Tiaa Cref Recharacterization Form 2013

What is the Tiaa Cref Recharacterization Form

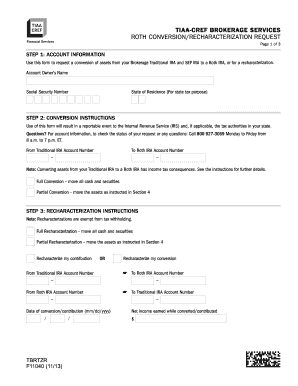

The Tiaa Cref Recharacterization Form is a specific document used to change the tax treatment of contributions made to a retirement account. This form allows individuals to recharacterize contributions from a traditional IRA to a Roth IRA, or vice versa, effectively allowing account holders to adjust their retirement savings strategy based on their current financial situation. Understanding this form is essential for individuals looking to optimize their tax outcomes and retirement planning.

How to use the Tiaa Cref Recharacterization Form

Using the Tiaa Cref Recharacterization Form involves several key steps. First, you need to determine whether you want to recharacterize contributions from a traditional IRA to a Roth IRA or the other way around. Once you have made this decision, you can obtain the form from Tiaa Cref's official website or customer service. After filling out the required information, including account details and the amount to be recharacterized, you will need to submit the form as directed. It is important to follow the instructions carefully to ensure compliance with IRS regulations.

Steps to complete the Tiaa Cref Recharacterization Form

Completing the Tiaa Cref Recharacterization Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your account number and contribution details.

- Indicate whether you are recharacterizing from a traditional IRA to a Roth IRA or vice versa.

- Fill out the form accurately, providing all required information.

- Review the form for any errors or omissions.

- Submit the completed form according to the provided instructions, either online or by mail.

Key elements of the Tiaa Cref Recharacterization Form

The Tiaa Cref Recharacterization Form includes several key elements that are essential for proper completion. These elements typically include:

- Your personal information, such as name and contact details.

- Your account numbers for both the traditional and Roth IRAs.

- The specific amount you wish to recharacterize.

- Signature and date to confirm the request.

Ensuring that all these elements are accurately filled out is crucial for processing your request efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Tiaa Cref Recharacterization Form are critical to consider. Generally, you must complete the recharacterization by the tax filing deadline for the year in which the contributions were made, including any extensions. For example, if you made contributions in 2023, you would need to submit the form by April 15, 2024, unless you have filed for an extension. Keeping track of these dates helps ensure that you can take full advantage of the tax benefits associated with recharacterization.

Eligibility Criteria

Eligibility to use the Tiaa Cref Recharacterization Form is typically based on your account type and the nature of your contributions. Generally, individuals must have made contributions to either a traditional IRA or a Roth IRA during the tax year in question. Additionally, there may be income limits that affect your ability to recharacterize. It is advisable to review IRS guidelines or consult a financial advisor to confirm your eligibility before proceeding.

Create this form in 5 minutes or less

Find and fill out the correct tiaa cref recharacterization form

Create this form in 5 minutes!

How to create an eSignature for the tiaa cref recharacterization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tiaa Cref Recharacterization Form?

The Tiaa Cref Recharacterization Form is a document used to reallocate contributions made to a retirement account. This form allows account holders to adjust their contributions based on changing financial circumstances or investment strategies. Understanding how to properly fill out this form can help you optimize your retirement savings.

-

How can airSlate SignNow help with the Tiaa Cref Recharacterization Form?

airSlate SignNow simplifies the process of completing and signing the Tiaa Cref Recharacterization Form. With our user-friendly platform, you can easily fill out the form, add your electronic signature, and send it securely. This streamlines the entire process, saving you time and ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the Tiaa Cref Recharacterization Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective while providing robust features for managing documents like the Tiaa Cref Recharacterization Form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Tiaa Cref Recharacterization Form?

airSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage. These tools make it easy to manage the Tiaa Cref Recharacterization Form efficiently. Additionally, our platform allows for real-time collaboration, ensuring all stakeholders can review and sign the document promptly.

-

Can I integrate airSlate SignNow with other applications for the Tiaa Cref Recharacterization Form?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow when handling the Tiaa Cref Recharacterization Form. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can seamlessly connect to improve efficiency.

-

What are the benefits of using airSlate SignNow for the Tiaa Cref Recharacterization Form?

Using airSlate SignNow for the Tiaa Cref Recharacterization Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, while also allowing for quick access and easy sharing with relevant parties.

-

Is it easy to track the status of the Tiaa Cref Recharacterization Form with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of the Tiaa Cref Recharacterization Form in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Tiaa Cref Recharacterization Form

- Banns application form marriage generic

- Simple thought record pdf form

- Probate form iht205

- Personal injury client questionnaire tourkow crell rosenblatt form

- Mi form dhs 1010

- Please select a pcp from the provider directory and write the pcp s name and 4 digit number below goldcoasthealthplan form

- Softwarer license agreement template form

- Sole custody agreement template 787747746 form

Find out other Tiaa Cref Recharacterization Form

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format