Direct Transfer Form for Registered Investments 2021-2026

What is the Direct Transfer Form For Registered Investments

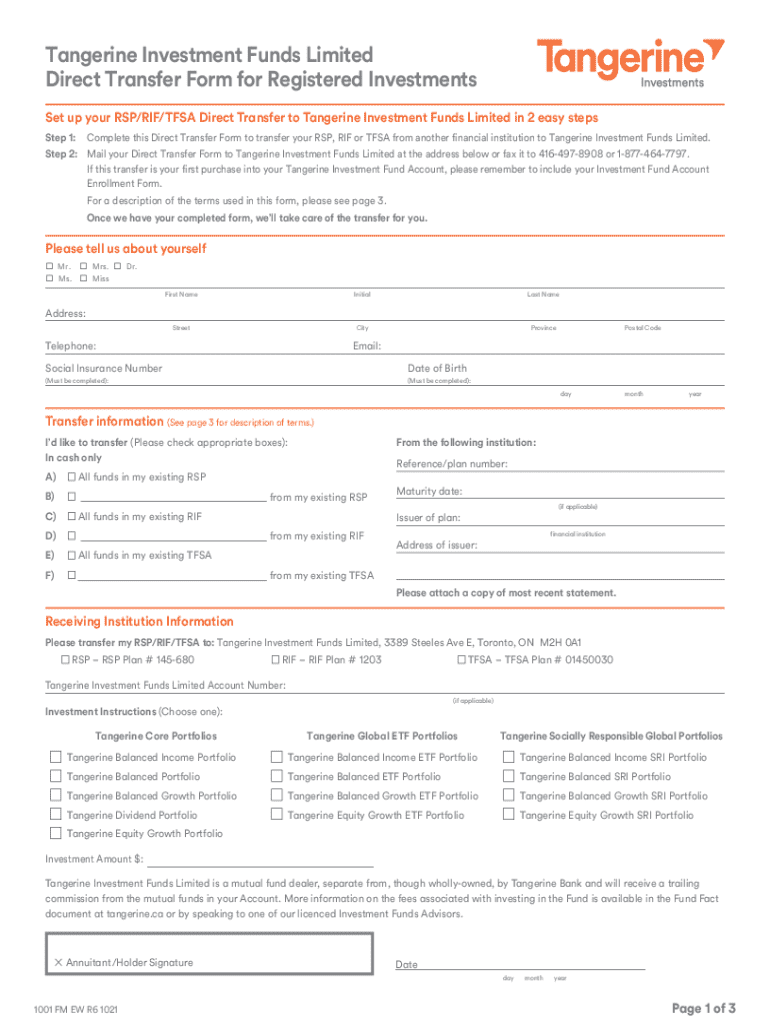

The Direct Transfer Form For Registered Investments is a crucial document used to facilitate the transfer of investment assets from one financial institution to another without incurring tax liabilities. This form is primarily utilized for retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, allowing account holders to move their funds seamlessly while maintaining their tax-deferred status. By completing this form, investors can ensure that their assets are transferred directly between institutions, thereby avoiding any potential tax implications that could arise from liquidating and re-investing the funds.

How to use the Direct Transfer Form For Registered Investments

Using the Direct Transfer Form For Registered Investments involves several straightforward steps. First, obtain the form from your current financial institution or download it from their website. Next, fill out the necessary personal information, including your name, address, and account details. It is essential to provide accurate information to prevent any delays in processing. After completing the form, submit it to your current institution, which will initiate the transfer process. Ensure that you keep a copy of the completed form for your records, as it may be required for future reference or verification.

Steps to complete the Direct Transfer Form For Registered Investments

Completing the Direct Transfer Form For Registered Investments requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your current account details and the receiving institution's information.

- Fill in your personal information accurately, including your Social Security number and contact details.

- Specify the type of account you are transferring, such as an IRA or 401(k).

- Indicate the amount or percentage of funds to be transferred.

- Sign and date the form to authorize the transfer.

- Submit the completed form to your current financial institution.

Legal use of the Direct Transfer Form For Registered Investments

The Direct Transfer Form For Registered Investments is legally recognized and serves as a formal request for the transfer of assets between financial institutions. It is essential to ensure that the form is filled out correctly and submitted according to the guidelines provided by both the current and receiving institutions. Failure to comply with these legal requirements may result in delays or complications during the transfer process. Additionally, maintaining accurate records of the transfer is crucial for tax purposes and future reference.

Key elements of the Direct Transfer Form For Registered Investments

Several key elements must be included in the Direct Transfer Form For Registered Investments to ensure its validity and effectiveness. These elements typically include:

- Personal information of the account holder, such as name, address, and Social Security number.

- Details of the current financial institution, including account numbers and contact information.

- Information about the receiving institution and the type of account being established.

- The amount or percentage of assets to be transferred.

- Signature of the account holder to authorize the transfer.

Required Documents

To successfully complete the Direct Transfer Form For Registered Investments, certain documents may be required. These typically include:

- A copy of your identification, such as a driver's license or passport.

- Recent statements from your current investment account to verify account details.

- Any specific forms or documents requested by the receiving institution.

Having these documents ready can help streamline the transfer process and ensure compliance with institutional requirements.

Create this form in 5 minutes or less

Find and fill out the correct direct transfer form for registered investments 782249198

Create this form in 5 minutes!

How to create an eSignature for the direct transfer form for registered investments 782249198

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Direct Transfer Form For Registered Investments?

A Direct Transfer Form For Registered Investments is a document that allows you to transfer your registered investment accounts directly from one financial institution to another. This form simplifies the process, ensuring that your investments are moved securely and efficiently without incurring unnecessary taxes or penalties.

-

How does airSlate SignNow facilitate the Direct Transfer Form For Registered Investments?

airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign your Direct Transfer Form For Registered Investments. With our intuitive interface, you can streamline the transfer process, ensuring that all necessary information is captured accurately and securely.

-

Are there any fees associated with using the Direct Transfer Form For Registered Investments?

While the Direct Transfer Form For Registered Investments itself may not incur fees, it's essential to check with your financial institution regarding any potential charges for processing the transfer. airSlate SignNow offers a cost-effective solution for managing your documents, helping you save on administrative costs.

-

What are the benefits of using airSlate SignNow for my Direct Transfer Form For Registered Investments?

Using airSlate SignNow for your Direct Transfer Form For Registered Investments offers numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform ensures that your documents are encrypted and compliant, giving you peace of mind during the transfer process.

-

Can I integrate airSlate SignNow with other financial tools for my Direct Transfer Form For Registered Investments?

Yes, airSlate SignNow can be integrated with various financial tools and software to streamline your workflow. This integration allows you to manage your Direct Transfer Form For Registered Investments alongside other financial documents, enhancing efficiency and organization.

-

Is it easy to track the status of my Direct Transfer Form For Registered Investments?

Absolutely! airSlate SignNow provides real-time tracking for your Direct Transfer Form For Registered Investments. You can easily monitor the status of your document, ensuring that you are informed every step of the way until the transfer is complete.

-

What types of registered investments can I transfer using the Direct Transfer Form?

You can use the Direct Transfer Form For Registered Investments to transfer various types of accounts, including RRSPs, RRIFs, TFSAs, and other registered investment accounts. This flexibility allows you to manage your investments effectively and ensure they are consolidated in your preferred financial institution.

Get more for Direct Transfer Form For Registered Investments

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises maryland form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles maryland form

- Letter from tenant to landlord about landlords failure to make repairs maryland form

- Maryland notice rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession maryland form

- Letter from tenant to landlord about illegal entry by landlord maryland form

- Letter from landlord to tenant about time of intent to enter premises maryland form

- Maryland tenant landlord form

Find out other Direct Transfer Form For Registered Investments

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself