Rlz 1 S 2016

What is the Rlz 1 S

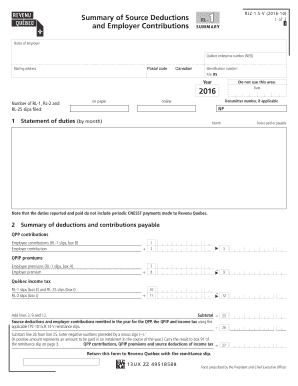

The Rlz 1 S is a tax form used in the United States to report source deductions and employer contributions for a given tax year. Specifically, the Rlz 1 S 2019 serves to summarize the amounts withheld from employees' salaries for income tax and other contributions, such as Social Security and Medicare. This form is essential for employers as it ensures compliance with tax regulations and provides employees with necessary information for their personal tax filings.

Steps to complete the Rlz 1 S

Completing the Rlz 1 S involves several key steps to ensure accuracy and compliance. First, gather all relevant payroll records for the year, including total wages paid and amounts withheld for taxes and contributions. Next, accurately fill in the required fields on the form, including employer information, employee details, and the total amounts for each category. After completing the form, review it for any errors or omissions to avoid potential penalties. Finally, submit the completed Rlz 1 S to the appropriate tax authorities by the specified deadline.

Legal use of the Rlz 1 S

The Rlz 1 S is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal validity, employers must comply with federal and state regulations regarding tax withholdings. This includes maintaining accurate payroll records and ensuring that the information reported on the form matches the amounts withheld throughout the year. Failure to adhere to these regulations can result in penalties, audits, or other legal consequences.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the Rlz 1 S to avoid late penalties. Generally, the form must be filed by January 31 of the following year, ensuring that employees receive their copies in a timely manner. It is important to stay updated on any changes to these deadlines, as they may vary based on state regulations or specific circumstances affecting tax filings.

Form Submission Methods (Online / Mail / In-Person)

The Rlz 1 S can be submitted through various methods, depending on the preferences of the employer and the requirements of the tax authority. Employers may choose to file the form electronically, which can streamline the process and reduce processing times. Alternatively, the form can be mailed directly to the appropriate tax office or submitted in person at designated locations. It is essential to confirm the preferred submission method with the relevant tax authorities to ensure compliance.

Required Documents

To complete the Rlz 1 S accurately, employers should gather several key documents. These include payroll records, employee tax withholding information, and any other relevant financial statements that detail contributions made throughout the year. Having these documents readily available will facilitate the completion of the form and help ensure that all reported information is accurate and compliant with tax regulations.

Who Issues the Form

The Rlz 1 S is issued by the Internal Revenue Service (IRS) in the United States. This form is part of the broader framework of tax documentation that employers must complete to report employee earnings and withholdings. Understanding the issuing authority is crucial for employers, as it underscores the importance of compliance with federal tax laws and regulations.

Quick guide on how to complete rlz 1 s

Effortlessly Prepare Rlz 1 S on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage Rlz 1 S on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Rlz 1 S with Ease

- Find Rlz 1 S and click on Get Form to begin.

- Use the resources we provide to fill out your document.

- Emphasize crucial sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Rlz 1 S to ensure outstanding communication at every phase of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rlz 1 s

Create this form in 5 minutes!

How to create an eSignature for the rlz 1 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rl 1 summary fillable form 2019?

The rl 1 summary fillable form 2019 is a document used in Canada for reporting income and deductions for various payments made to employees. It provides a comprehensive overview of taxable earnings, ensuring compliance with tax regulations. By using airSlate SignNow, you can easily fill out, sign, and send this form securely.

-

How can I create an rl 1 summary fillable form 2019 using airSlate SignNow?

Creating an rl 1 summary fillable form 2019 with airSlate SignNow is simple and efficient. Simply upload your template, customize the fields as needed, and make it fillable for your recipients. This saves you time and ensures that all necessary information is captured accurately.

-

Is airSlate SignNow suitable for businesses needing the rl 1 summary fillable form 2019?

Yes, airSlate SignNow is designed for businesses of all sizes that require efficient document management solutions. Our platform allows you to manage the rl 1 summary fillable form 2019 easily, providing companies with the tools to ensure timely filing and compliance with tax laws.

-

Are there any costs associated with using the rl 1 summary fillable form 2019 in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs. While the cost to access the rl 1 summary fillable form 2019 feature depends on the plan you select, we ensure that our service remains cost-effective, providing excellent value for its features.

-

What features does airSlate SignNow offer for the rl 1 summary fillable form 2019?

airSlate SignNow offers several key features for handling the rl 1 summary fillable form 2019, including easy document editing, eSignature capabilities, and secure storage. These features streamline the process, allowing users to manage compliance documents with confidence and ease.

-

Can I integrate the rl 1 summary fillable form 2019 with other applications?

Absolutely! airSlate SignNow supports various integrations, enabling you to streamline your workflow when using the rl 1 summary fillable form 2019. Connect seamlessly with your favorite CRM, accounting, or document management applications to enhance efficiency.

-

What benefits does airSlate SignNow provide when using the rl 1 summary fillable form 2019?

Using airSlate SignNow with the rl 1 summary fillable form 2019 offers multiple benefits, including improved accuracy, faster processing times, and enhanced security. Our platform helps reduce the risk of errors and allows you to track document statuses in real-time, improving your overall workflow.

Get more for Rlz 1 S

- General information sheet form download

- Abahani cricket academy form

- Yoga questionnaire for new students form

- How to write date of birth in nwu application form

- Bsa quartermaster checklist form

- Fl 278 s form

- Fl 688 short form order after hearing govermental

- Request for order cv california courts ca gov form

Find out other Rlz 1 S

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe