California Form 3548 Disabled Access Credit for Eligible Small Businesses California Form 3548 Disabled Access Credit for Eligib 2022

Understanding the California Form 3548 Disabled Access Credit

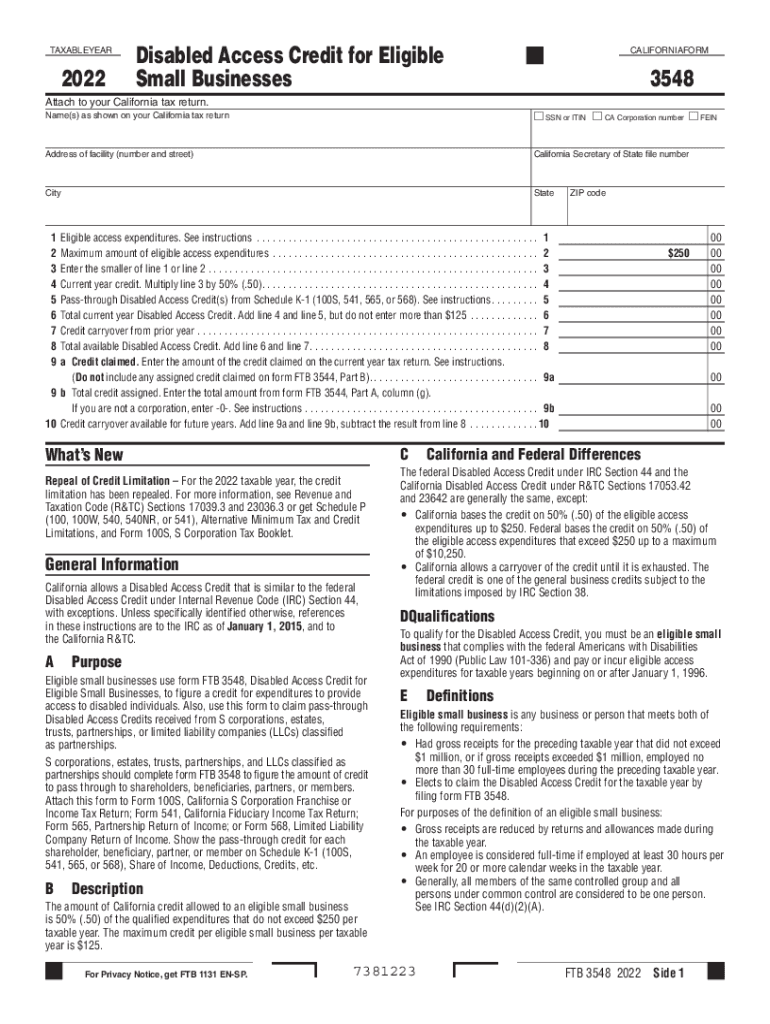

The California Form 3548 Disabled Access Credit is a tax incentive designed to assist eligible small businesses in making their facilities accessible to individuals with disabilities. This program aims to encourage business owners to invest in necessary improvements that enhance accessibility, thereby promoting inclusivity. The credit can cover a portion of the expenses incurred when making physical changes to a business location, such as installing ramps, modifying restrooms, or acquiring accessible equipment.

Steps to Complete the California Form 3548

Completing the California Form 3548 involves several straightforward steps:

- Gather necessary documentation, including receipts for eligible expenses.

- Fill out the form with accurate business information, including the business name, address, and tax identification number.

- Detail the expenses incurred for accessibility improvements in the designated section.

- Calculate the credit amount based on the eligible expenses and ensure all calculations are accurate.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the Disabled Access Credit

To qualify for the California Form 3548 Disabled Access Credit, businesses must meet specific criteria:

- The business must be a small business with gross receipts of less than a designated threshold.

- Improvements made must be directly related to enhancing accessibility for individuals with disabilities.

- Eligible expenses must be incurred during the tax year for which the credit is claimed.

- Businesses must comply with all applicable state and federal accessibility laws.

Required Documents for Submission

When submitting the California Form 3548, businesses should include the following documents:

- Receipts or invoices for all qualifying expenses related to accessibility improvements.

- A completed Form 3548 with accurate information and calculations.

- Any additional documentation that may support the claim, such as photographs of the improvements or correspondence with contractors.

Form Submission Methods

The California Form 3548 can be submitted through various methods:

- Online submission via the California Department of Tax and Fee Administration's website.

- Mailing a hard copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Common Scenarios for Claiming the Credit

Different business types may benefit from the Disabled Access Credit in various ways:

- Retail stores can utilize the credit to enhance customer access, such as installing automatic doors.

- Restaurants may claim expenses for modifying restrooms to meet accessibility standards.

- Service providers can invest in accessible equipment, such as specialized software or tools, to accommodate clients with disabilities.

Create this form in 5 minutes or less

Find and fill out the correct california form 3548 disabled access credit for eligible small businesses california form 3548 disabled access credit for

Create this form in 5 minutes!

How to create an eSignature for the california form 3548 disabled access credit for eligible small businesses california form 3548 disabled access credit for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California Form 3548 Disabled Access Credit For Eligible Small Businesses?

The California Form 3548 Disabled Access Credit For Eligible Small Businesses is a tax credit designed to assist small businesses in making their facilities accessible to individuals with disabilities. This credit can help offset the costs associated with necessary improvements and adaptations, making it easier for businesses to comply with accessibility standards.

-

Who qualifies for the California Form 3548 Disabled Access Credit?

To qualify for the California Form 3548 Disabled Access Credit For Eligible Small Businesses, your business must have 100 or fewer employees and have incurred expenses for making your facilities accessible. This includes costs for modifications, equipment, and other related expenses that enhance accessibility for disabled individuals.

-

How much can I claim with the California Form 3548 Disabled Access Credit?

Eligible small businesses can claim a credit of up to 50% of the eligible expenses incurred, with a maximum credit of $25,000 per year. This means that if your business spends $50,000 on accessibility improvements, you could potentially receive a credit of $25,000 through the California Form 3548 Disabled Access Credit For Eligible Small Businesses.

-

What types of expenses are covered under the California Form 3548 Disabled Access Credit?

Expenses that qualify for the California Form 3548 Disabled Access Credit For Eligible Small Businesses include costs for physical modifications to your business premises, purchasing adaptive equipment, and other related expenses that enhance accessibility. It's important to keep detailed records of these expenses to ensure eligibility for the credit.

-

How can airSlate SignNow help with the California Form 3548 Disabled Access Credit?

airSlate SignNow provides an easy-to-use platform for managing documents related to the California Form 3548 Disabled Access Credit For Eligible Small Businesses. Our solution allows you to eSign and send necessary forms quickly, ensuring that you can focus on making your business accessible without getting bogged down by paperwork.

-

Is there a cost associated with using airSlate SignNow for the California Form 3548 Disabled Access Credit?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution ensures that you can manage your documents efficiently while taking advantage of the California Form 3548 Disabled Access Credit For Eligible Small Businesses, ultimately saving you time and money.

-

Can I integrate airSlate SignNow with other software for managing the California Form 3548 Disabled Access Credit?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when managing the California Form 3548 Disabled Access Credit For Eligible Small Businesses. This integration helps you maintain organized records and ensures that all necessary documentation is easily accessible.

Get more for California Form 3548 Disabled Access Credit For Eligible Small Businesses California Form 3548 Disabled Access Credit For Eligib

- Edible soil lab answer key form

- Partnership agreement form 6074157

- Dss 1815 form

- Online advertising insertion order form california society of csahq

- Identification verification form

- Medisch attest openbaredienstenacv onlinebe openbarediensten acv online form

- Certificate of appreciation american legion auxiliary department form

- Veterinary consent form thinkpawsitivedog com

Find out other California Form 3548 Disabled Access Credit For Eligible Small Businesses California Form 3548 Disabled Access Credit For Eligib

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter