AR1000TC FileYourTaxes Com Form

What is the AR1000TC FileYourTaxes com

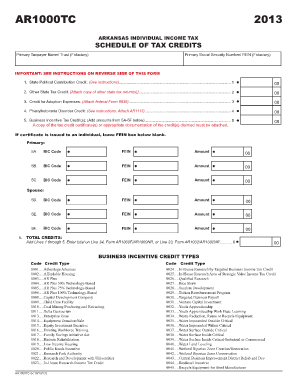

The AR1000TC form is a crucial document for taxpayers in the United States, specifically designed for reporting certain tax information. This form is utilized primarily for tax purposes, allowing individuals and businesses to provide necessary details to the IRS. Understanding the AR1000TC is essential for ensuring compliance with tax regulations and accurately reporting income or deductions. It serves as a formal declaration that can impact tax liabilities and potential refunds.

Steps to complete the AR1000TC FileYourTaxes com

Completing the AR1000TC form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Double-check calculations to avoid errors that could lead to penalties. Once completed, review the form for any missing signatures or required attachments before submission.

Legal use of the AR1000TC FileYourTaxes com

The AR1000TC form is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is essential to adhere to all legal requirements, including providing accurate information and signatures. Utilizing a reliable eSignature solution, like signNow, can enhance the legal validity of your submission. Compliance with federal and state regulations ensures that the form is recognized by tax authorities, minimizing the risk of disputes or audits.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the AR1000TC form. It is important to familiarize yourself with these guidelines to ensure compliance. The IRS outlines the necessary information to be included, deadlines for submission, and any additional documentation that may be required. Adhering to these guidelines helps to avoid potential penalties and ensures that your tax return is processed smoothly.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the AR1000TC form is crucial for timely submission. Typically, tax returns must be filed by April 15 of the following year. However, specific circumstances, such as extensions or special provisions, may alter these dates. Staying informed about important dates helps taxpayers avoid late fees and ensures compliance with tax regulations.

Required Documents

When completing the AR1000TC form, certain documents are required to support the information provided. These may include W-2 forms, 1099 forms, and any other relevant financial statements. Having these documents readily available streamlines the completion process and enhances the accuracy of the submitted information. Ensuring that all required documents are attached helps prevent delays in processing your tax return.

Quick guide on how to complete ar1000tc fileyourtaxes com

Prepare AR1000TC FileYourTaxes com seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents quickly without delays. Manage AR1000TC FileYourTaxes com on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and eSign AR1000TC FileYourTaxes com with ease

- Obtain AR1000TC FileYourTaxes com and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring the printing of additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign AR1000TC FileYourTaxes com and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1000tc fileyourtaxes com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000tc and how does it work?

The ar1000tc is a versatile eSignature solution offered by airSlate SignNow. It enables businesses to easily send, manage, and sign documents electronically, streamlining workflows and enhancing efficiency. With its user-friendly interface, the ar1000tc simplifies the signing process, allowing users to complete transactions quickly and securely.

-

What are the key features of the ar1000tc?

The ar1000tc includes features such as document templates, real-time tracking, and advanced security options. Users can customize their signing workflows and ensure compliance with legal standards. By leveraging these features, the ar1000tc enhances productivity and maintains the integrity of your documents.

-

How much does the ar1000tc cost?

Pricing for the ar1000tc is designed to be cost-effective, with various plans available to suit different business needs. airSlate SignNow offers flexible pricing options that cater to both small teams and large enterprises. For detailed pricing information, it's best to visit the official airSlate SignNow website.

-

Can I integrate the ar1000tc with other software?

Yes, the ar1000tc can seamlessly integrate with popular applications like Google Drive, Dropbox, and more. These integrations allow businesses to enhance their existing workflows and improve document management. This flexibility helps users maximize the benefits of the ar1000tc in their daily operations.

-

What are the benefits of using the ar1000tc for businesses?

Using the ar1000tc provides several benefits, including faster transaction times and reduced paper usage. Businesses can save valuable resources while ensuring documents are signed and returned promptly. Overall, the ar1000tc enhances operational efficiency and contributes to sustainable practices.

-

Is the ar1000tc secure for sensitive documents?

Absolutely, the ar1000tc prioritizes document security with advanced encryption and secure storage solutions. This ensures that all sensitive information remains protected during the signing process. By using the ar1000tc, businesses can have peace of mind knowing their documents are handled securely.

-

How can I get started with the ar1000tc?

Getting started with the ar1000tc is simple; you can sign up for a free trial on the airSlate SignNow website. Once registered, you can explore its features and create your first eSign document. The user-friendly dashboard makes it easy to navigate and start using the ar1000tc right away.

Get more for AR1000TC FileYourTaxes com

- Know ye that hereinafter referred to as grantor form

- Individual lender form

- Article six form

- This clause is a form

- Or the survivor means that only the named persons form

- Legacywritercomonline wills powers of attorney living wills form

- Online form builderform creator for online forms

- 12816065001enrecipients name use by the foreign t form

Find out other AR1000TC FileYourTaxes com

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy