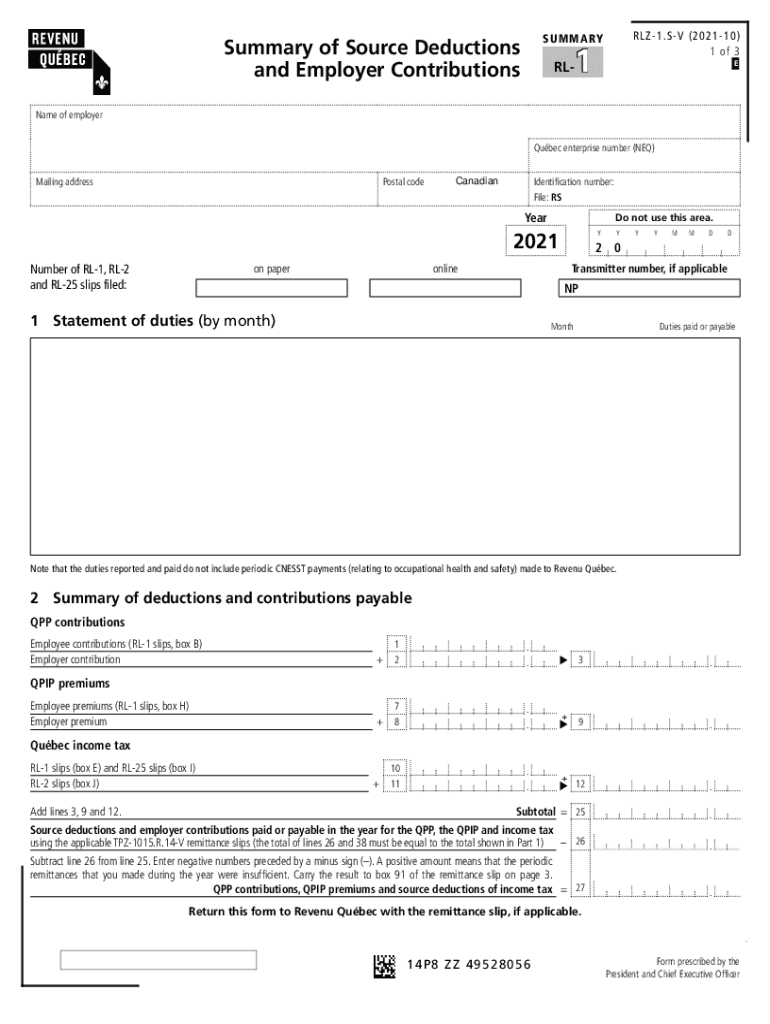

The RL 1 Summary of Source Deductions is a tax form used in Canada to report various types of income and the corresponding deductions withheld at the source. This form is crucial for both employers and employees, as it summarizes the total amounts deducted for income tax, Canada Pension Plan (CPP), and Employment Insurance (EI) from an employee's earnings. The information provided on the RL 1 is essential for employees when filing their income tax returns, ensuring they accurately report their income and claim any eligible deductions.

How to Use the RL 1 Summary of Source Deductions

To effectively use the RL 1 Summary of Source Deductions, individuals should first ensure they receive this form from their employer at the end of the tax year. Once obtained, review the document for accuracy, checking that all income and deductions are correctly reported. This form should be used in conjunction with other tax documents when preparing your tax return. It is important to keep a copy for your records, as it serves as proof of income and tax deductions for the year.

Steps to Complete the RL 1 Summary of Source Deductions

Completing the RL 1 Summary of Source Deductions involves several key steps. First, gather all necessary information, including your total income, deductions, and any other relevant financial details. Next, accurately fill out the form, ensuring that each section is completed according to the guidelines provided by the tax authorities. Double-check your entries for accuracy to avoid any potential issues with your tax filing. Finally, submit the completed form to the appropriate tax authority along with your income tax return.

