AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE 2011-2026

What is the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

The AFES Section 125 Flexible Benefit Plan Expense is a component of a benefits program that allows employees to utilize pre-tax dollars for certain eligible expenses. This plan is designed to provide tax savings for both employers and employees by allowing contributions to be deducted from gross income before taxes are applied. Common eligible expenses include health insurance premiums, dependent care costs, and other qualified medical expenses. The flexibility of this plan enables employees to tailor their benefits to fit their individual needs, enhancing overall satisfaction and financial well-being.

How to use the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

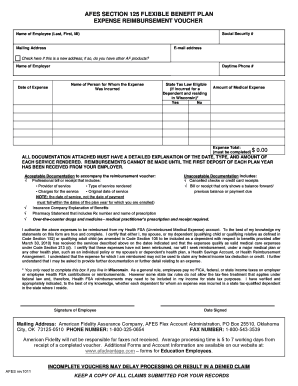

Using the AFES Section 125 Flexible Benefit Plan Expense involves several straightforward steps. First, employees must review the eligible expenses outlined by their employer. Next, they will need to submit claims for reimbursement, typically through a designated form or online portal. It is important to keep all receipts and documentation related to expenses for record-keeping and potential audits. Employees should also be aware of any deadlines for submitting claims to ensure they receive their reimbursements in a timely manner.

Key elements of the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

Several key elements define the AFES Section 125 Flexible Benefit Plan Expense. These include:

- Pre-tax contributions: Employees contribute to the plan using pre-tax dollars, reducing their taxable income.

- Eligible expenses: A defined list of expenses that qualify for reimbursement, such as medical and dependent care costs.

- Claim submission process: A structured method for employees to submit claims for reimbursement, ensuring proper documentation is provided.

- Annual limits: There may be limits on the amount employees can contribute to the plan each year, which can vary based on employer policies.

Steps to complete the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

Completing the AFES Section 125 Flexible Benefit Plan Expense involves a series of steps to ensure proper processing. Follow these steps:

- Review the list of eligible expenses provided by your employer.

- Gather all necessary documentation, including receipts and invoices for the expenses incurred.

- Fill out the required claim form, ensuring all information is accurate and complete.

- Submit the claim form along with supporting documents by the specified deadline.

- Keep copies of all submitted documents for your records.

Legal use of the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

The legal use of the AFES Section 125 Flexible Benefit Plan Expense is governed by the Internal Revenue Code. Employers must comply with specific regulations regarding the establishment and administration of the plan. This includes providing clear communication to employees about eligible expenses, contribution limits, and the claims process. Additionally, employers should maintain accurate records to demonstrate compliance with IRS requirements, which can help avoid potential penalties or audits.

Eligibility Criteria

Eligibility for the AFES Section 125 Flexible Benefit Plan Expense typically depends on the employer's specific plan design. Generally, employees must be full-time and actively employed to participate. Some plans may have waiting periods or may require employees to enroll during designated enrollment periods. Employers may also set specific criteria regarding the types of expenses that can be reimbursed, so it is essential for employees to understand their employer's policies.

Create this form in 5 minutes or less

Find and fill out the correct afes section 125 flexible benefit plan expense

Create this form in 5 minutes!

How to create an eSignature for the afes section 125 flexible benefit plan expense

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE?

The AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE is a tax-advantaged program that allows employees to pay for certain expenses with pre-tax dollars. This plan helps reduce taxable income, ultimately saving employees money on their taxes. It is designed to provide flexibility in managing healthcare and other qualified expenses.

-

How does the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE work?

Employees can choose to allocate a portion of their salary to the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE, which can then be used for eligible expenses such as medical, dental, and vision costs. This pre-tax contribution reduces their overall taxable income. The funds can be accessed through a reimbursement process or a debit card for convenience.

-

What are the benefits of using the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE?

The primary benefits of the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE include tax savings for both employees and employers. Employees enjoy reduced taxable income, while employers can lower payroll taxes. Additionally, this plan enhances employee satisfaction by providing more options for managing healthcare costs.

-

Are there any costs associated with the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE?

While the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE itself does not have direct costs for employees, there may be administrative fees charged by the plan provider. Employers should consider these costs when implementing the plan. Overall, the tax savings often outweigh any associated fees, making it a cost-effective solution.

-

Can the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE be integrated with other benefits?

Yes, the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE can be integrated with other employee benefits, such as health insurance and retirement plans. This integration allows for a comprehensive benefits package that meets the diverse needs of employees. Employers can work with their benefits provider to ensure seamless integration.

-

Who is eligible for the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE?

Eligibility for the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE typically includes full-time employees, but specific criteria may vary by employer. Employers can set their own eligibility requirements, which may include factors such as length of service or job classification. It's important for employees to check with their HR department for details.

-

How do I enroll in the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE?

Enrollment in the AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE usually occurs during open enrollment periods or when an employee experiences a qualifying life event. Employees should consult their HR department for specific enrollment procedures and deadlines. Completing the necessary forms accurately is crucial for successful enrollment.

Get more for AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

Find out other AFES SECTION 125 FLEXIBLE BENEFIT PLAN EXPENSE

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement