TIAA CREF BROKERAGE SERVICES ROTH CONVERSIONRECHA 2023-2026

What is the TIAA CREF Brokerage Services Roth Conversion?

The TIAA CREF Brokerage Services Roth Conversion is a process that allows individuals to convert their traditional retirement accounts into Roth accounts. This conversion enables account holders to pay taxes on the converted amount now, rather than during retirement, potentially leading to tax-free withdrawals in the future. The Roth conversion can be particularly beneficial for those who anticipate being in a higher tax bracket during retirement or for individuals seeking to leave tax-free assets to their heirs.

Steps to Complete the TIAA CREF Brokerage Services Roth Conversion

Completing a Roth conversion through TIAA CREF involves several key steps:

- Evaluate Eligibility: Ensure that you meet the eligibility criteria for a Roth conversion, including income limits and account types.

- Determine Conversion Amount: Decide how much of your traditional account you wish to convert to a Roth account, keeping in mind the tax implications.

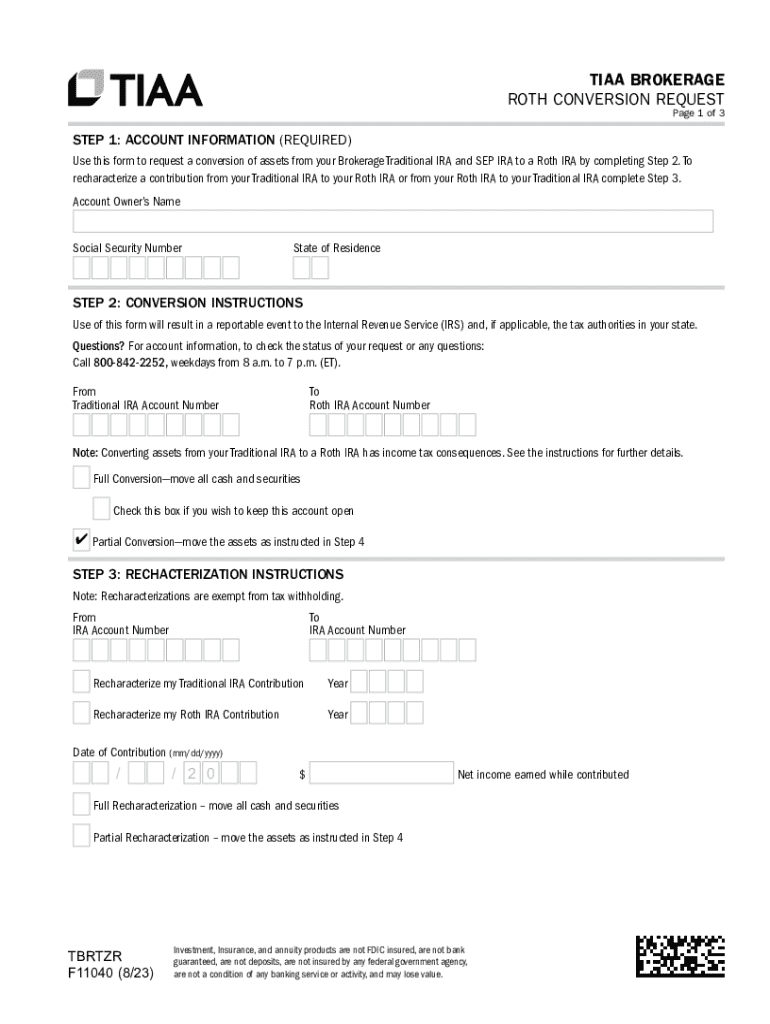

- Complete Required Forms: Fill out the necessary forms provided by TIAA CREF to initiate the conversion process.

- Submit the Forms: Send the completed forms to TIAA CREF via the appropriate submission method, either online or through the mail.

- Monitor the Conversion: After submission, track the conversion process to ensure it is completed correctly and on time.

Required Documents for the Roth Conversion

When initiating a Roth conversion with TIAA CREF, you will typically need to provide several documents:

- Identification: A government-issued ID to verify your identity.

- Account Information: Details of your existing traditional retirement account, including account numbers.

- Tax Documentation: Information regarding your current tax situation to assess potential tax liabilities from the conversion.

Legal Use of the TIAA CREF Brokerage Services Roth Conversion

The Roth conversion process is governed by IRS regulations, which outline the legal framework for converting retirement accounts. It is essential to comply with these regulations to avoid penalties. The conversion must be reported on your tax return for the year in which it occurs, and you must pay any applicable taxes on the converted amount. Understanding these legal requirements ensures that you make informed decisions regarding your retirement planning.

IRS Guidelines for Roth Conversions

The IRS provides specific guidelines on how to execute a Roth conversion. Key points include:

- The amount converted is subject to income tax in the year of conversion.

- There are no income limits for converting traditional IRAs to Roth IRAs.

- Converted amounts must be reported on your tax return, and failure to do so can result in penalties.

Eligibility Criteria for Roth Conversion

To qualify for a Roth conversion through TIAA CREF, you should consider the following criteria:

- You must have a traditional retirement account eligible for conversion.

- There are no age restrictions for conversions, but you must be aware of the tax implications.

- Income limits do not apply to conversions, allowing high-income earners to take advantage of this strategy.

Create this form in 5 minutes or less

Find and fill out the correct tiaa cref brokerage services roth conversionrecha

Create this form in 5 minutes!

How to create an eSignature for the tiaa cref brokerage services roth conversionrecha

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TIAA CREF Brokerage Services Roth ConversionRecha?

TIAA CREF Brokerage Services Roth ConversionRecha allows individuals to convert their traditional retirement accounts into Roth IRAs. This conversion can provide tax-free growth and withdrawals in retirement, making it a valuable option for long-term financial planning.

-

How does the TIAA CREF Brokerage Services Roth ConversionRecha work?

The TIAA CREF Brokerage Services Roth ConversionRecha involves transferring funds from a traditional IRA or 401(k) into a Roth IRA. This process requires paying taxes on the converted amount, but it can lead to signNow tax advantages in the future.

-

What are the benefits of using TIAA CREF Brokerage Services Roth ConversionRecha?

The primary benefits of TIAA CREF Brokerage Services Roth ConversionRecha include tax-free withdrawals in retirement and no required minimum distributions. This flexibility can enhance your retirement strategy and provide peace of mind.

-

Are there any fees associated with TIAA CREF Brokerage Services Roth ConversionRecha?

While TIAA CREF Brokerage Services may charge fees for account management, the Roth conversion itself typically does not incur additional fees. It's essential to review the fee structure to understand any potential costs involved.

-

Can I integrate TIAA CREF Brokerage Services Roth ConversionRecha with other financial tools?

Yes, TIAA CREF Brokerage Services Roth ConversionRecha can be integrated with various financial planning tools and software. This integration helps streamline your financial management and enhances your overall investment strategy.

-

Who is eligible for TIAA CREF Brokerage Services Roth ConversionRecha?

Eligibility for TIAA CREF Brokerage Services Roth ConversionRecha generally includes individuals with traditional IRAs or 401(k)s. However, income limits may apply, so it's advisable to consult with a financial advisor to determine your eligibility.

-

What documents do I need for TIAA CREF Brokerage Services Roth ConversionRecha?

To initiate TIAA CREF Brokerage Services Roth ConversionRecha, you will typically need your account statements, tax information, and identification documents. Having these ready can expedite the conversion process.

Get more for TIAA CREF BROKERAGE SERVICES ROTH CONVERSIONRECHA

- Troy birth certificate form

- Bus attendance sheet form

- New jersey designation of standby guardian statutory form

- Application for permit to import biological agents or cdc form

- Form dsp 5 dsp 5 application license for permanent export of unclassified

- Intentional interim pastor agreement form

- Patient information sheet drrandydurbincom

- Sisseton wahpeton oyate stimulus check form

Find out other TIAA CREF BROKERAGE SERVICES ROTH CONVERSIONRECHA

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors