RUT 5, Private Party Vehicle Use Tax Chart for 2023R1122 2024-2026

What is the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

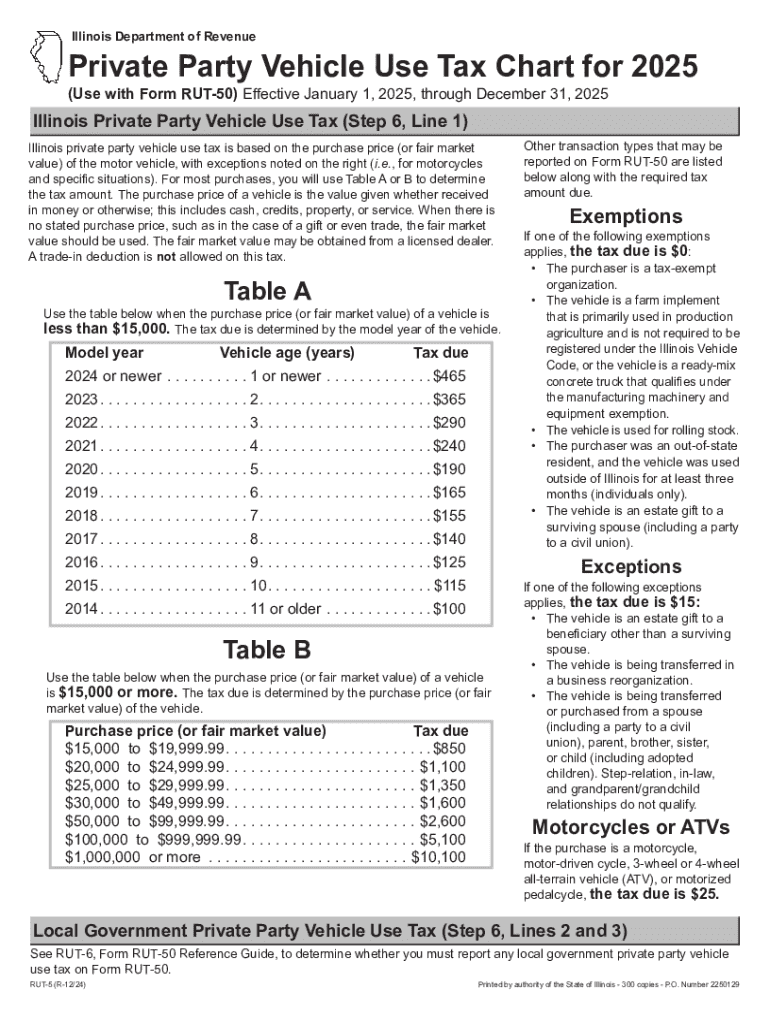

The RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122 is a tax document used in the United States to determine the applicable vehicle use tax for private party transactions. This chart provides a structured overview of the tax rates based on the purchase price of the vehicle. It is essential for individuals who are buying or selling vehicles privately, ensuring compliance with state tax regulations. The chart categorizes vehicles into different classes, allowing users to identify the correct tax amount owed when transferring ownership.

How to use the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

Using the RUT 5 chart involves a few straightforward steps. First, locate the purchase price of the vehicle in question. Next, find the corresponding tax rate in the chart based on the vehicle's classification. This information will assist in calculating the total vehicle use tax owed. It is important to ensure that the correct classification is used, as this can affect the tax amount significantly. Once the tax is calculated, it should be reported as part of the vehicle registration process.

Steps to complete the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

Completing the RUT 5 chart requires careful attention to detail. Begin by gathering all necessary information, including the vehicle's purchase price and classification. Follow these steps:

- Identify the vehicle type and its purchase price.

- Refer to the RUT 5 chart to find the appropriate tax rate.

- Calculate the tax by multiplying the purchase price by the tax rate.

- Document the calculated tax amount for your records.

Ensure that all calculations are accurate to avoid issues during the registration process.

Key elements of the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

The RUT 5 chart includes several key elements that are crucial for understanding vehicle use tax obligations. These elements include:

- Vehicle Classification: Different categories for various types of vehicles, such as passenger cars, trucks, and motorcycles.

- Tax Rates: Specific rates assigned to each classification based on the vehicle's purchase price.

- Purchase Price Ranges: Clearly defined ranges that help users determine the correct tax rate based on the vehicle's cost.

Understanding these elements is vital for ensuring compliance with tax regulations when engaging in private vehicle transactions.

Legal use of the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

The legal use of the RUT 5 chart is primarily for individuals involved in private vehicle sales in the United States. It serves as a guideline for calculating the vehicle use tax that must be paid to the state when transferring ownership. Utilizing this chart correctly ensures that both buyers and sellers fulfill their legal obligations, preventing potential penalties or fines associated with tax evasion. It is advisable to keep a copy of the completed calculations for personal records and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the RUT 5 chart are typically aligned with state vehicle registration deadlines. It is essential to submit the tax payment and any required documentation promptly to avoid late fees. Key dates may vary by state, so it is advisable to check local regulations for specific deadlines regarding vehicle registration and tax payments. Staying informed about these deadlines helps ensure compliance and smooth processing of vehicle transactions.

Create this form in 5 minutes or less

Find and fill out the correct rut 5 private party vehicle use tax chart for 2023r1122

Create this form in 5 minutes!

How to create an eSignature for the rut 5 private party vehicle use tax chart for 2023r1122

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122?

The RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122 is a comprehensive guide that outlines the tax rates applicable to private party vehicle transactions in 2023. This chart helps individuals and businesses understand their tax obligations when purchasing vehicles from private sellers, ensuring compliance with state regulations.

-

How can I access the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122?

You can easily access the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122 through our website or by contacting your local tax authority. We also provide downloadable resources to help you navigate the tax implications of your vehicle purchase.

-

What features does airSlate SignNow offer for managing vehicle tax documents?

airSlate SignNow offers a range of features for managing vehicle tax documents, including eSigning, document templates, and secure storage. With our platform, you can efficiently handle the paperwork associated with the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for vehicle tax documentation?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage your vehicle tax documentation, including the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122, without breaking the bank.

-

What are the benefits of using airSlate SignNow for eSigning documents related to vehicle taxes?

Using airSlate SignNow for eSigning documents related to vehicle taxes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the process of signing and managing documents like the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122, making it easier for you to stay compliant.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows you to easily incorporate the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122 into your existing workflows, enhancing your overall efficiency.

-

How does airSlate SignNow ensure the security of my vehicle tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. When handling sensitive information related to the RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122, you can trust that your data is protected against unauthorized access.

Get more for RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

Find out other RUT 5, Private Party Vehicle Use Tax Chart For 2023R1122

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now