Lohnabrechnung Ware Form

Understanding the Lohnabrechnung Ware

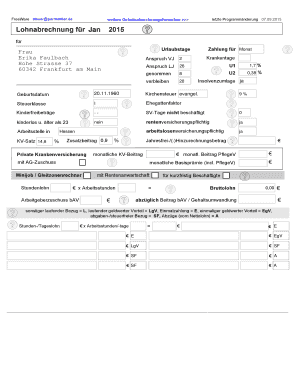

The Lohnabrechnung Ware is a payroll document that outlines the earnings and deductions for employees in a specific period. This document is essential for both employees and employers as it provides a clear breakdown of wages, taxes withheld, and other deductions. It serves as a record of employment income and is crucial for tax reporting and compliance purposes. Understanding the details included in the Lohnabrechnung Ware can help employees verify their pay and ensure that all deductions are accurate.

Steps to Complete the Lohnabrechnung Ware

Completing the Lohnabrechnung Ware involves several important steps. First, gather all relevant employee information, including personal details, hours worked, and wage rates. Next, calculate the gross pay by multiplying the hours worked by the hourly rate or summing up the salaries for salaried employees. After determining the gross pay, deduct applicable taxes and other withholdings, such as health insurance and retirement contributions. Finally, ensure that the document is signed and distributed to employees, either in paper form or electronically, to maintain compliance with legal requirements.

Legal Use of the Lohnabrechnung Ware

The Lohnabrechnung Ware must comply with federal and state regulations governing payroll documentation. Employers are required to provide this document to employees regularly, typically on a monthly or bi-weekly basis. It is important to ensure that all information is accurate and that the document includes required elements such as the employee's name, Social Security number, and detailed breakdown of earnings and deductions. Failure to provide accurate Lohnabrechnung Ware can result in penalties for employers, making it essential to adhere to legal standards.

Key Elements of the Lohnabrechnung Ware

A complete Lohnabrechnung Ware includes several key elements. These typically consist of the employee's name, address, and identification number, alongside the employer's information. The document should detail the pay period, gross wages, various deductions (such as federal and state taxes, Social Security, and Medicare), and the net pay. Additionally, it may include information about benefits and contributions to retirement plans. Providing this detailed information helps ensure transparency and clarity for both parties involved.

Examples of Using the Lohnabrechnung Ware

Employers utilize the Lohnabrechnung Ware in various scenarios. For instance, it is used during tax season to help employees report their income accurately on their tax returns. Additionally, employees may need this document when applying for loans or mortgages, as it serves as proof of income. Employers may also refer to the Lohnabrechnung Ware when conducting audits or ensuring compliance with labor laws. Understanding its applications can enhance the utility of this document in both personal and professional contexts.

Filing Deadlines and Important Dates

Employers must be aware of specific deadlines related to the Lohnabrechnung Ware. Typically, payroll documents should be distributed to employees by the end of each pay period. Additionally, employers need to file payroll taxes quarterly and annually, adhering to the IRS guidelines. Being mindful of these dates helps avoid penalties and ensures that both employers and employees remain compliant with tax regulations.

Required Documents for Lohnabrechnung Ware

To accurately complete the Lohnabrechnung Ware, several documents are necessary. Employers should have employee tax forms, such as the W-4, to determine withholding amounts. Additionally, records of hours worked, wage agreements, and any relevant benefit enrollment forms are essential. Having these documents readily available ensures that the payroll process is efficient and compliant with legal requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lohnabrechnung ware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Lohnabrechnung Ware and how does it work?

Lohnabrechnung Ware refers to the payroll processing services that streamline the management of employee salaries and benefits. With airSlate SignNow, businesses can easily create, send, and eSign payroll documents, ensuring accuracy and compliance. This solution simplifies the entire payroll process, making it efficient and user-friendly.

-

How can airSlate SignNow help with Lohnabrechnung Ware?

airSlate SignNow enhances Lohnabrechnung Ware by providing a secure platform for electronic signatures and document management. This allows businesses to quickly process payroll documents while maintaining compliance with legal standards. The platform's intuitive interface ensures that users can navigate the payroll process with ease.

-

What are the pricing options for Lohnabrechnung Ware services?

Pricing for Lohnabrechnung Ware services through airSlate SignNow is competitive and tailored to fit various business needs. We offer flexible subscription plans that cater to small businesses as well as larger enterprises. You can choose a plan that best suits your payroll processing volume and budget.

-

What features does airSlate SignNow offer for Lohnabrechnung Ware?

airSlate SignNow offers a range of features for Lohnabrechnung Ware, including customizable templates, automated workflows, and secure eSigning capabilities. These features help streamline the payroll process, reduce errors, and save time. Additionally, the platform provides real-time tracking of document status.

-

Are there any integrations available for Lohnabrechnung Ware?

Yes, airSlate SignNow supports various integrations that enhance Lohnabrechnung Ware functionality. You can connect with popular accounting and HR software to ensure seamless data transfer and management. This integration capability allows for a more cohesive payroll processing experience.

-

What are the benefits of using airSlate SignNow for Lohnabrechnung Ware?

Using airSlate SignNow for Lohnabrechnung Ware offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround times, which is crucial for timely payroll processing. Additionally, it ensures that all payroll documents are securely stored and easily accessible.

-

Is airSlate SignNow compliant with payroll regulations for Lohnabrechnung Ware?

Absolutely, airSlate SignNow is designed to comply with all relevant payroll regulations for Lohnabrechnung Ware. Our platform adheres to industry standards and legal requirements, ensuring that your payroll documents are processed in accordance with the law. This compliance helps protect your business from potential legal issues.

Get more for Lohnabrechnung Ware

Find out other Lohnabrechnung Ware

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement