Fidelity Advisor 529 Plan Account Application 2024-2026

What is the Fidelity Advisor 529 Plan Account Application

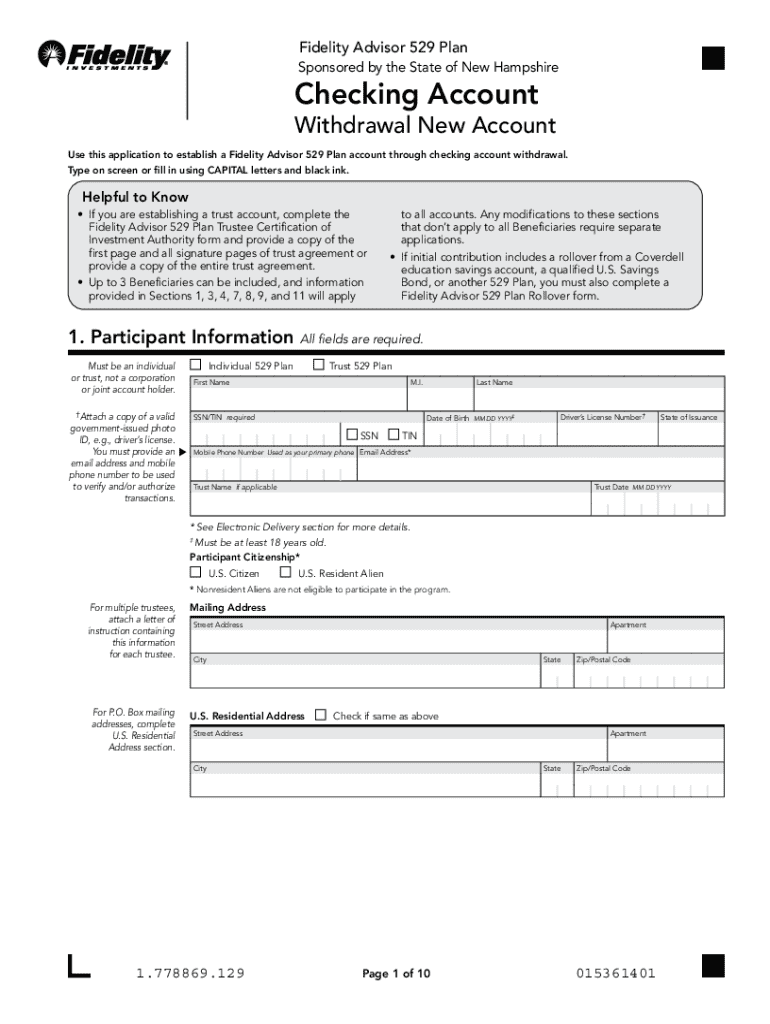

The Fidelity Advisor 529 Plan Account Application is a formal document used to establish a 529 college savings plan account. This application allows individuals to invest in a tax-advantaged savings plan designed to help families save for future education expenses. The Fidelity Advisor 529 Plan is managed by Fidelity Investments and offers various investment options, enabling account holders to choose a strategy that aligns with their financial goals and risk tolerance.

Steps to complete the Fidelity Advisor 529 Plan Account Application

Completing the Fidelity Advisor 529 Plan Account Application involves several key steps:

- Gather necessary information: Collect personal details, including Social Security numbers, addresses, and financial information for both the account owner and the beneficiary.

- Choose investment options: Review the available investment portfolios and select the options that best suit your savings objectives.

- Fill out the application: Accurately complete all required fields in the application form, ensuring that all information is current and correct.

- Review and sign: Carefully review the application for accuracy before signing and dating the document.

- Submit the application: Send the completed application to Fidelity via the preferred submission method, which can include online submission, mail, or in-person delivery.

Required Documents

When applying for the Fidelity Advisor 529 Plan, certain documents are typically required to ensure compliance and facilitate the application process. These may include:

- Proof of identity for the account owner and beneficiary, such as a driver's license or passport.

- Social Security numbers for both the account owner and the beneficiary.

- Financial information, including bank account details for funding the account.

Eligibility Criteria

To qualify for the Fidelity Advisor 529 Plan, applicants must meet specific eligibility criteria. Generally, the following conditions apply:

- The account owner must be a U.S. citizen or resident alien.

- The beneficiary must be a designated individual, typically a child or grandchild, who will use the funds for qualified educational expenses.

- There are no income restrictions for account owners, making the plan accessible to a wide range of families.

Form Submission Methods

The Fidelity Advisor 529 Plan Account Application can be submitted through various methods to accommodate different preferences:

- Online: Complete and submit the application directly through the Fidelity website.

- Mail: Print the completed application and send it to the designated Fidelity address.

- In-Person: Visit a Fidelity branch to submit the application and receive assistance from a representative.

Application Process & Approval Time

Once the Fidelity Advisor 529 Plan Account Application is submitted, the processing time may vary. Generally, the application process includes:

- Review of submitted documents for completeness and accuracy.

- Verification of identity and eligibility criteria.

- Approval notifications typically occur within a few business days, though it may take longer during peak application periods.

Create this form in 5 minutes or less

Find and fill out the correct fidelity advisor 529 plan account application

Create this form in 5 minutes!

How to create an eSignature for the fidelity advisor 529 plan account application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fidelity Advisor 529 Plan Account Application?

The Fidelity Advisor 529 Plan Account Application is a streamlined process that allows you to open a 529 college savings account. This application is designed to help families save for education expenses while benefiting from tax advantages. By using this application, you can easily manage your investments and contributions.

-

What are the benefits of using the Fidelity Advisor 529 Plan Account Application?

The Fidelity Advisor 529 Plan Account Application offers several benefits, including tax-free growth on your investments and tax-free withdrawals for qualified education expenses. Additionally, it provides flexibility in choosing investment options and allows you to change beneficiaries if needed. This application is a smart choice for families planning for future educational costs.

-

How much does it cost to open a Fidelity Advisor 529 Plan Account?

Opening a Fidelity Advisor 529 Plan Account typically requires a minimum initial investment, which can vary based on the investment options you choose. There are no annual maintenance fees, making it a cost-effective solution for saving for education. Always check the latest fee structure on the Fidelity website for the most accurate information.

-

Can I manage my Fidelity Advisor 529 Plan Account online?

Yes, the Fidelity Advisor 529 Plan Account Application allows you to manage your account online easily. You can track your investments, make contributions, and adjust your investment strategy through the user-friendly online portal. This convenience ensures you stay on top of your savings goals.

-

What investment options are available with the Fidelity Advisor 529 Plan?

The Fidelity Advisor 529 Plan Account Application provides a variety of investment options, including age-based portfolios and individual fund selections. These options allow you to tailor your investment strategy based on your risk tolerance and time horizon. This flexibility helps you optimize your savings for education.

-

Is there a limit to how much I can contribute to a Fidelity Advisor 529 Plan Account?

Yes, there are contribution limits for the Fidelity Advisor 529 Plan Account Application, which are set by the IRS. However, these limits are quite generous, allowing you to save a signNow amount for education expenses. It's important to stay informed about these limits to maximize your contributions.

-

How does the Fidelity Advisor 529 Plan Account Application integrate with other financial tools?

The Fidelity Advisor 529 Plan Account Application can integrate with various financial tools and platforms, making it easier to manage your overall financial strategy. This integration allows you to track your savings alongside other investments and accounts. Utilizing these tools can enhance your financial planning for education.

Get more for Fidelity Advisor 529 Plan Account Application

- Ibo agreement global revolution form

- Study abroad personal and emergency contact form bluefieldstate

- Visitor waiver form redlynch equestrian association

- Massachusetts form ct 3t

- Gulf place public beach improvements phase 2 city of gulf shores nj form

- Form w 8ben e form w 8ben e 2 ing emeklilik

- Al form individual revised mar2017

- Faqs 32bj funds form

Find out other Fidelity Advisor 529 Plan Account Application

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors