California Form 3548 Disabled Access Credit for Eligible Small Businesses 2024-2026

What is the California Form 3548 Disabled Access Credit For Eligible Small Businesses

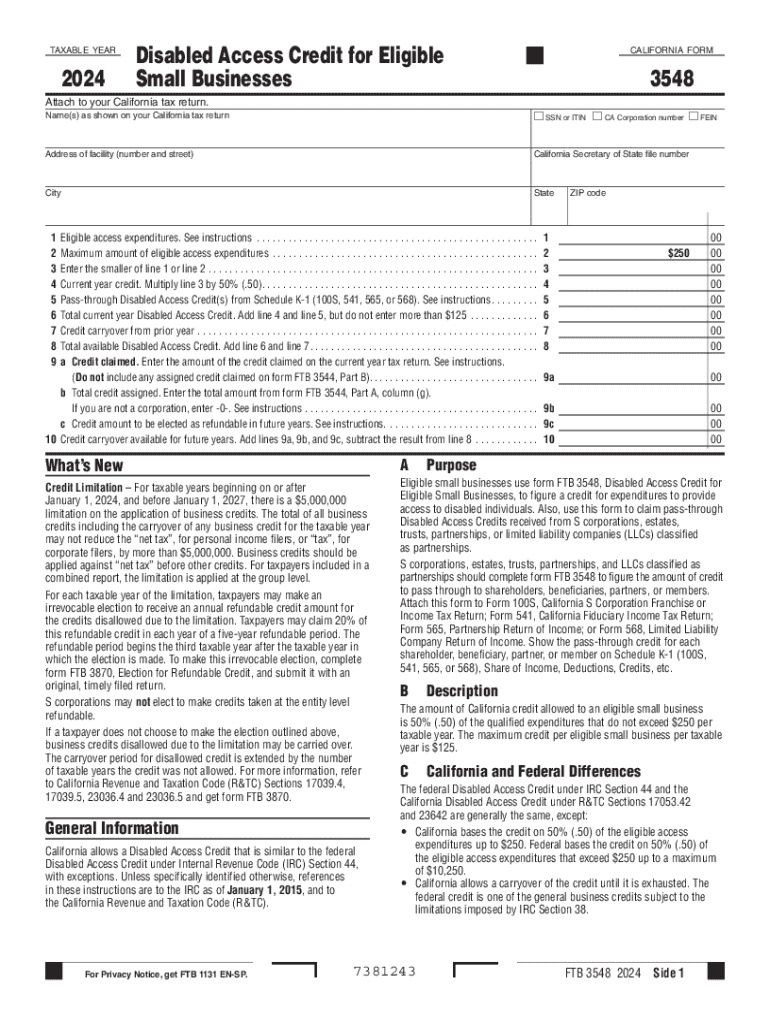

The California Form 3548 is a tax form designed to help eligible small businesses claim a credit for expenses incurred in making their facilities accessible to individuals with disabilities. This credit, known as the Disabled Access Credit, aims to encourage small businesses to comply with the Americans with Disabilities Act (ADA) by providing financial relief for necessary modifications. The credit can cover a variety of expenses, including the costs of acquiring or modifying equipment, making physical alterations to the business premises, and other related expenses that enhance accessibility.

Eligibility Criteria for the Disabled Access Credit

To qualify for the Disabled Access Credit, small businesses must meet specific criteria. Generally, the business must have gross receipts of $1 million or less in the previous tax year. Furthermore, the expenses claimed must be directly related to making the business accessible to individuals with disabilities. Eligible expenses can include costs for ramps, accessible restrooms, and signage. It is essential for businesses to maintain accurate records of all expenditures to substantiate their claims.

Steps to Complete the California Form 3548

Completing the California Form 3548 involves several key steps:

- Gather all necessary documentation, including receipts for eligible expenses.

- Fill out the form by providing basic business information, such as the business name, address, and tax identification number.

- Detail the specific expenses incurred for accessibility improvements in the designated sections of the form.

- Calculate the credit amount based on the total eligible expenses, adhering to the guidelines provided.

- Review the completed form for accuracy and ensure all required signatures are included.

How to Obtain the California Form 3548

The California Form 3548 can be obtained through the California Department of Tax and Fee Administration (CDTFA) website or by contacting their office directly. Additionally, businesses can access the form through various tax preparation software platforms that support California tax forms. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods

Businesses have several options for submitting the California Form 3548. The form can be filed electronically through approved tax software, which often simplifies the process and reduces the chances of errors. Alternatively, businesses can print the completed form and submit it via mail to the appropriate tax authority. In some cases, in-person submission may also be available, depending on local regulations and office hours.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the California Form 3548. Generally, the form must be submitted by the due date of the business's tax return for the year in which the expenses were incurred. Keeping track of these dates ensures that businesses do not miss out on claiming the credit, which can significantly benefit their financial standing.

Create this form in 5 minutes or less

Find and fill out the correct california form 3548 disabled access credit for eligible small businesses

Create this form in 5 minutes!

How to create an eSignature for the california form 3548 disabled access credit for eligible small businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 3548 for Disabled Access Credit?

California Form 3548 is a tax form that allows eligible small businesses to claim a credit for expenses incurred to make their facilities accessible to individuals with disabilities. This credit is designed to encourage businesses to invest in accessibility improvements, ultimately benefiting both the business and the community.

-

Who qualifies for the California Form 3548 Disabled Access Credit?

To qualify for the California Form 3548 Disabled Access Credit, a business must have gross receipts of $15 million or less and incur eligible expenses related to making their facilities accessible. This includes costs for modifications, equipment, and other improvements that enhance accessibility for individuals with disabilities.

-

How can airSlate SignNow help with the California Form 3548 application process?

airSlate SignNow streamlines the document signing process, making it easier for businesses to complete and submit the California Form 3548 Disabled Access Credit application. With our user-friendly platform, you can quickly gather signatures and ensure all necessary documents are in order for submission.

-

What are the benefits of claiming the California Form 3548 Disabled Access Credit?

Claiming the California Form 3548 Disabled Access Credit can signNowly reduce your tax liability, allowing you to reinvest those savings back into your business. Additionally, making your business more accessible can attract a wider customer base and improve your brand's reputation.

-

Are there any costs associated with using airSlate SignNow for document signing?

airSlate SignNow offers a cost-effective solution for document signing, with various pricing plans to fit different business needs. By using our platform, you can save time and resources while ensuring compliance with the California Form 3548 Disabled Access Credit requirements.

-

What features does airSlate SignNow offer for managing documents related to California Form 3548?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools help businesses efficiently manage their documentation for the California Form 3548 Disabled Access Credit, ensuring a smooth application process.

-

Can airSlate SignNow integrate with other software for managing tax credits?

Yes, airSlate SignNow can integrate with various accounting and tax software, making it easier to manage your financial documents and claims, including the California Form 3548 Disabled Access Credit. This integration helps streamline your workflow and ensures all necessary information is readily accessible.

Get more for California Form 3548 Disabled Access Credit For Eligible Small Businesses

- Customer property claim form united airlines

- Skittles math pdf form

- Employee direct depositpaycard deposit form columbia edp

- Gc 085 fillable orm form

- 355s fillable form

- Debonairs franchise application form

- Missouri state emergency management agency mo gov form

- Www camdenmo org wp content uploadsnecessary requirements to obtain a construction permit form

Find out other California Form 3548 Disabled Access Credit For Eligible Small Businesses

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online