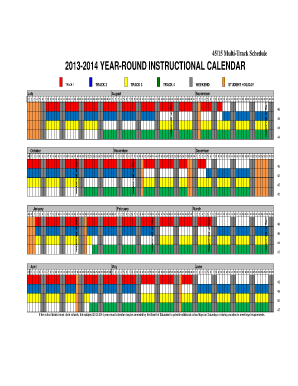

4515 Multi Track Schedule 2014

What is the 4515 Multi track Schedule

The 4515 Multi track Schedule is a specific form used primarily for tracking various financial activities and obligations. This form is essential for businesses and individuals who need to report multiple transactions or events that fall under different categories. It provides a structured way to present information, ensuring clarity and compliance with relevant regulations.

How to use the 4515 Multi track Schedule

To effectively use the 4515 Multi track Schedule, start by gathering all necessary information related to the transactions or events you need to report. This includes dates, amounts, and any relevant identifiers. Carefully fill out each section of the form, ensuring that all entries are accurate and complete. Once filled, review the form for any errors before submission to avoid potential delays or penalties.

Steps to complete the 4515 Multi track Schedule

Completing the 4515 Multi track Schedule involves several key steps:

- Gather all relevant financial documents and transaction records.

- Fill in your personal or business information at the top of the form.

- Detail each transaction or event in the designated sections, including dates and amounts.

- Review each entry for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 4515 Multi track Schedule

The 4515 Multi track Schedule must be used in accordance with applicable laws and regulations. It is crucial to ensure that all information reported is truthful and complies with federal and state requirements. Misrepresentation or failure to file correctly can result in legal consequences, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 4515 Multi track Schedule may vary based on the specific transactions being reported. It is essential to stay informed about these deadlines to ensure timely submission. Typically, forms must be filed by the end of the tax year or within a specified period following the completion of the transactions.

Examples of using the 4515 Multi track Schedule

Examples of scenarios where the 4515 Multi track Schedule is applicable include:

- Reporting multiple sales transactions for a business.

- Documenting various investment activities over the fiscal year.

- Tracking payments made to contractors and freelancers.

Required Documents

To complete the 4515 Multi track Schedule, you will need several documents, including:

- Transaction records, such as invoices and receipts.

- Bank statements reflecting the transactions.

- Any relevant contracts or agreements related to the reported activities.

Create this form in 5 minutes or less

Find and fill out the correct 4515 multi track schedule

Create this form in 5 minutes!

How to create an eSignature for the 4515 multi track schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4515 Multi track Schedule?

The 4515 Multi track Schedule is a powerful feature within airSlate SignNow that allows users to manage multiple document workflows simultaneously. This tool enhances productivity by enabling teams to track the progress of various documents in real-time, ensuring that nothing falls through the cracks.

-

How does the 4515 Multi track Schedule improve workflow efficiency?

By utilizing the 4515 Multi track Schedule, businesses can streamline their document management processes. This feature allows for simultaneous tracking of multiple documents, reducing the time spent on manual follow-ups and increasing overall efficiency in document handling.

-

What are the pricing options for the 4515 Multi track Schedule?

The pricing for the 4515 Multi track Schedule varies based on the subscription plan chosen. airSlate SignNow offers flexible pricing tiers that cater to different business sizes and needs, ensuring that you can find a cost-effective solution that fits your budget.

-

Can the 4515 Multi track Schedule integrate with other tools?

Yes, the 4515 Multi track Schedule seamlessly integrates with various third-party applications and tools. This integration capability allows businesses to enhance their existing workflows and ensures that all document processes are connected and efficient.

-

What are the key benefits of using the 4515 Multi track Schedule?

The key benefits of the 4515 Multi track Schedule include improved visibility into document status, enhanced collaboration among team members, and reduced turnaround times for document approvals. These advantages help businesses operate more effectively and meet deadlines with ease.

-

Is the 4515 Multi track Schedule suitable for small businesses?

Absolutely! The 4515 Multi track Schedule is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses. It helps them manage their document workflows efficiently without the need for extensive resources.

-

How can I get started with the 4515 Multi track Schedule?

Getting started with the 4515 Multi track Schedule is easy. Simply sign up for an airSlate SignNow account, and you can begin utilizing this feature right away. The platform provides tutorials and support to help you maximize its capabilities.

Get more for 4515 Multi track Schedule

Find out other 4515 Multi track Schedule

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors