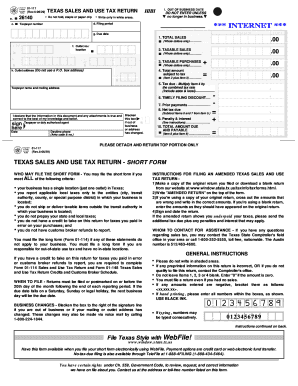

01 117 Texas Sales and Use Tax Return Short Form

What is the 01 117 Texas Sales And Use Tax Return Short Form

The 01 117 Texas Sales and Use Tax Return Short Form is a streamlined document designed for businesses and individuals to report their sales tax obligations in Texas. This form is specifically tailored for those with straightforward tax situations, allowing for a more efficient filing process. It captures essential information regarding taxable sales, exemptions, and the total amount of sales tax due. Utilizing this form can simplify compliance with state tax regulations while ensuring accurate reporting.

Steps to complete the 01 117 Texas Sales And Use Tax Return Short Form

Completing the 01 117 Texas Sales and Use Tax Return Short Form involves several key steps:

- Gather necessary information: Collect details about your sales, including gross sales, exempt sales, and any deductions.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy in reporting your taxable sales and exemptions.

- Calculate the total tax due: Based on your sales figures, calculate the total sales tax owed to the state.

- Review for accuracy: Double-check all entries for correctness to prevent errors that could lead to penalties.

- Submit the form: File the completed form either online or via mail, depending on your preference and the filing options available.

Legal use of the 01 117 Texas Sales And Use Tax Return Short Form

The legal use of the 01 117 Texas Sales and Use Tax Return Short Form is governed by Texas state law. To ensure compliance, it is essential to complete the form accurately and submit it by the designated deadlines. Electronic submissions are legally recognized, provided they meet the requirements set forth by the state. Utilizing a secure platform for electronic filing can enhance the legal validity of your submission, ensuring adherence to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Key elements of the 01 117 Texas Sales And Use Tax Return Short Form

Several key elements make up the 01 117 Texas Sales and Use Tax Return Short Form:

- Taxpayer Information: Includes the name, address, and Texas taxpayer number of the individual or business filing the return.

- Sales Information: Captures total sales, exempt sales, and any deductions applicable to the reporting period.

- Tax Calculation: Provides a section for calculating the total sales tax due based on reported figures.

- Signature Section: Requires the signature of the taxpayer or an authorized representative, affirming the accuracy of the information provided.

Form Submission Methods

The 01 117 Texas Sales and Use Tax Return Short Form can be submitted through various methods, accommodating different preferences:

- Online Submission: Many taxpayers opt for electronic filing through the Texas Comptroller's website, which offers a streamlined process for submitting the form.

- Mail: The form can also be printed and mailed to the appropriate address provided by the Texas Comptroller.

- In-Person: For those who prefer face-to-face interaction, submitting the form at a local Comptroller office is an option.

Filing Deadlines / Important Dates

Filing deadlines for the 01 117 Texas Sales and Use Tax Return Short Form are crucial for compliance. Typically, the form is due on the 20th day of the month following the end of the reporting period. For example, sales made in January must be reported by February 20. It is important to stay informed about any changes to deadlines or specific filing requirements, as these can vary based on the taxpayer's reporting frequency.

Quick guide on how to complete 01 117 texas sales and use tax return short form

Complete 01 117 Texas Sales And Use Tax Return Short Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the needed document and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Handle 01 117 Texas Sales And Use Tax Return Short Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 01 117 Texas Sales And Use Tax Return Short Form without stress

- Obtain 01 117 Texas Sales And Use Tax Return Short Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign 01 117 Texas Sales And Use Tax Return Short Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 01 117 texas sales and use tax return short form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is texas sales tax and how does it relate to eSignatures?

Texas sales tax is a tax imposed on the sale of goods and services in Texas. When using airSlate SignNow to eSign documents, it's important to ensure that any agreements comply with Texas sales tax regulations, especially for transactions involving taxable items.

-

How can airSlate SignNow help with texas sales tax compliance?

airSlate SignNow allows businesses to automate the signing process for documents related to sales tax compliance. By utilizing our easy-to-use platform, you can ensure that contracts include necessary terms regarding texas sales tax, making it simpler to keep your business compliant.

-

Is there a cost associated with using airSlate SignNow for texas sales tax documents?

Yes, airSlate SignNow offers a range of pricing plans that are cost-effective for businesses of all sizes. Depending on your needs, you can choose a plan that supports the management and signing of documents involving texas sales tax while maximizing your budget.

-

What features does airSlate SignNow offer for managing texas sales tax documentation?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and automated workflows that simplify the handling of texas sales tax documentation. These features ensure that you can efficiently manage compliance and streamline your eSignature process.

-

Can I integrate airSlate SignNow with my existing texas sales tax software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software solutions. This allows you to easily incorporate your existing texas sales tax systems and ensure that all documents are up-to-date and compliant.

-

How does airSlate SignNow improve efficiency in handling texas sales tax-related agreements?

By using airSlate SignNow, businesses can signNowly reduce the time spent on signing agreements related to texas sales tax. The platform enables easy digital signing, which expedites the process and allows for faster transaction confirmations.

-

Is airSlate SignNow secure for managing sensitive texas sales tax documents?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect your sensitive documents, including those related to texas sales tax. You can trust our system to safeguard your information while maintaining compliance.

Get more for 01 117 Texas Sales And Use Tax Return Short Form

- Of 3 gcfact 112017 genetic counselor fact sheet form

- Autopsy report hennepin form

- Minnesota uniform credentialing applicationinitial pdf

- Kathryn b miller odharvard medical school department of form

- Mhcp provider manual minnesota department of human services form

- Outpatient physical occupational amp speech therapy pre form

- 2018 authorization and notification requirements ucare form

- Southeasthealth occupation medicine clinic form

Find out other 01 117 Texas Sales And Use Tax Return Short Form

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document