Boe 262 Ah 2014

What is the Boe 262 Ah

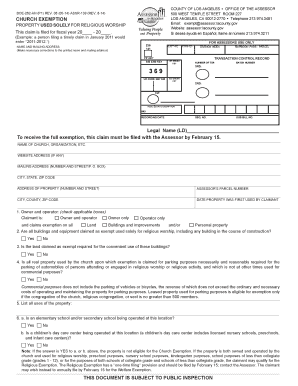

The Boe 262 Ah is a specific form used for various administrative purposes in the United States. It is often required by certain governmental agencies or organizations to collect essential information from individuals or businesses. This form typically includes sections for personal identification, financial details, and any relevant disclosures necessary for compliance with regulatory requirements.

How to use the Boe 262 Ah

Using the Boe 262 Ah involves several straightforward steps. First, ensure you have the latest version of the form, which can often be obtained online or through the issuing agency. Next, carefully read the instructions provided with the form to understand the information required. Fill out the form accurately, ensuring that all sections are completed as needed. Once completed, you can submit the form electronically or via traditional mail, depending on the submission guidelines specified by the agency.

Steps to complete the Boe 262 Ah

Completing the Boe 262 Ah requires attention to detail. Follow these steps for a smooth process:

- Download the form from a reliable source.

- Read the instructions thoroughly to understand what is required.

- Gather any necessary documents or information needed to complete the form.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form according to the guidelines provided, either electronically or by mail.

Legal use of the Boe 262 Ah

The legal use of the Boe 262 Ah is crucial for ensuring compliance with applicable laws and regulations. When completed and submitted correctly, the form serves as a legally binding document. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Utilizing a reliable electronic signature tool can further enhance the legal standing of the submitted form by ensuring compliance with eSignature laws.

Key elements of the Boe 262 Ah

The Boe 262 Ah consists of several key elements that are essential for its validity. These elements typically include:

- Personal identification details, such as name and address.

- Financial information relevant to the purpose of the form.

- Signatures from all required parties, confirming the accuracy of the information.

- Date of completion, which is critical for tracking submission timelines.

Form Submission Methods

Submitting the Boe 262 Ah can be done through various methods, depending on the requirements set by the issuing agency. Common submission methods include:

- Online submission through a secure portal, which often allows for quicker processing.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at an authorized location, if applicable.

Quick guide on how to complete boe 262 ah

Effortlessly Prepare Boe 262 Ah on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without delays. Manage Boe 262 Ah on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign Boe 262 Ah Without Stress

- Find Boe 262 Ah and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your alterations.

- Choose how you wish to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Boe 262 Ah and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct boe 262 ah

Create this form in 5 minutes!

How to create an eSignature for the boe 262 ah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the boe 262 ah?

The boe 262 ah is a specialized document management solution that provides businesses with the ability to streamline their document workflows. By using airSlate SignNow, users can easily eSign and manage documents related to the boe 262 ah. This enhances productivity and ensures compliance with industry regulations.

-

How does airSlate SignNow support the boe 262 ah?

airSlate SignNow offers a user-friendly interface that integrates with the boe 262 ah, allowing for efficient document signing and management. Users can customize workflows and automate repetitive tasks, which simplifies the process of handling documents associated with the boe 262 ah. This leads to faster processing times and increased accuracy.

-

What are the pricing options for airSlate SignNow users interested in the boe 262 ah?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on the boe 262 ah. The plans include monthly or annual subscriptions, allowing businesses to choose the option that best suits their budget. Each plan provides access to essential features that enhance document management capabilities.

-

What features does airSlate SignNow provide for managing the boe 262 ah?

With airSlate SignNow, users can benefit from features like eSigning, templates, and document tracking, specifically designed to enhance the management of the boe 262 ah. These features enable quick and secure signing processes, while also providing insights into document status. This ensures that users stay informed and can manage their workflows efficiently.

-

Can I integrate airSlate SignNow with other tools for the boe 262 ah?

Yes, airSlate SignNow seamlessly integrates with various applications and services to enhance the functionality of the boe 262 ah. By connecting with tools like Google Drive, Salesforce, and Dropbox, users can create a cohesive and streamlined document workflow. This integration helps in maximizing efficiency across your organization.

-

What benefits does airSlate SignNow offer for businesses using the boe 262 ah?

Using airSlate SignNow for the boe 262 ah provides several benefits, including increased speed and efficiency in document processing. Businesses can save time and resources by automating workflows and reducing manual errors. Moreover, the secure electronic signature feature enhances compliance and ensures that all transactions are legally binding.

-

Is airSlate SignNow easy to use for the boe 262 ah?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to manage documents related to the boe 262 ah. The straightforward interface allows users to navigate through features quickly, enabling businesses to adopt the solution with minimal training or technical expertise.

Get more for Boe 262 Ah

Find out other Boe 262 Ah

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA