the CREDIT APPLICATION HANDBOOK the Kaplan GroupCredit Application Form Templates Office ComTHE CREDIT APPLICATION HANDBOOK the 2022

Understanding the Credit Application Handbook

The Credit Application Handbook from The Kaplan Group serves as a comprehensive guide for businesses navigating the credit application process. This handbook outlines essential information regarding credit assessments, helping users to understand the requirements and implications of applying for credit. It is designed to assist both lenders and borrowers in ensuring a smooth application experience.

How to Use the Credit Application Handbook

Utilizing The Credit Application Handbook effectively involves familiarizing yourself with its structure and guidelines. Users should review the sections that pertain to their specific needs, whether they are applying for credit or evaluating applications. The handbook provides templates and examples that can be adapted for various business contexts, making it a valuable resource for both new and experienced users.

Steps to Complete the Credit Application Form

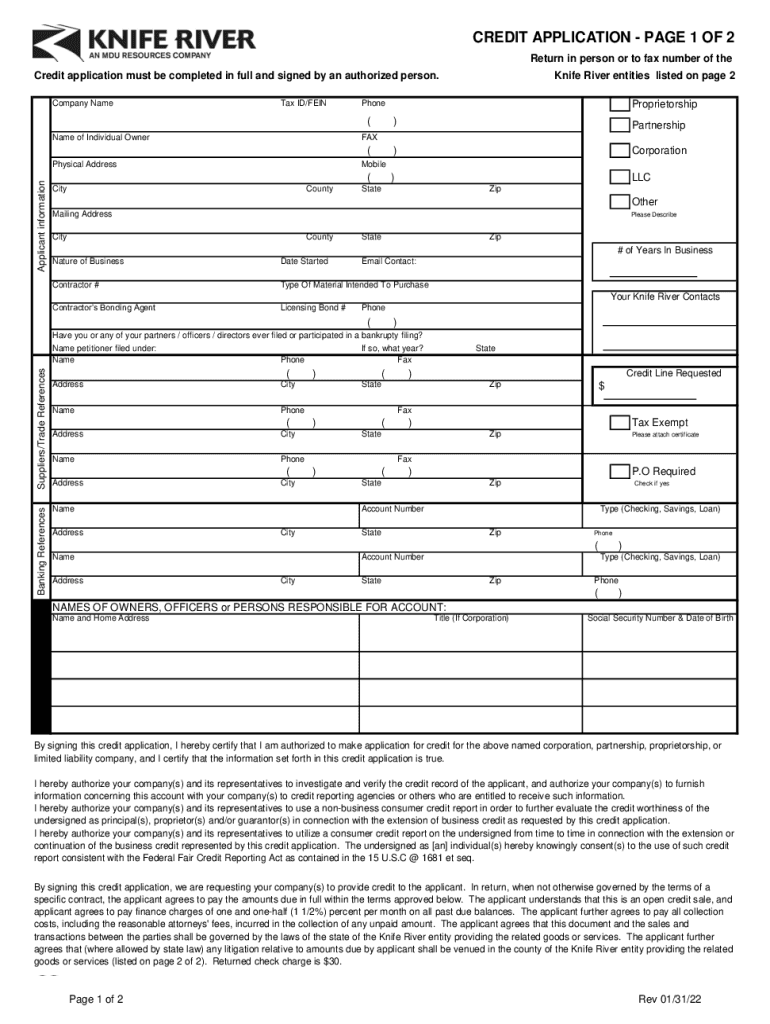

Completing the credit application form requires careful attention to detail. Begin by gathering necessary documentation, such as financial statements and identification. Next, fill out the form accurately, ensuring that all sections are completed. Double-check for any errors or omissions before submitting the application. Following these steps can enhance the likelihood of approval and streamline the review process.

Key Elements of the Credit Application Form

The credit application form includes several key elements that are crucial for assessment. These typically consist of personal identification information, financial history, credit references, and the purpose of the credit request. Each section is designed to provide lenders with a comprehensive view of the applicant’s financial situation, enabling informed decision-making.

Legal Use of the Credit Application Handbook

The Credit Application Handbook is intended for legal use in the United States, adhering to relevant regulations governing credit applications. Users must ensure that they comply with federal and state laws when utilizing the handbook and its templates. This compliance helps protect both the lender and the borrower, mitigating potential legal issues that may arise during the credit application process.

Examples of Using the Credit Application Handbook

Practical examples within The Credit Application Handbook illustrate how to apply its guidelines in real-world scenarios. These examples can include case studies of successful credit applications, common pitfalls to avoid, and strategies for presenting financial information effectively. By reviewing these examples, users can gain insights into best practices and enhance their application skills.

Eligibility Criteria for Credit Applications

Eligibility criteria for credit applications vary based on the lender and the type of credit being requested. Common factors include credit history, income level, and existing debt obligations. The Credit Application Handbook outlines these criteria, helping applicants assess their qualifications before submitting a credit application. Understanding these requirements can significantly improve the chances of approval.

Create this form in 5 minutes or less

Find and fill out the correct the credit application handbook the kaplan groupcredit application form templates office comthe credit application handbook the

Create this form in 5 minutes!

How to create an eSignature for the the credit application handbook the kaplan groupcredit application form templates office comthe credit application handbook the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

THE CREDIT APPLICATION HANDBOOK The Kaplan Group is a comprehensive resource designed to help businesses streamline their credit application processes. It includes essential templates and guidelines to ensure that your credit applications are thorough and compliant. By utilizing this handbook, businesses can enhance their credit management strategies effectively.

-

How can I access THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

You can access THE CREDIT APPLICATION HANDBOOK The Kaplan Group through our website, where it is available for download. Simply visit the product page, and you will find options to purchase and download the handbook along with the Credit Application Form Templates. This makes it easy to get started with your credit application process.

-

What are the benefits of using THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

Using THE CREDIT APPLICATION HANDBOOK The Kaplan Group provides numerous benefits, including improved efficiency in processing credit applications and reduced errors. The templates included are designed to be user-friendly and customizable, allowing businesses to tailor them to their specific needs. This ultimately leads to better customer relationships and faster decision-making.

-

Are there any pricing options for THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

Yes, THE CREDIT APPLICATION HANDBOOK The Kaplan Group is offered at competitive pricing to ensure accessibility for businesses of all sizes. We provide various purchasing options, including single downloads and bulk licenses for larger organizations. Check our pricing page for detailed information on the available packages.

-

Can I integrate THE CREDIT APPLICATION HANDBOOK The Kaplan Group with other tools?

Absolutely! THE CREDIT APPLICATION HANDBOOK The Kaplan Group is designed to integrate seamlessly with various business tools and software. This allows you to streamline your workflow and enhance productivity by connecting it with your existing systems, such as CRM and accounting software.

-

What features are included in THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

THE CREDIT APPLICATION HANDBOOK The Kaplan Group includes a variety of features such as customizable credit application templates, step-by-step guidelines, and best practices for credit management. These features are designed to help businesses create effective credit applications that meet industry standards and improve approval rates.

-

Is customer support available for users of THE CREDIT APPLICATION HANDBOOK The Kaplan Group?

Yes, we offer dedicated customer support for users of THE CREDIT APPLICATION HANDBOOK The Kaplan Group. Our support team is available to assist with any questions or issues you may encounter while using the handbook or templates. We are committed to ensuring that you have a smooth experience and can maximize the benefits of our product.

Get more for THE CREDIT APPLICATION HANDBOOK The Kaplan GroupCredit Application Form Templates office comTHE CREDIT APPLICATION HANDBOOK The

- Snowbird employee services form

- Wedding day packing list form

- F700 065 fillable form

- State of illinois trademark or servicemark application cyberdrive form

- Scsk12 46088051 form

- Dwc form 045 request to schedule reschedule or cancel a benefit review conference brc or to proceed directly to contested case

- Substitute application form

- Strike zone baseball form

Find out other THE CREDIT APPLICATION HANDBOOK The Kaplan GroupCredit Application Form Templates office comTHE CREDIT APPLICATION HANDBOOK The

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template