Form T2033 Direct Transfer under Subsection 146 314 1 2022

What is the Form T2033 Direct Transfer Under Subsection 146 314 1

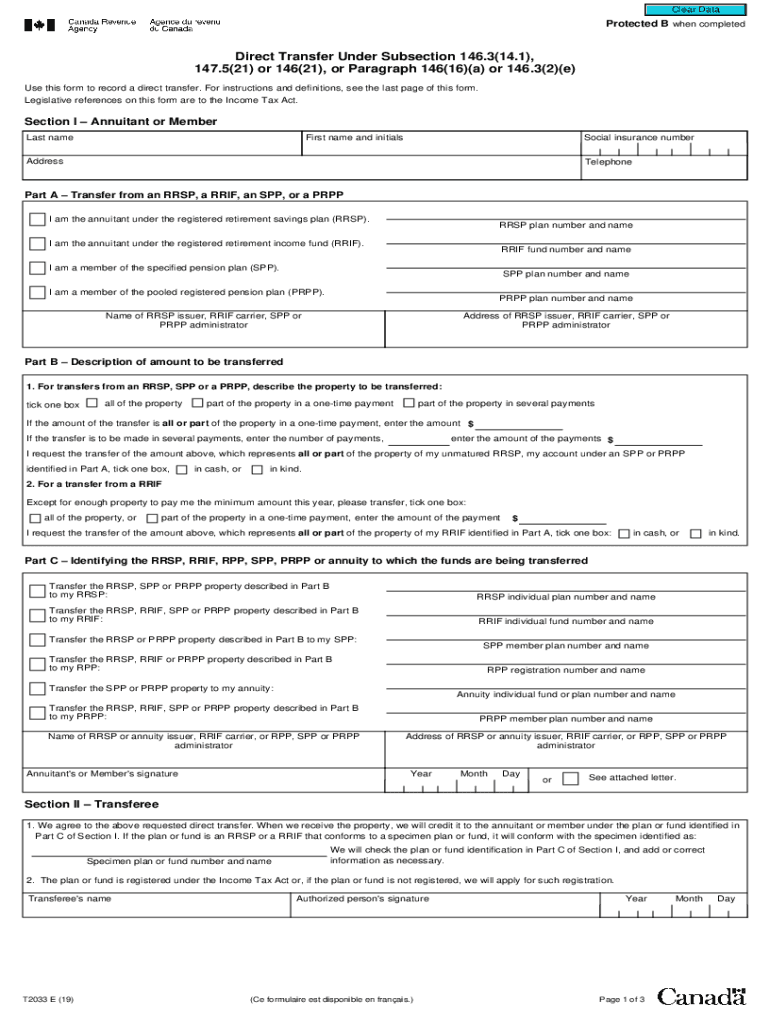

The Form T2033 Direct Transfer Under Subsection 146 314 1 is a tax form used in the United States for the direct transfer of retirement savings. This form allows individuals to transfer funds from one registered retirement savings plan (RRSP) to another without incurring immediate tax liabilities. The purpose of this transfer is to facilitate the movement of retirement funds while maintaining their tax-deferred status. Understanding this form is essential for individuals looking to manage their retirement savings effectively.

How to use the Form T2033 Direct Transfer Under Subsection 146 314 1

Using the Form T2033 involves a straightforward process. First, individuals must ensure they meet the eligibility criteria for a direct transfer. Next, they need to fill out the form accurately, providing necessary details such as account numbers and personal information. After completing the form, it should be submitted to the financial institution holding the current retirement account. This submission can often be done electronically, streamlining the transfer process. It is important to keep copies of all submitted documents for personal records.

Steps to complete the Form T2033 Direct Transfer Under Subsection 146 314 1

Completing the Form T2033 requires careful attention to detail. Here are the steps involved:

- Gather necessary personal information, including Social Security number and account details.

- Obtain the Form T2033 from the IRS or your financial institution.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to your current financial institution for processing.

Following these steps can help ensure a smooth transfer of retirement funds.

Required Documents

When preparing to use the Form T2033, certain documents are necessary to support the transfer process. These may include:

- Current retirement account statements.

- Identification documents, such as a driver's license or Social Security card.

- Any previous tax returns that may be relevant to your retirement accounts.

Having these documents ready can expedite the completion and submission of the form.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Form T2033. It is essential to adhere to these guidelines to avoid penalties or complications. Key points include:

- Ensure the transfer is between eligible retirement accounts.

- Complete the form accurately to reflect the transfer details.

- Submit the form within the designated time frames to maintain tax-deferred status.

Consulting the IRS guidelines can provide clarity on the requirements and help in the proper handling of the form.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form T2033 can result in significant penalties. These may include:

- Immediate taxation on the transferred amount if the transfer does not meet IRS criteria.

- Potential fines for late submissions or inaccuracies in the form.

- Loss of tax-deferred status for the transferred funds, leading to further tax implications.

Understanding these penalties emphasizes the importance of accurate and timely completion of the form.

Create this form in 5 minutes or less

Find and fill out the correct form t2033 direct transfer under subsection 146 314 1

Create this form in 5 minutes!

How to create an eSignature for the form t2033 direct transfer under subsection 146 314 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form T2033 Direct Transfer Under Subsection 146 314 1?

Form T2033 Direct Transfer Under Subsection 146 314 1 is a tax form used in Canada for transferring funds from one registered retirement savings plan (RRSP) to another without triggering tax implications. This form ensures that the transfer is compliant with the Income Tax Act, allowing for a seamless transition of retirement savings.

-

How does airSlate SignNow facilitate the completion of Form T2033 Direct Transfer Under Subsection 146 314 1?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign Form T2033 Direct Transfer Under Subsection 146 314 1. With our user-friendly interface, you can quickly complete the form and ensure all necessary information is accurately captured for a smooth transfer process.

-

What are the benefits of using airSlate SignNow for Form T2033 Direct Transfer Under Subsection 146 314 1?

Using airSlate SignNow for Form T2033 Direct Transfer Under Subsection 146 314 1 offers several benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible, making the transfer process more efficient and reliable.

-

Is there a cost associated with using airSlate SignNow for Form T2033 Direct Transfer Under Subsection 146 314 1?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that simplify the completion of Form T2033 Direct Transfer Under Subsection 146 314 1, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for managing Form T2033 Direct Transfer Under Subsection 146 314 1?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to streamline your workflow when managing Form T2033 Direct Transfer Under Subsection 146 314 1. This integration capability enhances productivity by connecting your existing tools with our eSigning platform.

-

What features does airSlate SignNow offer for managing Form T2033 Direct Transfer Under Subsection 146 314 1?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to simplify the management of Form T2033 Direct Transfer Under Subsection 146 314 1. These features help ensure that your documents are processed efficiently and securely.

-

How secure is airSlate SignNow when handling Form T2033 Direct Transfer Under Subsection 146 314 1?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data while handling Form T2033 Direct Transfer Under Subsection 146 314 1, ensuring that your sensitive information remains confidential and secure throughout the process.

Get more for Form T2033 Direct Transfer Under Subsection 146 314 1

- Regent university human subjects review board application regent form

- Touro college transcript form

- Does quest do titers form

- Application for readmission university of kentucky form

- Hot work permit osha form

- Nps complete fill up format form for syndicate bank

- Bankers life independent caregivers form

- Form 51 101f3 29309473

Find out other Form T2033 Direct Transfer Under Subsection 146 314 1

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure