VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE 2022-2026

What is the VAT and Excise Duty Exemption Certificate

The VAT and Excise Duty Exemption Certificate is a crucial document that allows eligible businesses to claim exemptions from value-added tax (VAT) and excise duties on certain goods and services. This certificate is particularly important for businesses involved in manufacturing, exporting, or providing specific services that qualify for tax relief. By obtaining this certificate, businesses can reduce their tax liabilities, thus improving cash flow and competitiveness in the market.

How to Obtain the VAT and Excise Duty Exemption Certificate

To obtain the VAT and Excise Duty Exemption Certificate, businesses must follow a structured application process. This typically involves:

- Identifying eligibility criteria based on the nature of the business and the goods or services provided.

- Gathering necessary documentation, such as proof of business registration and financial records.

- Completing the application form accurately, ensuring all required information is included.

- Submitting the application to the appropriate tax authority, which may vary by state.

Once submitted, businesses should expect a review period during which the tax authority evaluates the application for compliance with regulations.

Steps to Complete the VAT and Excise Duty Exemption Certificate

Completing the VAT and Excise Duty Exemption Certificate involves several key steps:

- Begin by downloading the appropriate form from the tax authority's website.

- Fill in the business details, including name, address, and tax identification number.

- Provide information about the specific goods or services for which the exemption is being requested.

- Attach any required supporting documents, such as sales invoices or previous tax returns.

- Review the completed form for accuracy before submission.

Ensuring all information is correct can help avoid delays in processing the application.

Legal Use of the VAT and Excise Duty Exemption Certificate

The legal use of the VAT and Excise Duty Exemption Certificate is governed by federal and state tax laws. Businesses must ensure that they only apply for exemptions on eligible goods and services. Misuse of the certificate can lead to penalties, including fines and back taxes. It is essential for businesses to maintain accurate records of transactions related to exempt items to support their claims during audits.

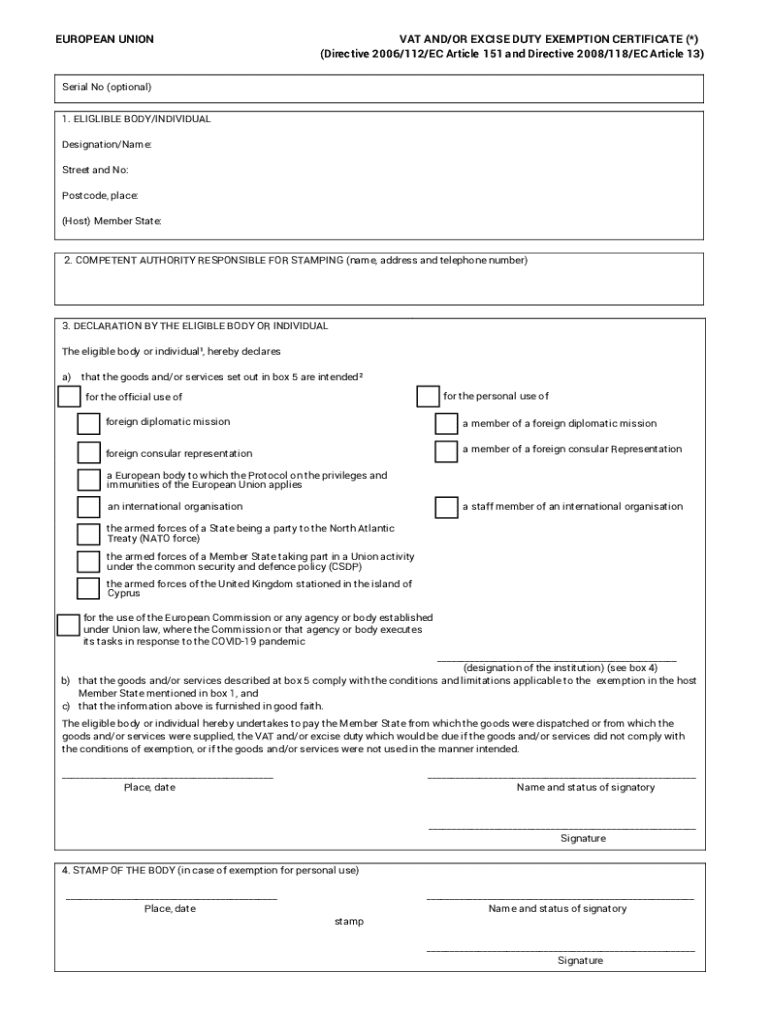

Key Elements of the VAT and Excise Duty Exemption Certificate

Several key elements are essential for the VAT and Excise Duty Exemption Certificate:

- Business Information: Name, address, and tax identification number of the business.

- Description of Goods/Services: Detailed description of the items or services for which the exemption is claimed.

- Exemption Reason: Justification for the exemption, including applicable laws or regulations.

- Signature: Authorized signature of the business representative certifying the accuracy of the information provided.

Each of these elements plays a critical role in the validity of the certificate and must be completed with care.

Examples of Using the VAT and Excise Duty Exemption Certificate

Businesses can utilize the VAT and Excise Duty Exemption Certificate in various scenarios, such as:

- A manufacturer purchasing raw materials that are exempt from VAT due to their intended use in production.

- An exporter claiming exemption on goods shipped overseas, which are not subject to domestic VAT.

- A service provider offering exempt services, such as certain educational or healthcare services.

These examples illustrate how the certificate can significantly impact operational costs and pricing strategies.

Create this form in 5 minutes or less

Find and fill out the correct vat andor excise duty exemption certificate

Create this form in 5 minutes!

How to create an eSignature for the vat andor excise duty exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE?

A VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE is a document that allows businesses to claim exemptions from VAT or excise duties on certain goods or services. This certificate is essential for companies looking to reduce their tax liabilities and ensure compliance with tax regulations. Understanding how to obtain and utilize this certificate can signNowly benefit your business.

-

How can airSlate SignNow help with VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE management?

airSlate SignNow provides a streamlined platform for managing VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES. With our eSigning capabilities, you can easily send, sign, and store these important documents securely. This not only saves time but also enhances compliance and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features specifically designed for managing VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for handling VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to simplify the management of VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES. Additionally, you can track document status in real-time, ensuring you never miss a deadline. These features enhance efficiency and compliance.

-

Are there any integrations available for managing VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES alongside your existing workflows. This integration capability ensures that you can streamline your processes and maintain accurate records across platforms. Popular integrations include CRM systems and accounting software.

-

What are the benefits of using airSlate SignNow for VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES?

Using airSlate SignNow for VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document management, which can signNowly speed up your processes. Additionally, you can ensure compliance with tax regulations more easily.

-

Is airSlate SignNow secure for handling VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATES. Our platform is designed to keep your sensitive information safe while allowing for easy access and management. You can trust us to handle your documents securely.

Get more for VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE

- Fha va financing addendum to purchase agreement form

- Relationship assessment tool form

- Navy ombudsman program manual form

- W 011 form wt 11 nonresident entertainer withholding report fill in 766387207

- Student housing questionnaire for mckinney vento eligibility form

- Data sharing education agreement template form

- Data sharing research agreement template form

- Commercial pressure wash contract template form

Find out other VAT ANDOR EXCISE DUTY EXEMPTION CERTIFICATE

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free