Legal Use of the RL 1 Summary of Source Deductions

The RL 1 Summary of Source Deductions is legally recognized as an official document for reporting income and tax deductions. It must be filled out accurately to comply with tax regulations. Employers are required by law to provide this form to their employees, ensuring transparency in income reporting and tax withholding. Failure to accurately report the information on the RL 1 can lead to penalties or audits by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the RL 1 Summary of Source Deductions typically align with the overall tax filing deadlines set by the IRS. It is essential to be aware of these dates to ensure timely submission and avoid penalties. Generally, individuals should aim to file their tax returns by April 15 of the following year. Employers must also provide the RL 1 forms to employees by the end of February to allow sufficient time for tax preparation.

Who Issues the Form

The RL 1 Summary of Source Deductions is issued by employers to their employees. It is the employer's responsibility to accurately complete and distribute this form at the end of the tax year. This ensures that employees have the necessary documentation to report their income and tax deductions when filing their tax returns. If an employee does not receive their RL 1 form, they should contact their employer for clarification.

Quick guide on how to complete rl 1 summarysummary of source deductions and

Complete RL 1 SummarySummary Of Source Deductions And effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without delays. Manage RL 1 SummarySummary Of Source Deductions And on any system using the airSlate SignNow applications for Android or iOS, and enhance any document-related activity today.

The easiest method to modify and electronically sign RL 1 SummarySummary Of Source Deductions And seamlessly

- Find RL 1 SummarySummary Of Source Deductions And and click Get Form to commence.

- Utilize the tools we provide to finish your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, through email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious document searching, or errors requiring the printing of new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign RL 1 SummarySummary Of Source Deductions And and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rl 1 summarysummary of source deductions and

Create this form in 5 minutes!

How to create an eSignature for the rl 1 summarysummary of source deductions and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RL 1 SummarySummary Of Source Deductions And?

The RL 1 SummarySummary Of Source Deductions And is a tax form in Canada that summarizes an employee's income and deductions for the year. It is essential for both employers and employees for accurate income reporting. Understanding this form is vital for proper tax filings and compliance.

-

How can airSlate SignNow help with the RL 1 SummarySummary Of Source Deductions And?

airSlate SignNow streamlines the process of sending and eSigning the RL 1 SummarySummary Of Source Deductions And. Our platform allows businesses to easily prepare and distribute these documents, ensuring compliance and efficiency in handling tax-related paperwork.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers customizable templates, secure eSigning, and automated workflows to help businesses manage documents efficiently. Features like document tracking and cloud storage ensure that RL 1 SummarySummary Of Source Deductions And and other important documents are easily accessible and monitored.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides various pricing plans to fit the needs of different businesses. Whether you're a small company or a large enterprise, you can find a customizable plan that offers features perfect for managing the RL 1 SummarySummary Of Source Deductions And, without breaking the bank.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore its features, including those for managing the RL 1 SummarySummary Of Source Deductions And. This trial helps users understand how our solution can enhance their document workflow before committing to a subscription.

-

Can airSlate SignNow integrate with other software applications?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including CRMs and accounting tools, to optimize your workflow. This integration capability is particularly useful for ensuring that RL 1 SummarySummary Of Source Deductions And documents align with your existing systems.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents provides several benefits, including increased efficiency, enhanced security, and improved compliance. The ability to eSign RL 1 SummarySummary Of Source Deductions And documents quickly and securely helps businesses maintain accurate records and meet their tax obligations.

Get more for RL 1 SummarySummary Of Source Deductions And

- Justification letter sample form

- How to get a metal detecting permit form

- Iowa 1040 fillable form

- Form approved omb control no 1902 0075 ferc form

- Vhda quick pay form

- Petition to change name of adult form

- Final order changing name of adult lawhelp org lawhelp form

- Dissolution fm case management order dissolution fm case management order form

Find out other RL 1 SummarySummary Of Source Deductions And

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast