Form 433F Rev 7

Understanding Form 433F Rev 7

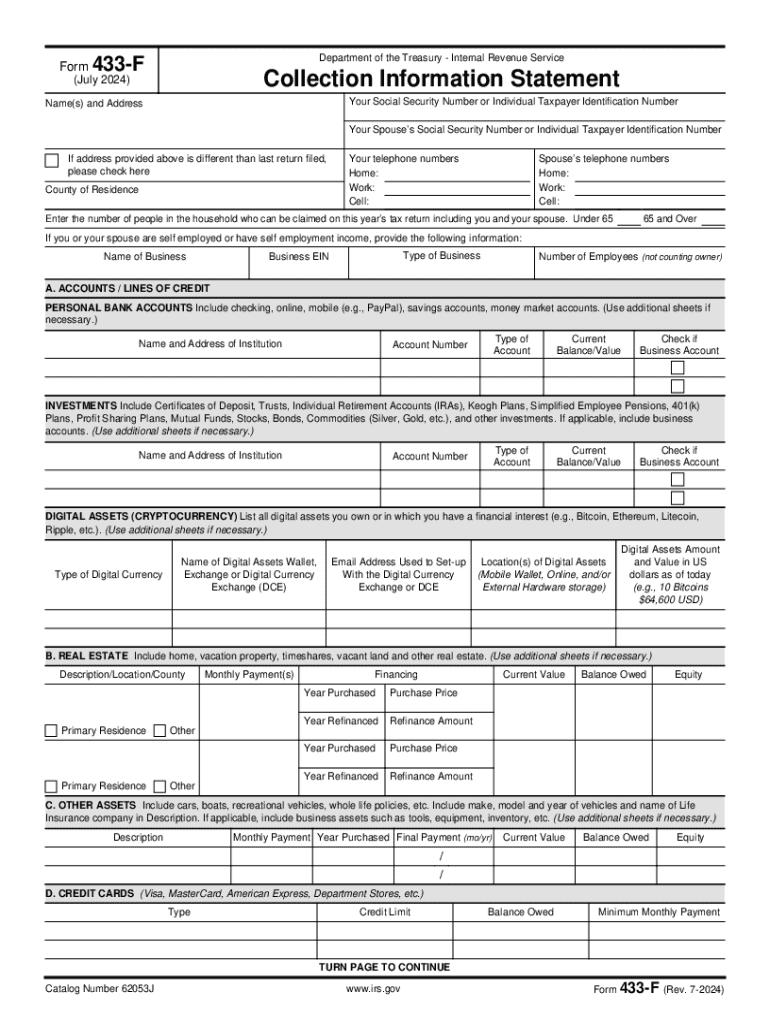

Form 433F Rev 7 is a financial statement used by the Internal Revenue Service (IRS) to assess a taxpayer's financial situation. This form is typically utilized during the process of determining eligibility for installment agreements or offers in compromise. It allows the IRS to gather essential information regarding an individual's income, expenses, assets, and liabilities. By providing a comprehensive overview of a taxpayer's financial condition, Form 433F Rev 7 helps the IRS make informed decisions regarding payment arrangements.

Steps to Complete Form 433F Rev 7

Completing Form 433F Rev 7 involves several key steps that ensure accurate and thorough reporting of financial information. First, gather all necessary financial documents, including pay stubs, bank statements, and records of monthly expenses. Next, fill out the personal information section, which includes your name, Social Security number, and contact details. Then, provide details about your income sources, such as wages, self-employment income, and any other earnings. After that, list your monthly expenses, including housing costs, utilities, and transportation. Finally, disclose your assets and liabilities, ensuring that all information is current and accurate.

Obtaining Form 433F Rev 7

Form 433F Rev 7 can be obtained directly from the IRS website or through various tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as older versions may not be accepted by the IRS. If you prefer a paper version, you can also request a copy by contacting the IRS directly. Ensure that you have the necessary resources to complete the form accurately once you have obtained it.

Legal Use of Form 433F Rev 7

Form 433F Rev 7 is legally binding once submitted to the IRS. It is crucial to provide truthful and accurate information, as any discrepancies or false statements can lead to penalties or legal repercussions. The IRS uses this form to evaluate your financial status, which can impact your ability to negotiate payment terms. Therefore, understanding the legal implications of the information provided is essential for compliance and to avoid any potential issues with the IRS.

Key Elements of Form 433F Rev 7

Several key elements are essential to effectively complete Form 433F Rev 7. These include personal identification information, a comprehensive breakdown of income sources, detailed monthly expenses, and a complete list of assets and liabilities. Each section is designed to provide the IRS with a clear picture of your financial health. Additionally, ensuring that all figures are accurate and up to date is vital for the form's acceptance and the subsequent evaluation process.

Form Submission Methods

Form 433F Rev 7 can be submitted to the IRS through various methods. Taxpayers may choose to file the form electronically using compatible tax software, which often simplifies the submission process. Alternatively, the form can be mailed directly to the appropriate IRS address specified in the form instructions. In some cases, in-person submission may be possible at designated IRS offices, although this is less common. It is important to follow the submission guidelines carefully to ensure timely processing.

Handy tips for filling out Form 433F Rev 7 online

Quick steps to complete and e-sign Form 433F Rev 7 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining filling in forms could be. Gain access to a HIPAA and GDPR compliant solution for maximum simplicity. Use signNow to e-sign and share Form 433F Rev 7 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 433f rev 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 433F Rev 7 and how is it used?

Form 433F Rev 7 is a financial statement used by the IRS to evaluate an individual's financial situation. It helps in determining the ability to pay taxes or settle tax debts. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining the submission process.

-

How can airSlate SignNow help with completing Form 433F Rev 7?

airSlate SignNow provides an intuitive platform for completing Form 433F Rev 7. With its user-friendly interface, you can quickly input your financial information and eSign the document, ensuring a smooth and efficient process. This eliminates the hassle of paper forms and manual signatures.

-

Is there a cost associated with using airSlate SignNow for Form 433F Rev 7?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides access to features that simplify the completion and signing of Form 433F Rev 7. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for Form 433F Rev 7?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning for Form 433F Rev 7. These tools enhance productivity and ensure that your documents are completed accurately and efficiently. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other applications for Form 433F Rev 7?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling Form 433F Rev 7. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for Form 433F Rev 7?

Using airSlate SignNow for Form 433F Rev 7 provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your sensitive information is protected while allowing for quick access and easy sharing of your completed forms. This efficiency can signNowly reduce the stress associated with tax documentation.

-

Is airSlate SignNow compliant with legal standards for Form 433F Rev 7?

Yes, airSlate SignNow is compliant with all legal standards for electronic signatures, making it a reliable choice for Form 433F Rev 7. Our platform adheres to regulations such as ESIGN and UETA, ensuring that your electronically signed documents are legally binding and secure.

Get more for Form 433F Rev 7

Find out other Form 433F Rev 7

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter