Substitute W9DO NOT SEND to IRSAction Requested P 2022-2026

What is the Substitute W-9 DO NOT SEND TO IRS Action Requested P

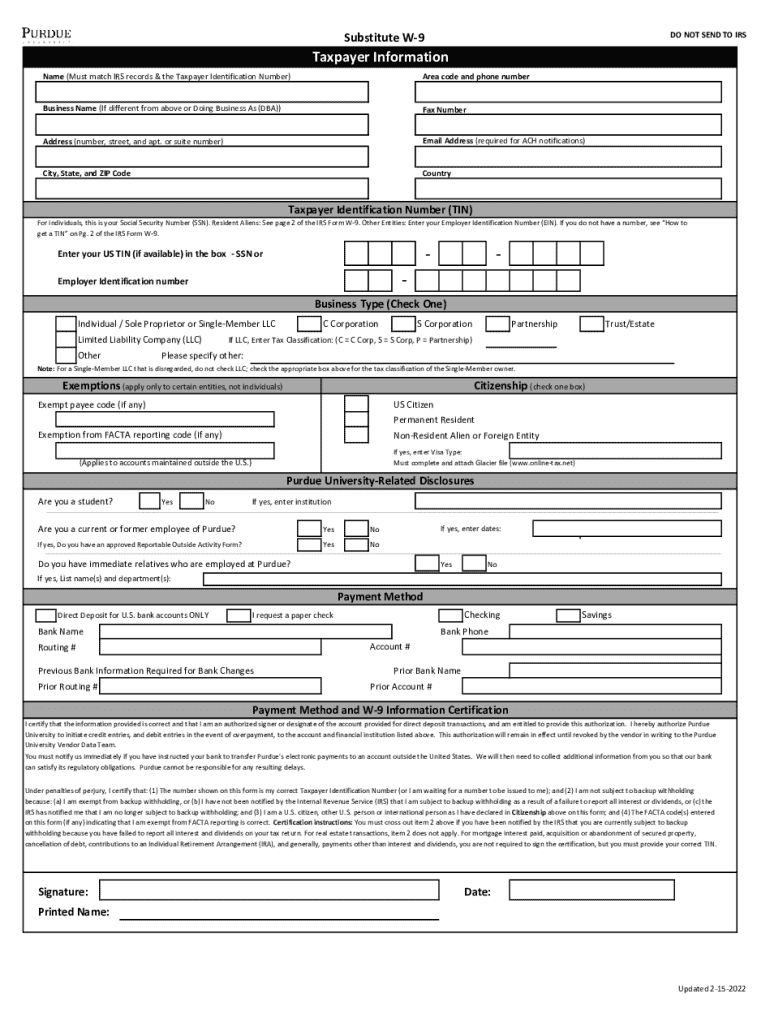

The Substitute W-9 DO NOT SEND TO IRS Action Requested P is a specific form used in the United States for tax purposes. This form serves as a substitute for the standard W-9 form, which is typically used by businesses to request the taxpayer identification number (TIN) of individuals or entities. The "DO NOT SEND TO IRS" notation indicates that this form is intended for internal use only, often for record-keeping or verification purposes within a company. It is important for businesses to understand that this form should not be submitted to the IRS, as it is not an official document for tax filing.

How to use the Substitute W-9 DO NOT SEND TO IRS Action Requested P

To effectively use the Substitute W-9 DO NOT SEND TO IRS Action Requested P, individuals or businesses should follow a few straightforward steps. First, ensure that the form is filled out completely and accurately, providing all necessary information, including the name, address, and TIN of the individual or entity. Next, retain the completed form for your records, as it may be required for future reference or audits. It is also advisable to securely store this document to protect sensitive information. Lastly, communicate with the relevant parties to confirm that they understand the form's purpose and that it is not to be sent to the IRS.

Steps to complete the Substitute W-9 DO NOT SEND TO IRS Action Requested P

Completing the Substitute W-9 DO NOT SEND TO IRS Action Requested P involves several key steps:

- Begin by downloading the form from a reliable source or creating it based on the required format.

- Fill in the name of the individual or business entity accurately, ensuring it matches official records.

- Provide the complete address where the individual or entity can be reached.

- Enter the taxpayer identification number (TIN), which may be a Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to validate the information provided.

- Keep a copy of the completed form for your records and distribute it as needed within your organization.

Key elements of the Substitute W-9 DO NOT SEND TO IRS Action Requested P

The Substitute W-9 DO NOT SEND TO IRS Action Requested P contains several key elements that are crucial for its proper use:

- Name: The full legal name of the individual or business entity.

- Address: The complete mailing address where the individual or entity can be contacted.

- Taxpayer Identification Number (TIN): This includes either the SSN or EIN, which is essential for tax identification purposes.

- Certification: A declaration that the information provided is accurate and complete, usually requiring a signature and date.

IRS Guidelines

While the Substitute W-9 DO NOT SEND TO IRS Action Requested P is not submitted to the IRS, it is essential to adhere to IRS guidelines when completing any tax-related forms. The IRS requires accurate reporting of taxpayer identification information to ensure compliance with tax laws. Businesses should ensure that they are using the correct version of the W-9 form and understand the implications of using a substitute form. It is advisable to consult IRS publications or a tax professional for guidance on proper form usage and compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Substitute W-9 DO NOT SEND TO IRS Action Requested P can lead to several penalties. If a business does not obtain a valid TIN from a payee, it may be subject to backup withholding, where a percentage of payments is withheld for tax purposes. Additionally, inaccuracies or omissions on the form can result in fines or penalties from the IRS. To avoid these issues, it is important to ensure that all information is correct and that the form is used appropriately within the organization.

Create this form in 5 minutes or less

Find and fill out the correct substitute w9do not send to irsaction requested p

Create this form in 5 minutes!

How to create an eSignature for the substitute w9do not send to irsaction requested p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Substitute W9DO NOT SEND TO IRSAction Requested P?

A Substitute W9DO NOT SEND TO IRSAction Requested P is a form used by businesses to collect taxpayer information from contractors and vendors. This form is essential for ensuring accurate tax reporting and compliance. By using airSlate SignNow, you can easily create and manage this document without the hassle of physical paperwork.

-

How does airSlate SignNow simplify the process of handling Substitute W9DO NOT SEND TO IRSAction Requested P?

airSlate SignNow streamlines the process of sending and eSigning Substitute W9DO NOT SEND TO IRSAction Requested P forms. Our platform allows you to quickly prepare, send, and track documents, ensuring that you receive completed forms promptly. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Substitute W9DO NOT SEND TO IRSAction Requested P?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing documents like the Substitute W9DO NOT SEND TO IRSAction Requested P. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software for managing Substitute W9DO NOT SEND TO IRSAction Requested P?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing Substitute W9DO NOT SEND TO IRSAction Requested P forms. Whether you use CRM systems, accounting software, or other tools, our integrations help you maintain a smooth process and keep all your documents organized.

-

What are the benefits of using airSlate SignNow for Substitute W9DO NOT SEND TO IRSAction Requested P?

Using airSlate SignNow for your Substitute W9DO NOT SEND TO IRSAction Requested P offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere, making it easier to manage your business needs.

-

Is it easy to eSign a Substitute W9DO NOT SEND TO IRSAction Requested P with airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning a Substitute W9DO NOT SEND TO IRSAction Requested P quick and straightforward. Users can sign documents electronically from any device, ensuring a hassle-free experience for both senders and recipients.

-

How does airSlate SignNow ensure the security of my Substitute W9DO NOT SEND TO IRSAction Requested P documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your Substitute W9DO NOT SEND TO IRSAction Requested P documents. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

Get more for Substitute W9DO NOT SEND TO IRSAction Requested P

- Owner form

- Warranty deed from michigan form

- Last will and testament form idaho

- Purchase and sale agreement tn contract for deed form

- Intent to lien form florida

- Arizona agreement or contract for deed for sale and purchase of real estate aka land or executory contract form

- Standard contract sale house nj form

- Lien release form oklahoma

Find out other Substitute W9DO NOT SEND TO IRSAction Requested P

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract