Form 4022 2016-2026

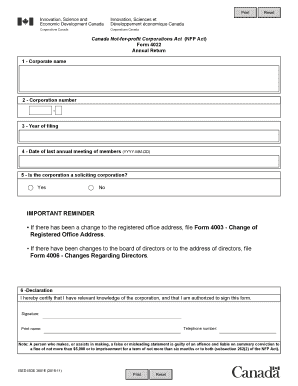

What is the Form 4022

The Form 4022 is a specific document used in various legal and administrative processes within the United States. This form is often utilized for purposes such as applications, claims, or notifications that require official acknowledgment. Understanding its purpose is crucial for individuals and businesses to ensure compliance with relevant regulations.

How to use the Form 4022

Using the Form 4022 involves several steps to ensure it is completed accurately. First, gather all necessary information and documentation required to fill out the form. Next, carefully complete each section, ensuring clarity and accuracy in your responses. Once filled, the form can be submitted according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form 4022

Completing the Form 4022 requires attention to detail. Follow these steps:

- Review the form instructions thoroughly before starting.

- Fill in personal or business information as required.

- Provide any necessary supporting documentation.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

Legal use of the Form 4022

The legal use of the Form 4022 is governed by specific regulations that outline its applicability. It is essential to understand the context in which the form is used to avoid potential legal issues. This may include compliance with state laws, federal regulations, or specific industry standards.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4022 can vary based on the purpose of the form and the jurisdiction in which it is submitted. It is important to be aware of these deadlines to ensure timely processing. Missing a deadline may result in penalties or delays in your application or claim.

Who Issues the Form

The Form 4022 is typically issued by a government agency or regulatory body relevant to its use. Understanding which entity is responsible for issuing the form can help users find accurate information and guidance regarding its completion and submission.

Examples of using the Form 4022

There are various scenarios in which the Form 4022 may be utilized. For instance, it can be used for applications related to permits, licenses, or benefits. Each example illustrates the form's versatility and highlights the importance of understanding its specific requirements and implications.

Create this form in 5 minutes or less

Find and fill out the correct form 4022

Create this form in 5 minutes!

How to create an eSignature for the form 4022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4022 and how can airSlate SignNow help?

Form 4022 is a document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing Form 4022 by providing an intuitive platform that allows users to eSign documents quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Form 4022?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the signing process for Form 4022, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 4022?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for Form 4022. These tools enhance efficiency and ensure that your documents are always accessible and organized.

-

Can I integrate airSlate SignNow with other applications for Form 4022?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage Form 4022 alongside your existing workflows. This integration helps streamline processes and improves overall productivity.

-

How does airSlate SignNow ensure the security of Form 4022?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication protocols to protect your Form 4022 and other documents, ensuring that your sensitive information remains confidential.

-

What are the benefits of using airSlate SignNow for Form 4022?

Using airSlate SignNow for Form 4022 offers numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. Our platform empowers businesses to streamline their document workflows and enhance collaboration.

-

Is it easy to use airSlate SignNow for completing Form 4022?

Yes, airSlate SignNow is designed with user-friendliness in mind. Completing Form 4022 is straightforward, thanks to our intuitive interface that guides users through the signing process with ease.

Get more for Form 4022

- Fulfillment deed form

- Deed trust form 481374744

- Deed trust form 481374745

- Washington request for partial reconveyance form

- Washington statutory form

- Washington payment form

- Washington 30 day notice to terminate month to month lease for residential from tenant to landlord form

- Washington variable day notice of breach other than nonpayment of rent residential form

Find out other Form 4022

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document