Credit Application 2022-2026

What is the Credit Application

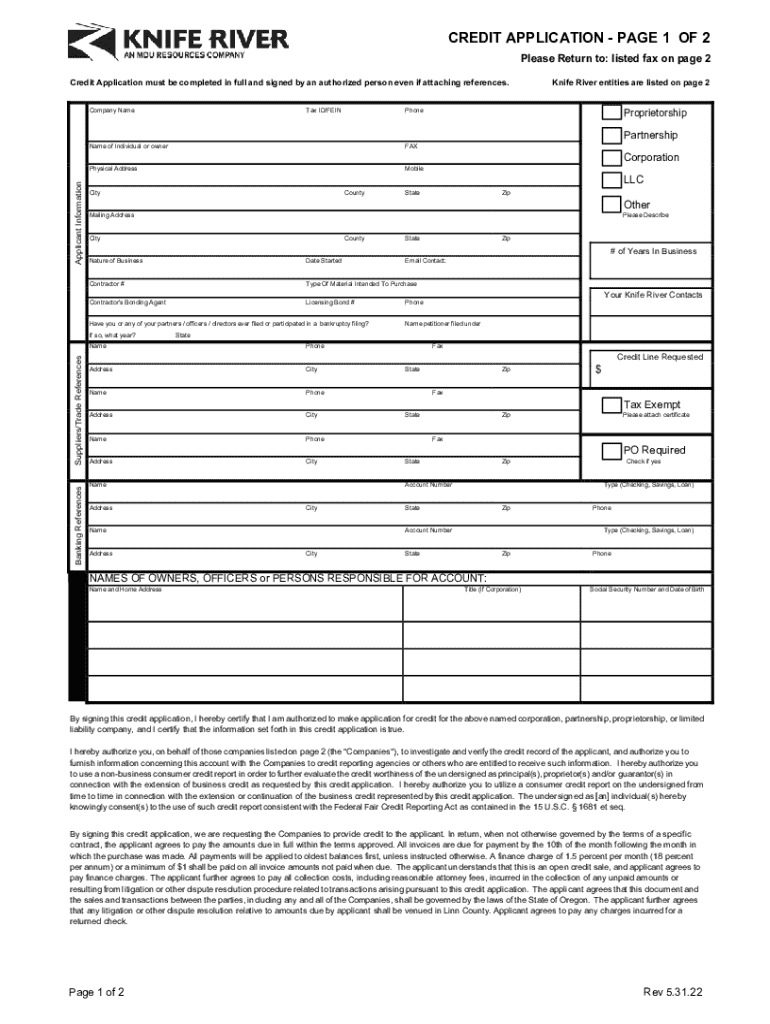

A credit application is a formal request submitted by an individual or business to a lender or financial institution to obtain credit. This document typically collects essential information about the applicant's financial history, including income, debts, and credit score. The primary purpose of the credit application is to help lenders assess the risk associated with granting credit and to determine the applicant's eligibility for loans, credit cards, or other financial products.

Key elements of the Credit Application

Understanding the key elements of a credit application can enhance the chances of approval. Common components include:

- Personal Information: Name, address, Social Security number, and contact details.

- Employment Details: Current employer, job title, and income information.

- Financial Information: Existing debts, monthly expenses, and assets.

- Credit History: Past borrowing behavior and credit score.

Each of these sections plays a crucial role in helping lenders evaluate the applicant's financial stability and creditworthiness.

Steps to complete the Credit Application

Completing a credit application involves several straightforward steps. Here’s a guide to help navigate the process:

- Gather Required Information: Collect all necessary personal and financial documents.

- Fill Out the Application: Provide accurate information in each section of the form.

- Review Your Application: Double-check for errors or missing information.

- Submit the Application: Send the completed form to the lender via the preferred submission method.

Following these steps can help streamline the application process and improve the likelihood of a favorable outcome.

Legal use of the Credit Application

The legal use of a credit application is governed by federal and state regulations. Lenders must adhere to the Fair Credit Reporting Act (FCRA), which ensures that applicants are treated fairly and that their credit information is handled responsibly. Additionally, lenders are required to provide applicants with a notice if their application is denied based on information from a credit report, allowing individuals to understand the reasons behind the decision.

Eligibility Criteria

Eligibility for a credit application typically depends on several factors, including:

- Age: Applicants must be at least eighteen years old.

- Income: A stable source of income is often required to ensure the ability to repay borrowed funds.

- Credit History: A favorable credit history can enhance eligibility, while poor credit may hinder approval.

Understanding these criteria can help applicants better prepare their applications and improve their chances of approval.

Form Submission Methods

Credit applications can be submitted through various methods, each offering different levels of convenience:

- Online Submission: Many lenders provide digital platforms for quick and easy application submissions.

- Mail Submission: Applicants can print and send their completed applications through postal services.

- In-Person Submission: Some individuals may prefer to submit applications directly at a lender's branch office.

Choosing the right submission method can depend on personal preferences and the lender's specific requirements.

Create this form in 5 minutes or less

Find and fill out the correct credit application 778786781

Create this form in 5 minutes!

How to create an eSignature for the credit application 778786781

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Credit Application and how does it work with airSlate SignNow?

A Credit Application is a document that businesses use to assess the creditworthiness of potential clients. With airSlate SignNow, you can easily create, send, and eSign Credit Applications, streamlining the process and ensuring that all necessary information is collected efficiently.

-

How much does it cost to use airSlate SignNow for Credit Applications?

airSlate SignNow offers various pricing plans to accommodate different business needs. The cost for using airSlate SignNow for Credit Applications is competitive and provides excellent value, especially considering the time and resources saved through its efficient eSigning capabilities.

-

What features does airSlate SignNow offer for managing Credit Applications?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for Credit Applications. These features help businesses manage their applications more effectively, ensuring a smooth and organized process from start to finish.

-

Can I integrate airSlate SignNow with other software for Credit Applications?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM systems and accounting tools. This allows you to manage your Credit Applications alongside other business processes, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Credit Applications?

Using airSlate SignNow for Credit Applications provides numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. The platform's user-friendly interface ensures that both businesses and clients can navigate the application process with ease.

-

Is airSlate SignNow secure for handling Credit Applications?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all Credit Applications are protected with advanced encryption and secure storage. This gives businesses peace of mind when handling sensitive financial information.

-

How can I track the status of my Credit Applications in airSlate SignNow?

airSlate SignNow provides real-time tracking for all Credit Applications, allowing you to monitor their status at any time. You will receive notifications when applications are viewed, signed, or completed, keeping you informed throughout the process.

Get more for Credit Application

- Volleyball waiver form 5595312

- Monalisa touch external treatment informed consent to treat

- Belize digital border crossing card application form

- Wsda pesticide application record form

- Nc topps mental health and substance abuse child ages 6 11 episode completion interview ncdhhs form

- Spb appeals form state personnel board spb ca

- Pt 701pu annual return for taxation railroad equipment car form

- Form st 12b sales tax exempt certificate for

Find out other Credit Application

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP