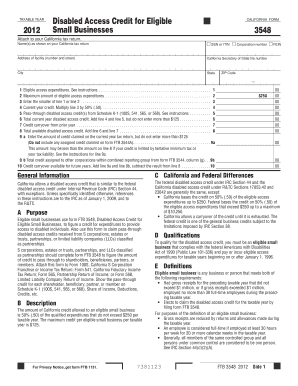

Form 3548 2012

Understanding Form 3548

Form 3548 is a document used primarily for the purpose of requesting a waiver of the requirement to file a tax return for certain individuals. This form is essential for taxpayers who may qualify for specific exemptions under U.S. tax laws. It is particularly relevant for those who may not have had a filing requirement due to low income or other qualifying factors.

Steps to Complete Form 3548

Completing Form 3548 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and income details. Next, carefully fill out each section of the form, providing truthful and complete information. It is crucial to double-check entries for any errors before submission. Finally, sign and date the form to validate your request.

Obtaining Form 3548

To obtain Form 3548, you can visit the official IRS website, where the form is available for download. It is also possible to request a physical copy by contacting the IRS directly. Ensure you have the most current version of the form to avoid any issues during the filing process.

Legal Use of Form 3548

Form 3548 must be used in accordance with IRS guidelines to ensure legal compliance. This means it should only be submitted by individuals who meet the specific eligibility criteria outlined by the IRS. Misuse of the form can lead to penalties or other legal repercussions, so understanding the legal framework surrounding its use is essential.

Filing Deadlines for Form 3548

Filing deadlines for Form 3548 vary depending on individual circumstances. Generally, it is advisable to submit the form as soon as you determine your eligibility for a waiver. Keeping track of important dates related to tax filings can help ensure that you do not miss any critical deadlines.

Examples of Using Form 3548

Form 3548 can be particularly useful in various scenarios. For instance, a self-employed individual with fluctuating income may use this form to request a waiver if their earnings fall below the filing threshold. Similarly, retirees with limited income may also find this form beneficial for maintaining compliance without the need for a tax return.

Create this form in 5 minutes or less

Find and fill out the correct form 3548

Create this form in 5 minutes!

How to create an eSignature for the form 3548

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3548 and how can airSlate SignNow help?

Form 3548 is a crucial document for businesses seeking to apply for loan forgiveness under the Paycheck Protection Program. airSlate SignNow simplifies the process of filling out and eSigning Form 3548, ensuring that your application is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form 3548?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage and eSign Form 3548 without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 3548?

airSlate SignNow provides a range of features for managing Form 3548, including customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process, making it easier for businesses to handle their paperwork efficiently.

-

Can I integrate airSlate SignNow with other software for Form 3548?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Form 3548 alongside your existing tools. This integration enhances productivity and ensures a smooth workflow for your document management needs.

-

What are the benefits of using airSlate SignNow for Form 3548?

Using airSlate SignNow for Form 3548 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive information is protected while making the eSigning process quick and hassle-free.

-

How does airSlate SignNow ensure the security of Form 3548?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your Form 3548 and other documents. Our platform is designed to keep your data safe, giving you peace of mind while you manage your important paperwork.

-

Is it easy to use airSlate SignNow for completing Form 3548?

Yes, airSlate SignNow is designed with user-friendliness in mind. Completing Form 3548 is straightforward, with an intuitive interface that guides you through the process, making it accessible for users of all skill levels.

Get more for Form 3548

Find out other Form 3548

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer