Application for Employee Refund of Occupational Taxes Withheld 2024-2026

What is the Application For Employee Refund Of Occupational Taxes Withheld

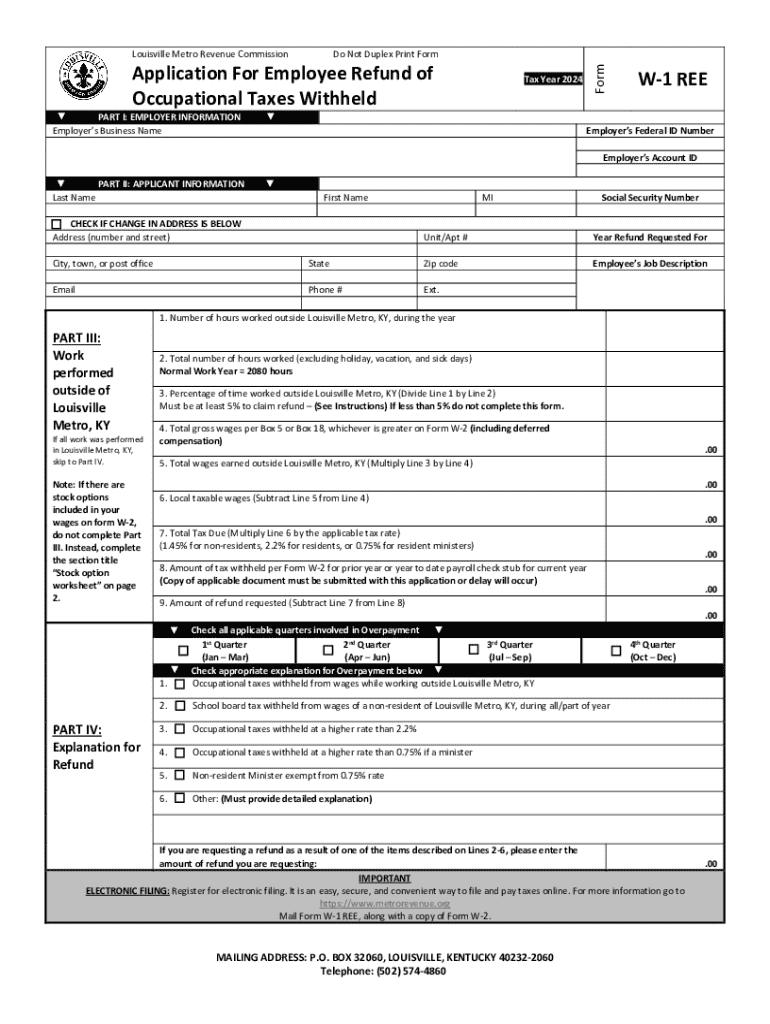

The Application For Employee Refund Of Occupational Taxes Withheld is a formal request submitted by employees to reclaim occupational taxes that have been deducted from their wages. These taxes are typically levied by local governments and can vary by jurisdiction. The application serves as a mechanism for employees to seek refunds for overpayments or for periods when they were not subject to these taxes, such as when they worked remotely or were employed in a different locality.

Steps to complete the Application For Employee Refund Of Occupational Taxes Withheld

Completing the Application For Employee Refund Of Occupational Taxes Withheld involves several key steps:

- Gather necessary information, including your personal details, employment history, and tax withholding records.

- Obtain the application form from your local tax authority or relevant government website.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation, such as pay stubs or tax statements that verify your claims.

- Review the application for accuracy before submission to avoid delays.

Required Documents

When submitting the Application For Employee Refund Of Occupational Taxes Withheld, certain documents are typically required to support your claim. These may include:

- Pay stubs or W-2 forms that show the taxes withheld.

- A copy of your employment contract or offer letter, if applicable.

- Proof of residency or work location during the tax period in question.

- Any correspondence from your employer regarding tax withholdings.

Eligibility Criteria

To qualify for a refund through the Application For Employee Refund Of Occupational Taxes Withheld, employees generally must meet specific eligibility criteria. This often includes:

- Being a resident or employee in a locality that imposes occupational taxes.

- Having evidence of over-withholding or incorrect tax deductions.

- Submitting the application within the designated timeframe set by local tax authorities.

Form Submission Methods

The Application For Employee Refund Of Occupational Taxes Withheld can typically be submitted through various methods, depending on local regulations. Common submission options include:

- Online submission via the local tax authority's website.

- Mailing the completed form and supporting documents to the appropriate office.

- In-person submission at designated tax offices or government buildings.

Application Process & Approval Time

The application process for the Employee Refund Of Occupational Taxes Withheld generally involves the following stages:

- Submission of the application and required documents.

- Review by tax authorities to verify the information provided.

- Approval or denial of the refund request, typically communicated within a specified timeframe.

Approval times can vary significantly based on the jurisdiction and the volume of applications being processed, but it is common for employees to wait several weeks to receive a decision.

Create this form in 5 minutes or less

Find and fill out the correct application for employee refund of occupational taxes withheld 784863736

Create this form in 5 minutes!

How to create an eSignature for the application for employee refund of occupational taxes withheld 784863736

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Employee Refund Of Occupational Taxes Withheld?

The Application For Employee Refund Of Occupational Taxes Withheld is a formal request that employees can submit to reclaim taxes that were withheld from their paychecks. This application is essential for ensuring that employees receive any overpaid taxes back from their employers or tax authorities.

-

How can airSlate SignNow assist with the Application For Employee Refund Of Occupational Taxes Withheld?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Application For Employee Refund Of Occupational Taxes Withheld. Our user-friendly interface simplifies the process, making it easy for employees to complete and submit their applications efficiently.

-

What are the pricing options for using airSlate SignNow for tax applications?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that facilitate the Application For Employee Refund Of Occupational Taxes Withheld, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax-related documents?

Yes, airSlate SignNow includes features tailored for tax-related documents, such as templates for the Application For Employee Refund Of Occupational Taxes Withheld, automated reminders, and secure storage. These features help ensure that your tax applications are processed smoothly and efficiently.

-

What benefits does airSlate SignNow offer for managing tax refund applications?

Using airSlate SignNow for the Application For Employee Refund Of Occupational Taxes Withheld offers numerous benefits, including reduced processing time, enhanced accuracy, and improved compliance. Our platform helps businesses manage their tax refund applications with ease, ensuring that employees receive their refunds promptly.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your workflow for the Application For Employee Refund Of Occupational Taxes Withheld. This integration allows for better data management and streamlined processes across your organization.

-

Is it secure to submit the Application For Employee Refund Of Occupational Taxes Withheld through airSlate SignNow?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Application For Employee Refund Of Occupational Taxes Withheld, are protected with advanced encryption and secure access controls. You can trust that your sensitive information is safe when using our platform.

Get more for Application For Employee Refund Of Occupational Taxes Withheld

- Form mv 21 a lien entry form 691935659

- Cpt20 fill 21e pdf clear data protected b when completed form

- Form dc 5 hawaii gov

- Form ow 8 es oklahoma individual estimated tax year worksheet for individuals

- Form 538 s claim for credit refund of sales tax

- Form 13 9 application for credit or refund of state and local sales or use tax 699489787

- Investmentnew jobs credit oklahoma digital prairie form

- Khsaa form ge04 high school parental permission and

Find out other Application For Employee Refund Of Occupational Taxes Withheld

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF