Policy Surrender Full Withdrawal 8 25 16 Axa Com Ph Axa Com 2016

Understanding the Policy Surrender Full Withdrawal

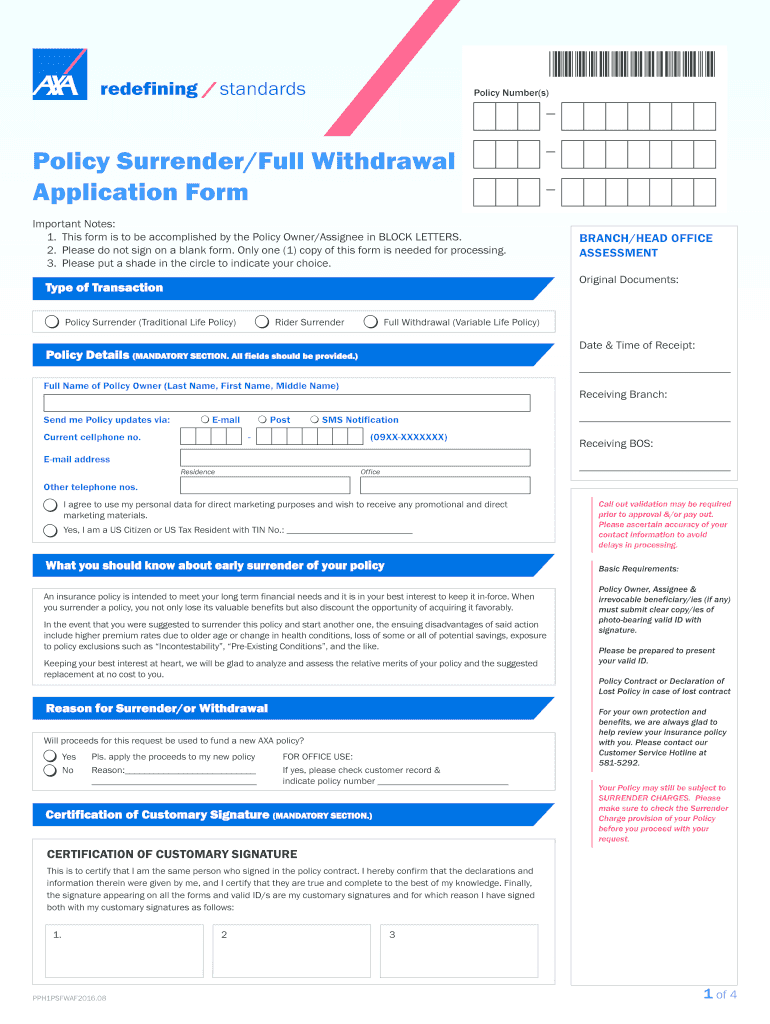

The Policy Surrender Full Withdrawal is a formal request to terminate a life insurance policy, allowing the policyholder to receive the cash value accumulated in the policy. This process is often initiated when the policyholder no longer needs the coverage or wishes to access the funds for other financial needs. It is essential to understand that surrendering a policy may result in the loss of death benefits and could have tax implications based on the amount withdrawn and the policy's status.

Steps to Complete the Policy Surrender Full Withdrawal

Completing a Policy Surrender Full Withdrawal involves several key steps:

- Review your policy details to understand the cash value and any potential penalties for early withdrawal.

- Obtain the necessary forms from your insurance provider, which may include the Policy Surrender request form.

- Fill out the form accurately, ensuring all required information is provided, including your policy number and personal identification.

- Submit the completed form to your insurance company via the specified method, which may include online submission, mail, or in-person delivery.

- Keep a copy of the submitted form and any correspondence for your records.

Required Documents for the Policy Surrender Full Withdrawal

When initiating a Policy Surrender Full Withdrawal, you will typically need to provide several documents to facilitate the process:

- Your life insurance policy document.

- A completed Policy Surrender request form.

- Proof of identity, such as a government-issued ID.

- Any additional documentation requested by your insurance provider, which may vary by company.

Legal Considerations for the Policy Surrender Full Withdrawal

It is important to be aware of the legal implications associated with surrendering a life insurance policy. Depending on your state, there may be specific regulations governing the surrender process, including waiting periods and disclosure requirements. Additionally, the cash value received may be subject to income tax if it exceeds the total premiums paid into the policy. Consulting with a financial advisor or tax professional can provide clarity on these issues.

Examples of Situations for Policy Surrender Full Withdrawal

There are various scenarios in which a policyholder might consider a Policy Surrender Full Withdrawal:

- A policyholder facing financial difficulties may choose to access the cash value to cover immediate expenses.

- Individuals who have reached retirement age and no longer need life insurance coverage may opt to surrender their policy.

- A policyholder who has found a better investment opportunity may decide to withdraw funds from their policy to reinvest elsewhere.

Eligibility Criteria for Policy Surrender Full Withdrawal

To be eligible for a Policy Surrender Full Withdrawal, policyholders generally must meet the following criteria:

- The policy must be active and not lapsed or canceled.

- The policyholder should have reached the age of majority, typically eighteen years old in most states.

- All premiums must be paid up to date to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct policy surrender full withdrawal 8 25 16 axa com ph axa com

Create this form in 5 minutes!

How to create an eSignature for the policy surrender full withdrawal 8 25 16 axa com ph axa com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com?

The Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com refers to a specific process for withdrawing funds from your AXA insurance policy. This option allows policyholders to access their accumulated cash value, providing financial flexibility when needed. It's essential to understand the terms and conditions associated with this withdrawal.

-

How can I initiate a Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com?

To initiate a Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com, you need to contact your AXA representative or visit their official website. They will guide you through the necessary steps and documentation required for the process. Ensure you have your policy details handy for a smoother experience.

-

Are there any fees associated with the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com?

Yes, there may be fees associated with the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com, depending on your policy terms. It's crucial to review your policy documents or consult with an AXA representative to understand any potential charges. This will help you make an informed decision about your withdrawal.

-

What are the benefits of choosing the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com?

The benefits of the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com include immediate access to your funds and the ability to use the cash value for various financial needs. This option can provide liquidity during emergencies or signNow life events. However, consider the long-term implications on your policy before proceeding.

-

Can I partially withdraw from my policy instead of a full surrender?

Yes, AXA offers options for partial withdrawals, allowing you to access a portion of your policy's cash value without fully surrendering it. This can be a beneficial alternative if you want to maintain your policy benefits while still accessing funds. Discuss your options with an AXA representative to find the best solution for your needs.

-

How does the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com affect my policy?

Choosing the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com will terminate your policy and forfeit any remaining benefits. It's essential to weigh the immediate financial gain against the loss of coverage. Consulting with a financial advisor can help you understand the long-term impact on your financial planning.

-

What documents do I need for the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com?

To process the Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com, you typically need to provide your policy number, identification, and any forms required by AXA. It's advisable to check with your AXA representative for a complete list of necessary documents to ensure a smooth withdrawal process.

Get more for Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com

Find out other Policy Surrender Full Withdrawal 8 25 16 Axa com ph Axa Com

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU