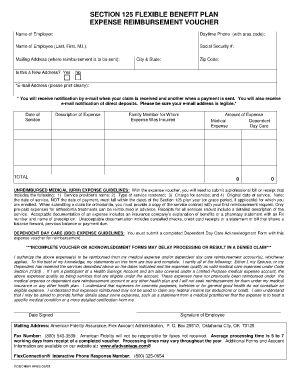

Section 125 Flexible Benefit Plan Expense Reimbursement Voucher 2008

What is the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher

The Section 125 Flexible Benefit Plan Expense Reimbursement Voucher is a document used by employees to request reimbursement for eligible expenses under a Section 125 cafeteria plan. This plan allows employees to use pre-tax dollars for certain qualified expenses, such as medical, dental, or dependent care costs. By utilizing this voucher, employees can effectively manage their healthcare and dependent care expenses while maximizing tax savings.

How to use the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher

To use the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher, employees should first gather all relevant receipts and documentation for the expenses they wish to claim. Next, fill out the voucher by providing necessary details such as your name, employee ID, and the specific expenses being claimed. Attach the receipts to the voucher and submit it according to your employer's guidelines, which may include online submission or mailing the documents to the HR department.

Steps to complete the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher

Completing the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher involves several straightforward steps:

- Gather all receipts and documentation for eligible expenses.

- Fill out the voucher with your personal information, including your name and employee ID.

- List the expenses being claimed, ensuring they meet the criteria for reimbursement.

- Attach all relevant receipts to the voucher.

- Submit the completed voucher according to your employer's submission process.

Required Documents

When submitting the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher, employees must include specific documents to ensure their claims are processed efficiently. Required documents typically include:

- Receipts for all claimed expenses, clearly showing the date and amount.

- A completed voucher form with accurate personal and expense details.

- Any additional documentation as specified by your employer's reimbursement policy.

Eligibility Criteria

Eligibility to use the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher generally depends on the employee's participation in a Section 125 cafeteria plan. Key eligibility criteria include:

- Being an active employee of the organization offering the plan.

- Enrollment in the Section 125 plan during the designated enrollment period.

- Submitting claims for qualified expenses that align with IRS guidelines.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Section 125 Flexible Benefit Plan Expense Reimbursement Voucher. These guidelines outline what constitutes eligible expenses, the tax implications of using pre-tax dollars, and the necessary documentation to support reimbursement claims. Employees should familiarize themselves with these guidelines to ensure compliance and maximize their benefits under the plan.

Create this form in 5 minutes or less

Find and fill out the correct section 125 flexible benefit plan expense reimbursement voucher

Create this form in 5 minutes!

How to create an eSignature for the section 125 flexible benefit plan expense reimbursement voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Section 125 Flexible Benefit Plan Expense Reimbursement Voucher?

A Section 125 Flexible Benefit Plan Expense Reimbursement Voucher is a document that allows employees to request reimbursement for eligible expenses under a Section 125 plan. This voucher simplifies the reimbursement process, ensuring that employees can easily submit their claims and receive their funds in a timely manner.

-

How does airSlate SignNow facilitate the use of Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers?

airSlate SignNow streamlines the process of managing Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers by providing an easy-to-use platform for document creation, signing, and storage. With our solution, businesses can efficiently handle voucher submissions and approvals, reducing administrative burdens.

-

What are the benefits of using airSlate SignNow for Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers?

Using airSlate SignNow for Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform ensures that all documents are securely stored and easily accessible, making the reimbursement process smoother for both employees and employers.

-

Is there a cost associated with using airSlate SignNow for Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans are flexible and cater to various business sizes, ensuring that you can find an option that fits your budget while effectively managing Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers.

-

Can airSlate SignNow integrate with other HR systems for managing Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers?

Absolutely! airSlate SignNow offers seamless integrations with various HR systems, allowing for efficient management of Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers. This integration helps streamline workflows and ensures that all employee data is synchronized across platforms.

-

What features does airSlate SignNow offer for Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers?

airSlate SignNow provides a range of features for managing Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers, including customizable templates, electronic signatures, and automated workflows. These features enhance the user experience and simplify the reimbursement process for both employees and administrators.

-

How secure is the information submitted through Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers on airSlate SignNow?

Security is a top priority at airSlate SignNow. All information submitted through Section 125 Flexible Benefit Plan Expense Reimbursement Vouchers is protected with advanced encryption and secure storage protocols, ensuring that sensitive employee data remains confidential and secure.

Get more for Section 125 Flexible Benefit Plan Expense Reimbursement Voucher

- Christening form

- Active reading section 1 renewable energy today form

- Precertification request form healthcomp

- Unionbank ada enrollment form dragonpay dragonpay

- Commonwealth of massachusetts ucsf library form

- Descending volley after electrical and magnetic transcranial form

- Playbill ad contract form cherry hill east theatre boosters

- Private vehicle payment agreement template form

Find out other Section 125 Flexible Benefit Plan Expense Reimbursement Voucher

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free