Sol Licitud De Taxaci Pericial Contradict Ria Form

What is the Sol·licitud De Taxació Pericial Contradictòria

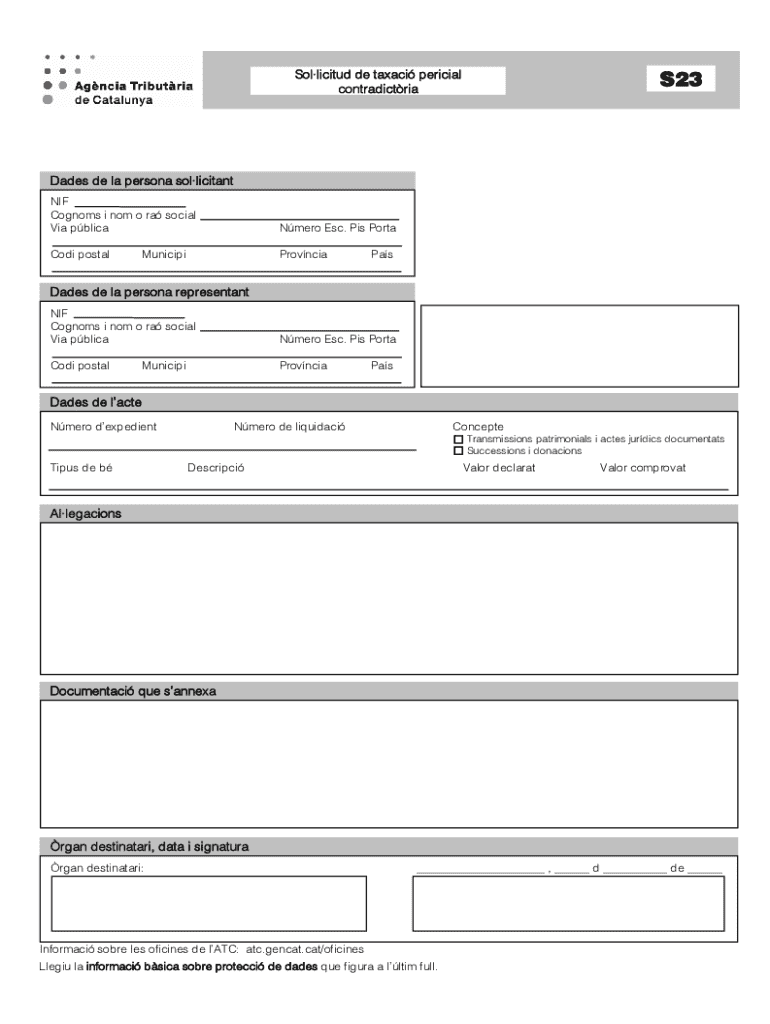

The Sol·licitud De Taxació Pericial Contradictòria is a formal request used in the context of property taxation disputes. This document allows taxpayers to challenge the assessed value of their property as determined by local tax authorities. The purpose of this form is to initiate a review process, which may lead to a reassessment of the property’s value, potentially resulting in lower tax obligations.

This form is particularly relevant for property owners who believe that their property has been overvalued, leading to higher taxes than warranted. The process typically involves providing evidence to support the claim, which may include appraisals, market comparisons, and other relevant documentation.

How to use the Sol·licitud De Taxació Pericial Contradictòria

Using the Sol·licitud De Taxació Pericial Contradictòria involves several key steps. First, ensure you have all necessary documentation that supports your claim. This may include recent property appraisals, comparative market analyses, and any other evidence that highlights discrepancies in the assessed value.

Next, fill out the form accurately, providing all required information, such as your property details and the reasons for your dispute. Once completed, submit the form to the appropriate local tax authority, following their specific submission guidelines. It is important to keep a copy of the submitted form and any supporting documents for your records.

Steps to complete the Sol·licitud De Taxació Pericial Contradictòria

Completing the Sol·licitud De Taxació Pericial Contradictòria involves a systematic approach:

- Gather necessary documentation, including appraisals and tax assessments.

- Obtain the form from your local tax authority or their website.

- Fill out the form, ensuring all sections are completed accurately.

- Attach supporting documents that substantiate your claim.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated local tax office, either online, by mail, or in person, as per their guidelines.

Key elements of the Sol·licitud De Taxació Pericial Contradictòria

Several key elements must be included in the Sol·licitud De Taxació Pericial Contradictòria to ensure its effectiveness:

- Property Information: Include the property address, parcel number, and any other identifying details.

- Assessment Details: Provide information on the current assessed value and the tax year in question.

- Dispute Reason: Clearly state the reasons for disputing the assessment, supported by evidence.

- Supporting Documentation: Attach any relevant documents that support your claim, such as appraisals or market analyses.

Eligibility Criteria

To file the Sol·licitud De Taxació Pericial Contradictòria, certain eligibility criteria must be met. Generally, the property owner or their authorized representative can submit the form. The property in question must be subject to local property taxes, and the owner must be able to demonstrate a legitimate reason for disputing the assessed value. Additionally, the request must be submitted within the timeframe set by local regulations, typically within a specific period following the assessment notice.

Form Submission Methods

The Sol·licitud De Taxació Pericial Contradictòria can be submitted through various methods, depending on the local tax authority's regulations. Common submission methods include:

- Online: Many jurisdictions offer electronic submission through their official websites.

- By Mail: The completed form can often be mailed to the designated tax office address.

- In-Person: Taxpayers may also have the option to submit the form directly at the local tax office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sollicitud de taxaci pericial contradictria

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Sol·licitud De Taxació Pericial Contradictòria?

A Sol·licitud De Taxació Pericial Contradictòria is a formal request for a contradictory expert appraisal, often used in legal and financial contexts. This document helps parties involved in disputes to seek an independent valuation. Understanding this process is crucial for ensuring fair assessments.

-

How can airSlate SignNow assist with the Sol·licitud De Taxació Pericial Contradictòria?

airSlate SignNow streamlines the process of creating and signing a Sol·licitud De Taxació Pericial Contradictòria. Our platform allows users to easily draft, send, and eSign documents securely. This efficiency saves time and reduces the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for Sol·licitud De Taxació Pericial Contradictòria?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while efficiently managing your Sol·licitud De Taxació Pericial Contradictòria. Check our website for detailed pricing information.

-

What features does airSlate SignNow provide for managing Sol·licitud De Taxació Pericial Contradictòria?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage for your Sol·licitud De Taxació Pericial Contradictòria. Additionally, you can integrate with various applications to enhance your workflow and ensure seamless document management.

-

Is airSlate SignNow secure for handling sensitive documents like Sol·licitud De Taxació Pericial Contradictòria?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and authentication methods to protect your Sol·licitud De Taxació Pericial Contradictòria and other sensitive documents. You can trust our platform to keep your information safe.

-

Can I integrate airSlate SignNow with other tools for my Sol·licitud De Taxació Pericial Contradictòria?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, making it easy to incorporate your Sol·licitud De Taxació Pericial Contradictòria into your existing workflow. This flexibility enhances productivity and collaboration across teams.

-

What are the benefits of using airSlate SignNow for my Sol·licitud De Taxació Pericial Contradictòria?

Using airSlate SignNow for your Sol·licitud De Taxació Pericial Contradictòria provides numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy. Our user-friendly interface ensures that you can manage your documents with ease, allowing you to focus on your core business activities.

Get more for Sol licitud De Taxaci Pericial Contradict ria

Find out other Sol licitud De Taxaci Pericial Contradict ria

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free