Louisville Occupational Tax 2010

What is the Louisville Occupational Tax

The Louisville Occupational Tax is a tax levied on individuals and businesses operating within the city of Louisville, Kentucky. This tax is calculated based on the income earned by employees and the profits generated by businesses. It is essential for funding local services and infrastructure, contributing to the overall economic health of the community. The tax rate may vary depending on the type of entity and the nature of the income. Understanding this tax is crucial for compliance and financial planning for both employees and employers.

How to complete the Louisville Occupational Tax

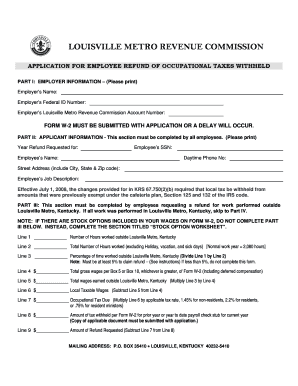

Completing the Louisville Occupational Tax involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and any relevant business records. Next, determine the correct tax rate applicable to your situation, as this may differ for individuals and various business entities. Fill out the required forms, such as the application for employee refund of occupational taxes withheld, ensuring all information is accurate and complete. Finally, review the completed forms for any errors before submission.

Required Documents for the Louisville Occupational Tax

When preparing to file the Louisville Occupational Tax, specific documents are necessary to support your submission. These typically include:

- W-2 forms for employees

- 1099 forms for independent contractors

- Income statements for business owners

- Previous tax returns, if applicable

- Any documentation related to tax credits or deductions

Having these documents ready will facilitate a smoother filing process and help ensure compliance with local tax regulations.

Form Submission Methods for the Louisville Occupational Tax

The Louisville Occupational Tax forms can be submitted through various methods to accommodate different preferences. These methods include:

- Online submission via the Louisville Metro Revenue Commission's website

- Mailing the completed forms to the designated tax office

- In-person submission at local tax offices

Each method has its own set of guidelines and deadlines, so it is important to choose the most convenient option while adhering to the necessary timelines.

Legal use of the Louisville Occupational Tax

The legal framework governing the Louisville Occupational Tax ensures that it is applied fairly and consistently. Compliance with local laws is essential for both individuals and businesses. This includes understanding the tax obligations, filing deadlines, and any applicable penalties for non-compliance. Utilizing a reliable eSignature solution, such as airSlate SignNow, can streamline the process of completing and submitting tax forms, ensuring that they are legally binding and secure.

Eligibility Criteria for the Louisville Occupational Tax

Eligibility for the Louisville Occupational Tax typically depends on various factors, including:

- Residency status: Individuals living in Louisville are subject to the tax

- Employment status: Employees working within the city limits are liable for the tax

- Business operations: Companies conducting business in Louisville must comply with the tax requirements

Understanding these criteria helps ensure that all parties meet their tax obligations and avoid potential penalties.

Quick guide on how to complete louisville occupational tax

Effortlessly prepare Louisville Occupational Tax on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a great eco-friendly alternative to traditional printed and signed forms, enabling you to access the correct template and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Louisville Occupational Tax on any device using the airSlate SignNow Android or iOS applications, and simplify any document-related process today.

Steps to modify and electronically sign Louisville Occupational Tax effortlessly

- Locate Louisville Occupational Tax and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Louisville Occupational Tax and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisville occupational tax

Create this form in 5 minutes!

How to create an eSignature for the louisville occupational tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the application for employee refund of occupational taxes withheld?

The application for employee refund of occupational taxes withheld is a formal request submitted by employees to reclaim taxes that were incorrectly deducted from their pay. This application allows employees to specify the amount they are claiming back and provide necessary documentation to support their request. Using airSlate SignNow simplifies this process, making it quick and efficient.

-

How does airSlate SignNow help with the application for employee refund of occupational taxes withheld?

airSlate SignNow provides a streamlined platform for creating and sending the application for employee refund of occupational taxes withheld. Our easy-to-use system allows employees to fill out the application digitally, eSign it, and send it directly to their tax office, signNowly reducing paperwork and processing times.

-

What are the costs associated with using airSlate SignNow for tax applications?

The pricing for airSlate SignNow is flexible and designed to meet various business needs. You can choose from different subscription plans that offer features including unlimited document signing, templates for the application for employee refund of occupational taxes withheld, and more. Our cost-effective solution ensures you get the best value while streamlining your tax-related processes.

-

Can I integrate airSlate SignNow with other software for tax processing?

Yes, airSlate SignNow allows seamless integration with multiple software platforms that businesses typically use for HR and tax processing. This means you can connect your existing systems to automate and enhance the workflow for the application for employee refund of occupational taxes withheld. This integration capability ensures a smoother, interconnected experience across your tools.

-

What features does airSlate SignNow offer for managing tax refund applications?

With airSlate SignNow, you have access to features such as customizable templates, automated reminders, and secure cloud storage for all your documents. These features make the process of submitting the application for employee refund of occupational taxes withheld more efficient and organized. Additionally, users can track the status of their applications in real-time.

-

Is airSlate SignNow a secure platform for submitting tax documents?

Absolutely! airSlate SignNow prioritizes data security and employs industry-standard encryption to protect sensitive information. When you submit the application for employee refund of occupational taxes withheld through our platform, you can be confident that your documents are safe and secure against unauthorized access.

-

How long does it take to process the application for employee refund of occupational taxes withheld?

The processing time for your application for employee refund of occupational taxes withheld can vary based on your local tax authority's procedures. However, by utilizing airSlate SignNow, you eliminate delay caused by manual paperwork and ensure a quicker submission process. This can ultimately lead to faster refunds, depending on the efficiency of the tax office.

Get more for Louisville Occupational Tax

- Assupol fsp number form

- Volunteer questionnaire form

- M your implant passport straumann straumann form

- Loan application acknowledgment form

- Horse riding risk assessment example form

- Divemaster candidate information and evaluation form a1 scuba

- Slp supervisor evaluation form red jacket redjacket

- Software as a service license agreement template form

Find out other Louisville Occupational Tax

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage